Land Taxation in Philadelphia:

A General Equilibrium Analysis

Mary Braun

[A University of Pennsylvania Research Paper, 2003.

Reprinted with permission by the author. The mathematical equations

contained in the original paper could not be reproduced in this format

and have been omitted. Additonally, Appendixes and References are

omitted from the original. Researches interested in the subject should

contact the author for a version of this paper in Microsoft Word]

Abstract

Although economists generally agree that land value taxation is

economically efficient, only a handful of U.S. municipalities have

ever implemented a land tax. The relative rarity of this type of

taxation makes it difficult to predict how land tax reform effects

local economies. Research on this type of taxation typically involves

examining the impact modest land tax reforms have had on small

Pennsylvania towns, or using general equilibrium modeling to examine

radical land tax reforms. This paper uses a small-open economy general

equilibrium model to estimate the nature and the magnitude of economic

change resulting from modest land tax reform. The model is calibrated

to resemble Philadelphia's current fiscal and economic climate. Two

different types of tax reform are examined, (1) Philadelphia's Real

Estate Tax is modified so that revenues generated by taxing property

structures equal revenues generated by taxing land, and (2) the tax

burden is shifted from the Wage Tax onto the Land Tax. The model found

that in Philadelphia, modest land tax reform resulted in significant

jobs creation and population growth. Thus, when compared to other

revenue alternatives, land value taxation can act as a strong economic

stimulant.

I am indebted to Robert Inman and Andrew Haughwout, without their

help, this paper would not have been possible. All errors and

oversights are my own.

Table of Contents

- 1. Introduction

- 2. The Need for a Change in Philadelphia's Tax Structure

2.1 The City Controller's Tax Structure Analysis Report

- 3. What is Land Value axation

3.1 What do Critics Say about the Land Value Tax?

3.2 What do Proponents of Land Value Taxation Claim?

- 4. Empirical Research on Land Value Taxation in

Pennsylvania

- 5. General Equilibrium Modeling and Land Taxation

5.1 Open and Closed Case for Property Tax Reform (Tideman)

5.2 Prospects for Land Rent Taxes in State and Local Tax

Reforms (Nechyba)

5.3 A General Equilibrium Analysis of Land Taxation in NYC

(Haughwout)

- 6. The Need for New Research Analyzing Policy Proposals in

Philadelphia

- 7. Modeling Philadelphia's Economy (Haughwout & Inman)

- 8. Model Modifications and Simulations

8.1 Modifying the Model

8.2 First Policy Proposal

8.3 Second Policy Proposal

- 9. Results

- 10. A Word of Caution

- 11. Conclusion

- 12. Appendixes

- 13. References

|

Introduction

Land is unique because, no matter how much you tax it, the supply

will never change. This makes it possible to levee a tax on land rents

without changing people's production decisions and stifling economic

progress. When compared to most other types of taxation, a land tax is

both more efficient and more equitable. Land taxation is more

equitable because it recaptures for society the portion of property

value that is derived from the community rather than from the property

owner's labor. Additionally, there are both theoretical and empirical

reasons to believe that replacing more distortionary taxes with a land

value tax would help stimulate the economy.

In Philadelphia, there is ongoing debate both among policy makers and

city residents about the relative merits of land value taxation. Much

of this debate was generated by a series of policy proposals laid out

in the City Controller's

Tax Structure Analysis Report. Because this type of taxation

is relatively unknown, and because most land tax municipalities in the

United States are quite small, there exists some uncertainty about the

ways in which the economy of a large city, like Philadelphia, would

respond to land tax reform. Although several general equilibrium

models have been used to examine the impact of dramatic land tax

reform, no research has been done which explores the consequences of

adopting a modest land tax reform, like the one proposed by the City

Controller. My research is designed to fill this void.

This paper is organized as follows: Section 2 establishes the fact

that, in Philadelphia, there is a great need for tax reform. This

section also contains a brief summary of the policy proposals put

forth in the City Controller's Tax Structure Analysis Report.

In Section 3 there is an in-depth analysis of land value taxation.

Section 4 provides an overview of empirical research done on land

value taxation in Pennsylvania. In section 5, three prominent general

equilibrium models used to analyze the impact of land value taxation

are discussed. Section 6 establishes the fact that there is a need for

new research explaining how a city like Philadelphia would be effected

by modest land tax reform. Section 7 contains an overview of Andrew

Haughwout and Robert Inman's general equilibrium model. A modified

version of their model is used in this paper to analyze the impact

land value taxation would make on Philadelphia's economy. Section 8

describes how the original model was modified and what simulations

were conducted. The results of these simulations are presented and

discussed in Section 9. Section 10 contains information about the

limitations of general equilibrium modeling and offers a word of

caution about interpreting the results.

2. The Need for a Change in Philadelphia's Tax Structure

Philadelphia reached its population peak in 1950 at 2.1 million and

since that time roughly a quarter of Philadelphia's population has

left the city. Since the 1950's the tax burden on those who remained

dramatically increased. This occurred because the wealthy and middle

class moved out of the city at a faster rate than the poor and because

the city's budget did not decreased as rapidly as the population did.

An increased demand for city services and a lack of fiscal discipline

on the part of elected city officials lead to increased per capita

city spending. Year after year as the tax base shrunk, local

politicians chose to hold constant and even increase taxes rather than

cut back on the levels of service provision. Philadelphia's taxes are

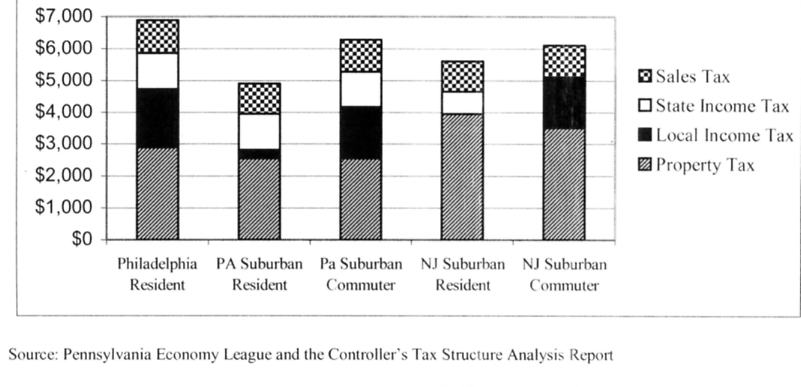

now the highest in the region. Figure 1 gives a breakdown of the tax

burden faced by the median household in different parts of the

Philadelphia metropolitan area.

Figure 1: Median Household Tax Burden in the Philadelphia

Region

This comparison of the tax burden faced by median households in the

region illustrates how much greater the tax burden currently is for

Philadelphia residents. Figure 1 also illustrates that the tax burden

for workers commuting into Philadelphia is greater than for people

living an working outside of Philadelphia. This adversely affects both

employees and employers. Businesses located in the city that wish to

remain competitive, must pay their employees more to compensate for

the tax burden they face as commuters.

In its January 2001 A Philadelphia Report Card, the Federal

Reserve Bank of Philadelphia found that, "the city is near its

peak of revenue-generating capacity - that is, raising taxes shrinks

the city's economy and tax base so much that revenues will not rise

significantly."[1] This leaves elected city officials in a

difficult position; they cannot raise taxes and they cannot easily

reduce service levels, which would upset the municipal unions and

would likely cause more residents to flee to the suburbs in order to

find better schools and safer streets. Some experts, such as those at

the Federal Reserve Bank of Philadelphia, suggest that though it may

at first seem counterintuitive, the solution lies in cutting taxes. "While

lowering taxes will reduce the city's tax revenues it will increase

economic activity in the city. Thus, in the long run, the annual

revenues loss will be less than the initial loss in taxes."[2]

The City Controller takes a different approach and suggests that by

readjusting rather than reducing the tax burden, it will be possible

to stimulate the economy without causing a loss of revenue and

therefore a loss in services.

2.1 The City Controller's Tax Structure Analysis Report

Recognizing that a change in Philadelphia's economic climate is

necessary, the City Controller's Office created a comprehensive Tax

Structure Analysis Report. This report describes many of the economic

problems facing Philadelphia. It explains how recent tax cuts have

produced favorable results and proposes a series of key changes. The

City Controller's goal was to stimulate the economy through tax reform

without reducing aggregate revenues. By significantly reducing

business taxes and by shifting the tax burden to reduce the

Residential Wage Tax to encourage development, the Controller's Office

argues that it will be possible to stimulate the economy without

changing the city budget. Part of the Controller's plan involves

transforming the Real Estate Tax into a split-rate land value tax and

then shifting the tax burden from the Wage Tax onto the newly modified

Real Estate Tax. See Appendix A to read excerpts from the Tax

Structure Analysis Report related to land and wage tax reform.

The Controller's Office proposes taxing land at 3.44 times the rate

of structures so that half of the Real Estate Tax revenues come from

land and half from buildings. Currently, land only generates 22.5% of

the Real Estate Tax revenues even though it is taxed at the same rate

as structures. Initially the shift towards land value taxation would

be revenue neutral, meaning that, in the first year, revenues

generated by the higher tax on land and the lower tax on structures

would be sufficient to meet the current revenue projections for the

Real Estate Tax. Using property assessment data from the Board of

Revision of Taxes (BRT), the Controller's Office estimates that

approximately 78% of residential taxpayers would see their Real Estate

Taxes reduced with this shift, while approximately two thirds of those

whose taxes might increase would see increases of less that $100 per

year.[3]

The Controller's Office also proposes reducing the City Wage Tax to

4% and increasing the city's Real Estate Tax to create a budget

neutral first year shift. In this context, the term budget neutral

refers to the fact that aggregate revenues generated by the Wage Tax

and the Real Estate Tax would remain constant. After the proposed

shift, there would be sufficient revenues to meet the current combined

revenue projections for those taxes. In this scenario, the

Controller's Office predicts that, "only individuals whose homes

have a resale value of more than three times their annual household

income might see an increase in taxes."[4] This proposed shift

builds on the fact that land taxes distort people's economic

incentives less than other types of taxation. People can leave the

city but they cannot take their land with them. See Appendix B for a

brief discussion about Philadelphia's Wage Tax. This appendix contains

information about why, out of all the different typed of distortionary

taxes, the Controller's Office focuses on reducing the Wage Tax.

3. What is the Land Value Taxation?

The concept of land value taxation can be traced all the way back to

Adam Smith and the birth of modern economics. In the 19th century,

classical economist David Ricardo advanced land tax theory by studying

the existence and importance of land rents.[5] Ricardo noticed that

all of the earnings from poor quality land must be used to cover labor

and capital cost; yet, because it is more economically productive,

high quality land produces more than enough to cover these basic labor

and capital costs. Ricardo considers these extra earnings to be

economic rent. Ricardo's law of economic land rent is as follows: the

rent of land is determined by the excess of its product over that

which the same application can secure from the least productive land

in use.[6] Ricardo goes on to theorize that, as the population grows,

more poor land must be cultivated in order to meet the growing demand.

Thus the rent "earned" by good land increases. This

phenomenon (coupled with the fact that poor land necessitates

increased labor input to maintain minimal output) results in falling

profit levels for everyone except for the few lucky land owners who

prosper without themselves contributing to the productive process.

Ricardo claimed that since rents gobble up profits, and profits lead

to investment, which leads to growth, rising rent costs indirectly

hinder societal economic progress.

The late 19th century social philosopher Henry George built upon

Ricardo's theory, that land rents would absorb all of the fruits of

progress. Convinced that, "the association of poverty with

progress is the great enigma of our times," George sought to

unravel this riddle in his groundbreaking book,

Progress and Poverty. In this book, George eloquently

expresses his belief that poverty exists in America's rapidly growing

cities (in the midst of unprecedented prosperity and unparalleled

rates of growth) because owners of land and other "natural

opportunities," appropriate the benefits derived from other

people's capital and labor. To bring about greater economic justice

without stifling economic progress, George proposed that the

government adopt a "single tax" on land. George's argument

for land value taxation has two primary components, one ethical and

one relating to economic efficiency.

George believed that, because increases in land values are caused by

society rather than by land owners, land rents should be taxed away

for the good of society. To support his theory, George points out that

land or "site" value is not created by the actions of an

individual owner but by the community, acting in three capacities.

First, society provides the legal institutions of land ownership from

which the concept of land value springs. Land would be of little value

without the legal framework which assures land owners that their

investments won't be taken away from them without due compensation.

Second, the larger community is the provider of infrastructure and

amenities such as good schools, roads, and police protection, which

give land much of its value. Third, it is the community, in the shape

of the market, which causes local economies to grow and develop

directly affecting land values. At first it may appear as if the value

of land is only linked to the soil's fertility but without legal

protection, a network of roads upon which crops can be transported, or

markets in which to sell these crops, agricultural land becomes

infinitely less valuable. Thus, as scholar Dick Netzer claims, "the

ethical conclusion is than that the community, not the individual site

owners, should recoup the fruits of these economic activities."[7]

In addition to the ethical argument, George claims that there are

convincing economic reasons for implementing the single land tax;

namely that a tax on land rent it is the most efficient type of

taxation possible. Unlike other forms of taxation, a tax on land rents

does not stifle economic growth. In order to understand this claim it

is first important to understand that typically, under perfect

competition, economic rents only exist when a change in supply is not

possible. Because the supply of land is fixed, land rents can

accrue.[8] Although theoretically, any type of economic rents could be

taxed without distorting production decisions, in the long run it is

nearly impossible to tax excess wages or interest earned by capital.

When the market is working perfectly, the supply and price of capital

and labor continuously adjust until equilibrium is reached and no

excess economic wages or profits from interest rates remain. Thus, in

a perfectly functioning market, it is impossible to tax the rent on

capital and labor. Any tax on elastic goods (such as labor and

capital) will simply reduce the amount people are willing to consume

or produce. This stifles economic growth and leads to economic

inefficiencies.[9] In contrast, because the supply of land is fixed,

it is possible for land rents to accrue, allowing the land to be taxed

without distorting production decisions and leading to economic

inefficiency.[10]

Throughout the rest of our discussion it is important to note the

difference between property and land. Although these two terms are

commonly viewed as interchangeable, in this paper the term property

will be used to describe the combination of land and all structures on

the land. Hence, property rent is the combined return on land and

capital improvements. The term land value refers to the value of land

without improvements, the residual value after the values of other

assets that exist on the land are removed. Unlike land taxes, the

implementation of property taxes results in economic distortions

because people no longer have as good of an incentive to improve their

property and use it efficiently.

3.1 What do Critics Say About the Land Value Tax?

Leo Tolstoy once claimed that, "people do not argue with the

teachings of George, they simply do not know it…and it's

impossible to do otherwise with his teachings, for he who becomes

acquainted with it cannot but agree."[11] Most critics of the

land tax often question how practical it would be to implement such a

policy.

Some scholars, such as Dick Netzer, point out that the sudden

implementation of a new land value tax would unjustly victimize recent

buyers of land.[12] Netzer claims that (until the market had time to

adjust) a pure land tax could be confiscatory in its nature.[13] A

similar criticism is that voters and elected officials would likely be

sympathetic to any individuals who found themselves bankrupt as the

result of the new tax. These may be valid concerns, but as Steven B.

Cord argues, a gradual shift towards land value would give both

markets and people time to adjust and to begin putting land to its

best use.[14] Land owners who are not currently maximizing their

land's productive potential would have time to adjust and would be

able to prepare for a large tax increase. Though gradual

implementation delays potential benefits, land tax proponents such as

Walter Rybeck suggest that a full tax reform would arouse too much

political opposition to gain acceptance, thus a land tax should be

gradually adopted.[15] This can easily be achieved by gradually

increasing the land tax to structure tax ratio.

George and the original single tax supporters advocated replacing all

local, state, and federal taxes with a single tax on land rents.

Several prominent land tax critics claim that though a single tax may

have been possible at the turn of the century, when George first wrote

Progress and Poverty, such a tax is no longer feasible. Since

1933, persistent and reoccurring unemployment has produced pressure

for increased federal spending. This has caused government spending to

skyrocket. According to economist Arthur P. Becker, "government

intervention has grown to the point where the public sector now

comprises 35 percent of Gross National Product and 49 percent of

national income."[16] Thus, because the magnitude and focus of

U.S. government expenditures has greatly increased in the past 100

years, it is no longer possible to generate sufficient revenue from a

land tax to run the federal government. Other land tax critics argue

that because the trend of increasing government spending permeates all

levels of government, it is not even feasible to finance local

government expenditures with a single land tax. While this may be a

valid argument against single taxation, this criticism does not hold

when a two-rate land tax is implemented alongside other types of

taxes. Despite the fact that property taxes are currently a major

source of revenues for local jurisdictions,[17] many ardent advocates

of land value taxation seem to agree that, "with the commitments

of modern governments, land value taxation would, by itself, be hard

pressed to raise sufficient revenue to cover all spending demands."[18]

Rather than advocating for a single tax, most modern followers of

George envision a scenario in which land value taxation accounts for a

significant share of all local public sector revenue (10-20%).[19]

Perhaps the most frequent criticism of land value taxation is that an

accurate assessment of land values is impossible, or too costly, to

obtain. In theory, a tax that is levied on the value of land alone

does not cause any economic distortions, but in order to levy such a

tax, assessors must have the ability to estimate the value of land

separately from improvements. Jerome German, Dennis Robinson, and Joan

Youngman suggest that George's single tax argument is based on the

assumption that appraisers would always be well supplied with plenty

of nearby unimproved land, so that the improved land sites could be

valued easily by comparison.[20] Although this assumption made sense

in George's day, the American landscape has dramatically changed since

then. Now, data on the value of unimproved land can be difficult to

obtain because in urban areas most parcels of land have already been

improved.[21]

Virtually everyone on both sides of the land tax debate agrees that "the

single greatest challenge to any type of land value taxation system is

accurate valuation of land on a large scale."[22] Skepticism

about the feasibility of urban land valuation has historically proven

to be a major stumbling block to serious consideration of two-rate

property taxes. However, recent advances in computerized property

assessment tools have important implications for this debate.

Assessors now have access to a vast array of sophisticated techniques

that would enable them to accurately determine the value of urban

land. For a detailed description of the most common land assessment

techniques see Appendix C. More then twenty years ago, Oliver Oldman

of Harvard Law School wrote, "the key to developing an accurate

land value assessment role is the process of land value mapping."[23]

New computerized methods of spatial data analysis make this type of

mapping possible and make it difficult to reject land value taxation

on the grounds that accurate land valuation is not possible.

3.2 What do Proponents of Land Value Taxation Claim?

Most scholars agree that the majority of the benefits associated with

land value taxation accrue because land is fixed both in supply and

location. Arlo Woolery, points out that one of the strongest arguments

for a land-based tax is its relative stability. Woolery claims that

since land, unlike other forms of wealth, is fixed in its location, it

makes an ideal tax base.[24] Similarly, Andrew Reschovsky suggests

that revenues from land value taxation would be more stable over the

course of the business cycle than either a tax on income or

consumption (although he conditions his statement by claiming that

there is a need for more research on the topic).[25] Often government

deficits arise because while government spending is relatively fixed

in the short term, tax revenues fluctuate with the business cycle. Any

method of taxation that promises a relatively constant revenue stream

would have obvious benefits.

Advocates of the land value tax argue that land value taxation

results in increased societal economic prosperity by encouraging

landowners to maximize the productive potential of their land. Working

from the assumption that people own productive sites and capital

assets because of the return they yield, Georgian theorists claimed

that the most efficient economic climate occurs when land owners seek

the use of their assets that yields the greatest return available.

Thus, when every parcel of land is already being put to its highest

and best use, within the legal limits imposed by zoning regulation,

the land tax is neutral and does not affect production decisions.

However, if speculators are holding large amounts of land fallow and

off of the market, scholars argue that a land tax would increase

productivity by encouraging speculators to use their land more

productively. Because, as Becker claims, "high speculative land

values lower profitable investment opportunities and lead to

unemployment," thus any system that discourages speculation would

increase economic productivity.[26]

Economists and policy makers have long assumed that, even if land

value taxation is not allocatively neutral, because of existing

inefficiencies in land use, it is more efficient than other existing

forms of taxation. In the past twenty years, several scholars have

demonstrated that a tax on land value is non-neutral,[27] but Duck-Ho

Lim suggests that because the land tax is still more efficient than

other forms of taxation, any such findings are of little practical

significance.[28] Using a two period model, Lim proves that while a

land value tax may be distortionary, its economic impact is

significantly less than the impact caused by a wage tax of equivalent

yield. Lim's findings reinforce what other scholars have long argued:

namely that, in order to alleviate poverty and stimulate progress, the

introduction of a land value tax must be commensurate with sharply

reduced taxes on earnings and other economic endeavors.[29] Analyzing

the tradeoff between a tax on land rents and a tax on capital income,

Thomas J. Nechyba, demonstrated that land taxes are significantly more

efficient than capital taxes.[30] Similarly, in a purely theoretical

paper, Mitch Kunce proves that when local jurisdictions are allowed to

tax land as well as two distinct types of capital, the most efficient

choice will always be a pure land tax.[31]

Not only do proponents of the land tax claim that it is an

economically efficient form of taxation, they argue that it is an

incredibly powerful urban planning tool. George predicted that, "if

land were taxed to anything near its rental value, no one could afford

to hold land that he was not using."[32] By penalizing random,

unplanned withholding of land from more extensive development, land

value taxation could theoretically reduce land speculation and promote

increased urban density. Because a pure land tax would result in lower

taxes in decaying areas and higher taxes in rapidly growing areas,

land taxes could help cover the cost of new development and could

channel development back into the largely abandoned urban core. Jeff

Wuensch, Frank Kelly, and Thomas Hamilton claim that, "if true

land values have fallen to very low levels, as they do in 'urban decay

settings,' a moderate stimulus to redevelopment should emerge, given

that the costs of demolition are not too high and potential profits

can become sufficiently large."[33] Thus, when properly

implemented, a land value tax would promote urban renewal in the city

core.

4. Empirical Research on Land Value Taxation in Pennsylvania

In the Unites States, most municipalities collect some form of

property tax, yet a few of these municipalities have a pure, gradated,

or two-rate land tax. This makes empirical analysis of land value

taxation difficult. As a result, the bulk of all empirical research

has focused on a handful of cities in Pennsylvania. Because it is the

only state that allows all of its first, second, and third class

cities to tax land and structures at different rates, the overwhelming

majority of land tax municipalities are in Pennsylvania. A host of

research has been done on these municipalities to determine whether

land value taxation significantly impacts the economy. In all of the

Pennsylvania studies, researchers use the value of new construction as

a proxy for economic growth.

Three separate empirical studies found little direct connection

between land taxation and economic growth in Pennsylvania. In the late

1970's, when only three cities had adopted two-rate taxes, Mathis and

Zech undertook a cross-sectional analyses of 27 Pennsylvania cities;

they were unable to detect a statistically significant correlation

between construction activity and the structure to land tax ratio.[35]

In a more comprehensive study using fourteen years worth of data from

53 different Pennsylvania cities Tideman and Johnson found no

statistically significant correlation between new construction and

structure to land tax ratios.[36] However, these authors speculated

that limitations in both the data and the econometric techniques used

in this analysis could have an obfuscating effect. Performing separate

time series analysis for three Pennsylvania cites that had previously

adopted two-rate taxes, Bourassa was equally unable to show any

connection between land tax rate and new construction.[37]

In all three aforementioned studies, estimated coefficients capturing

the effect of a change in the tax regime had strikingly large standard

errors. The resulting lack of statistical significance can be

attributed to insufficient data, poor choice of proxy measurements,

and data that is already biased against finding a tax effect. Because

two-rate taxes were primarily adopted by small municipalities in

severe economic distress, and because in these municipalities school

real estate taxes were not reformed, tax relief might not have created

a sufficiently incentive to overcome economic depression. Furthermore,

because the existing capital stock in many of Pennsylvania's older

towns exceed the residents' needs, it is unlikely that researchers

using the value of new construction as a proxy for economic growth

would be able to fully capture the effect of any tax reform.

Additionally, according to Plassmann and Tideman, inconsistencies in

the data make the traditional econometric methods of analysis used in

previous studies unreliable.[38] In any given year many of these

municipalities did not experience any new construction, which skewed

the calculation of the mean and median number and monetary value of

new construction permits. In their mathematically sophisticated model,

Plassmann and Tideman estimate key parameters with a Markov chain

Monte Carlo method, the Gibbs sampler, to correct for the this

irregularity in the data. After comparing 15 land tax municipalities

with 204 similar Pennsylvania municipalities, over a period of 22

years, their research shows that two-rate and land tax cities do

indeed experienced significantly higher levels of construction.

In addition to the comparative research done in Pennsylvania

municipalities, a large body of research focuses specifically on

two-rate taxation Pittsburgh.[39] In 1914, Pittsburgh became the first

large city in the Unites States to implement any sort of land value

tax. Initially Pittsburgh taxed land at twice the rate as buildings.

The 2:1 ratio was adopted for political rather than theoretical

reasons. At the time, because the majority of local government

revenues were generated by property taxes, this was considered to be a

significant tax reform policy. In 1979, as part of a wide sweeping

urban revival project, Pittsburgh restructured its property tax system

by raising the rate on land to more than five times the rate on

structures. During the 1980's, Pittsburgh bucked the trend of steady

decline set by similar rust-belt cities and experienced a dramatic

boom in new building construction. An empirical analysis, conducted by

Oates and Schwab, found that an increased reliance on land taxation

was not a direct cause of Pittsburgh's dramatic economic revival. In

their regression analysis, Oates and Schwab found that the coefficient

for the dummy variable representing the change in tax regime was not

statistically significant. They claim that this is inline with

economic theory, which holds that a tax on land rents should be

neutral and will not impact people's decisions. However, the

researchers argue that just because this tax is "neutral"

does not mean that the tax played no part in Pittsburgh's revival.

Oates and Schwab argue that land value taxation, "played an

important supporting role by enabling the city to avoid rate increases

in other taxes which would have impeded development."[40] A land

tax allowed the city to provide more public services, which attracts

people to the city, without imposing a tax which dampens economic

growth. These authors also suggest that, because the role of land

value taxation is best understood in terms of the revenue

alternatives, "the interesting and the relevant issue here is the

response of the Pittsburgh economy to such an alternative tax."[41]

The results from these empirical studies are somewhat inconclusive.

Three early studies executed with various degrees of complexity failed

to find any link between economic activity, measured as a change in

the total number and value of new construction permits. However recent

research indicated that there might indeed be a connection. It is

simply difficult to find without sophisticated econometric techniques.

Oats and Schwab offer an eloquent explanation as to why the connection

between new construction and land taxation should be difficult (or

even impossible) to identify. They suggest that to truly understand

the impact land taxation can have on an economy, it is necessary to

study land taxation in terms of its revenue alternatives.

5. General Equilibrium Modeling and Land Taxation

A general equilibrium model examines how changes in one market affect

all other markets. Increasingly sophisticated and complex modeling

techniques have allowed researchers to thoroughly analyze the economic

effects of different fiscal policy proposals. This makes it possible

to understand how different types of taxes impact different aspects of

the economy. Although a rich literature exists on this type of

modeling, few researchers have used these methods to directly study

land value taxation; Tideman, Nechyba, and Andrew Haughwout have all

recently presented or published papers that use equilibrium modeling

techniques to understand the impact of a shift to land taxation.

5.1. Open and Closed Case for Property Tax Reform (Tideman)[42]

Although Tideman is interested in the economic impact of replacing

local property taxes with a land tax, his dynamic general equilibrium

model is calibrated using national data. Tideman rationalizes this by

pointing out that economic behavior depends on all taxes which a

person is subject to and that the best data is available only for the

national economy. As such, he argues that even though the model uses

national data it should, "be considered an expansion of a model

of a city, by a scale factor that does not affect the question of

interest."[43]

Tideman's fairly straightforward model involves three factors of

production (land, labor, and capital) as well as a parameter capturing

technological advances over time. Unlike most general equilibrium

models, which assume that the amount of land available in the economy

never changes, Tideman's model attempts to capture the effect of land

speculation. The percentage of economically available land is given by

T = e?(1-n) where n is the percentage of land rent that is collected

by the property tax and ? is chosen to yield an estimate of land

efficiency under the existing tax regime. The model analyzes the labor

and investment decisions of one infinitely lived representative

household that, following a linear approximation of U.S. population

growth, expands over time. Although a constant portion of the

household is employed, the model contains a parameter capturing

labor-leisure decisions. Household utility is a symmetric CSE function

based upon: private goods per worker, public goods per worker, and

leisure per worker.

What makes Tideman's research particularly interesting is the fact

that he conducts separate model simulations for both closed and open

economies. In the closed model, the quantity of capital that is used

in any year is the amount that the household has accumulated in

maximizing its intertemporal utility function. In the open model, the

quantity of capital that is used in any year is the amount that earns

an after tax return equal to what the after tax return on capital

would have been that year without tax reform. Tax reform would mirror

that of a closed economy, if taxes were simultaneously reformed all

over the country (or at least throughout out one large region).

However, if tax reform only occurred in a single locality, an open

economy model would be more suitable.

According to the model, eliminating the structural component of the

property tax and increasing the tax on land, in a revenue neutral

manner, would significantly enhance real per capita income. In a

closed economy, tax reform causes per capita income to grow between

$650 and $2,000 per year. In an open economy, real income grows by

approximately $500 per worker per year. Significantly larger wages do

not lead to an increase in real per capita income; in the short term

wages rise by 1% to 2% and in the long they rise by 2.75%. Real income

grows because, in a closed economy, property tax reform leads to

significantly larger returns to capital (5% per year for the first 20

years), and because, in both open and closed economies, people have an

increased incentive to invest. Increased investment causes capital

stock in a closed economy to grow by 100% and capital stock in an open

economy to grow by 130%.

5.2 Prospects for Land Rent Taxes in State and Local Tax Reforms

(Nechyba)[44]

Nechyba, building on Jan Brueckner's property tax analysis,[45]

created a general equilibrium model of an economy that produces output

using capital, land and labor as inputs. He uses this model to predict

how the economy would respond if different types of distortionary

taxes were replaced (in a revenue neutral manner at the state level)

with a tax on land. Nechyba conducted this analysis for all 50 states

and one "typical" state. When developing state specific tax

rates for the individual factors of production (capital, land, and

labor) Nechyba was forced to make a series of simplifying assumptions.

Specifically, he assumed that the property tax is a tax on land as

well as all forms of capital; the corporate income tax is a tax solely

on capital; and the personal income tax, the sales tax, and all "other"

taxes are born by all forms of income. After developing a series of

state specific models, Nechyba preformed policy simulations to

identify which types of tax reforms are likely to be economically and

politically successful. Under plausible yet conservative assumptions

about the elasticity of substitution between capital and land as well

as the supply elasticities for capital and labor, Nechyba found that

large tax reforms replacing entire classes of distortionary taxes with

land taxes are feasible in virtually all states.[46] One of the

Nechyba's more intriguing findings is that a tax on land could

actually increases the value of that land. Typically, experts in local

finance agree that property taxes, consisting of a tax on land and a

tax on capital, are quickly and completely capitalized into the price

of the land.[47] Nechyba concedes that because it reduces the

discounted present value of land rents, when considered in isolation,

a tax on land should reduce land prices. However, in his model,

Nechyba considers land taxation to be part of a revenue-natural tax

reform in which land taxes replace other classes of taxes. Because

these other classes of taxes are distortionary, eliminating them

stimulates the economy and indirectly increases land values.

Furthermore, a land tax that replaces capital taxes increases the

intensity of capital usage, which in turn raises land prices (because

the land is now more desirable). Thus, when capital/building taxes are

lowered, construction of an office building becomes more profitable

and investors are willing to pay a higher price for the land upon

which the office building is being constructed.

5.3. General Equilibrium Analysis of Land Taxation in NYC

(Haughwout)[48]

By modifying the computable general equilibrium model of a small open

economy originally presented by Haughwout and Inman in 2001, Haughwout

is able to examine the impact land tax reform in New York City.[49]

Readers interested in a detailed overview of the original Haughwout

and Inman model are referred to section 7 of this paper. For

Haughwout, conducting research on land value taxation in New York City

required several different steps. First, it was necessary to calibrate

the original model using fiscal, economic, and demographic data from

New York City. This made it possible for Haughwout to conduct two

different model simulations calculating the economic impact created by

replacing part or all of New York City's current tax system with a

land tax. Haughwout also modified the original model by stipulating

that the all purpose public good "G" might not be a pure

public good. By definition, pure public goods are "non-rivalrous"

in consumption; there is no congestion and the marginal cost of

providing the good to an additional person is zero. This may be true

for some traditional public goods, such as street lights, but at the

local level many publicly funded programs are subject to a degree of

congestibility. For example, after a threshold level has been

surpassed, the addition of another child to a classroom becomes

noticeable as the quality of education provided to all students is

diminished.

Haughwout's first simulation looked at what might happen if the land

portion of the property tax remained unchanged while all sales,

capital, and income tax rates were eliminated. Although the removal of

these distortionary taxes would make New York City a more attractive

place to live and work, Haughwout found that a reduction in the tax

rates reduced government revenues and public good provision. This

reduction in public good provision decreased the relative

attractiveness of living and working in the city, effectively negating

some of the benefits caused by the removal of distortionary taxes.

Haughwout's second simulation increased the land portion of the

property tax so that if all sales, capital, and income tax were

eliminated, the aggregate tax revenue would remain at its pre-tax

reform equilibrium level. Originally land was taxed at a rate of

2.83%, but in order to conduct the prescribed tax reform in a revenue

neutral manner, the rate on land would increase to 21.7%.

One interesting feature of Haughwout's second simulation is that,

when the size of the public sector is constrained, this type of land

tax reform would cause land values to fall. The model predicts that,

under these specific conditions, the removal of distortionary taxes

would actually make the city less attractive as a place to live and do

business.[50] A possible explanation as to why land prices fell in the

second model simulation has to do with the fact that the tax shift

dramatically increased the number of city residents and workers. At

this new city size it may not be efficient to provide services to

everyone in the city. This problem would be even worse if the large

public sector was financed with distortionary taxes.[51] This

explanation is partially supported by the fact that when Haughwout

conducted further test simulations, the net effect of a reduction of

the land tax rate (and public service provision) actually increased

land values.

6. The Need for New Research Analyzing Policy Proposals in

Philadelphia

The existing body of empirical and general equilibrium research done

on land value taxation provides a good base from which to broadly

speculate about the impact that a land value tax would have in

Philadelphia. However, this research does not lend itself well to

analyzing the effect that the City Controller's land tax proposal

would have on Philadelphia's economy.

All of the empirical research done on land taxation in Pennsylvania

municipalities relies on time series data. Because land tax reform has

not yet been implemented in Philadelphia there is no time series data

on which to draw. This makes a isolated, forward-looking Philadelphia

analysis quite complicated. Furthermore, because Pittsburgh is the

only large city to have implemented a land tax, it is not clear that

conclusions drawn from the majority of these studies should be

directly extended to a city as large as Philadelphia. These studies

can generally indicate how Philadelphia might be impacted, but they

cannot provide a detailed understanding of how such a tax reform would

effect the city's economy.

Although the three general equilibrium models provide a better

framework from which to analyze the effect of a proposed land tax

reform in Philadelphia, to some extent their findings are inconclusive

and inapplicable. Part of the discrepancy among these three

researchers' results has to do with the fact that they all modeled

different types of economies: Tideman examined the effect of revenue

neutral property tax reform on both open and closed economies, Nechyba

looked at how revenue neutral replacement of different classes of

distortionary taxes would impact large non-open economies, and

Haughwout studied the effect that replacing all distortionary taxes

with a land tax (both in a revenue neutral and non-neutral manner)

would have on a small open economy.[52] Although it might seem as if

Tideman's work on open and closed economies could be used to easily

link the work done by Nechyba and Haughwout, this is not entirely

true. Tideman's study nicely complements existing general equilibrium

research, but his model is quite different from the other two models

described in this paper. Although Tideman looks at factors largely

ignored by Nechyba and Haughwout (such as labor-leisure decisions and

the incidence of land speculation), Tideman's model does not provide a

mechanism for measuring how tax reform would effect property values.

This is a crucial component of the other two models. Furthermore,

while the Nechyba and Haughwout's models are static, Tideman's model

is dynamic and looks at the yearly equilibrium effect of tax

reform.[53]

Another source of discrepancy between these models stems from the

fact that they all look at different types of land tax reform: Tideman

transformed traditional property taxes into land value taxes by

removing the tax on structures and improvements, Nechyba replaced

entire classes of distortionary taxes with land taxes, and Haughwout

eliminated all taxes except for the tax on land. Despite the fact that

they look at different types of land tax reform, in each of the models

at least one entire type of tax is eliminated and replaced with a tax

on land. All three models could have been set up to examine the effect

of a more modest tax reform. However, these researchers all chose to

publish the results of dramatic tax reforms. This not only allowed

them to remain fairly true to George's original vision of a single tax

on land rents, it also allowed them to illustrate what would happen in

the best (or worst, depending on your personal view of land taxation)

case scenario.[54] However, by focusing on the impact of dramatic tax

reforms, these researchers worked outside of the realm of political

reality. It is true that Nechyba and Haughwout discuss the political

feasibility of their proposed tax reform (by examining the likely

impact on land values and thus on land owners), but they never take

account of the fact that public policy proposals always reflect a

political compromise. Proposed tax reforms, such as the ones studied

by these researchers, would likely face staunch political opposition.

Not only are these extreme tax reform packages politically

unrealistic, but from an econometrician's perspective, the results

from such model simulations are only marginally reliable. All three of

the discussed general equilibrium models are very sensitive to

elasticity estimates and to assumptions made about the relative

importance of land capital consumption.[55] Elasticity estimates play

a central role in determining the equilibrium effect of policy

proposals, yet relatively little is known about them. Typically,

aggregate elasticity estimates are formulated by looking at large

amounts of historical data. If the economic climate of a city were to

be suddenly altered by the introduction of a new and dramatic type of

tax reform, it would be difficult to predict how the elasticities of

supply and demand might change. Similarly, if such a drastic tax

policy were introduced, existing ratios relating to personal

consumption and firm production might no longer be accurate. This is

not to discredit the structure of these models, but simply to say that

the less policy proposals differ from the status quo, the more

reliable equilibrium estimates will be.

After identifying why none of the existing empirical or equilibrium

research should be used to evaluate the impact of the Philadelphia

City Controller's land tax proposal, it is necessary to identify what

type of research would be the most appropriate. Because the

Controller's policy proposal would only be implemented within city

limits, it makes sense to use small open economy model. Ideally, this

model should be calibrated to Philadelphia's fiscal, economic, and

demographic conditions. In order to replicate the Controller's

proposal, land tax reform would have to be limited in its scope and

all simulations would have to be conducted in a revenue neutral

manner.

7. Modeling Philadelphia's Economy (Haughwout and Inman)[56]

In this paper, rather than creating an entirely new general

equilibrium model, a modified version of Haughwout and Inman's open

city model is used to analyze the effect that land value taxation

would have on Philadelphia's economy. The following section contains

an overview of the model's structure and important features.

The Model:

The model is of a small open economy with mobile firms, resident

workers, and commuters (who work in the city while consuming housing

and other goods outside of the city).[57] In the model, there is a

fixed supply of land and an exogenously determined number of

non-working, non-mobile, dependent residents. All factors of

production (except land) must meet certain criteria in order to remain

located in the city: capital must earn its competitive rate of return,

firms must be able to sell the goods they produce in the city at

competitive world prices, labor working within the city, but living in

the suburbs, must earn a competitive after-tax wage, and residents

living and working in the city must maintain an overall level of

utility comparable to that outside of the city. Equilibrium is

achieved in this open city model when no mobile firm, resident, or

commuter has an incentive to change its location, residence, or job.

For each combination of different fiscal polices, a unique equilibrium

is reached. When evaluating tax reform policies it is necessary to

find and contrast the initial equilibrium outcome with the equilibrium

outcome created after implementing the tax reform. The model consists

of 15 exogenous parameters and 18 endogenous variables. See Appendix D

for a complete list of these parameters and variables.

Commuting Workers:

In addition to hiring resident workers, firms employ commuting

workers. In this model commuters have been classified as "managers"

which mirrors the existing pattern of labor location in the United

States. However, the model is sufficiently general to allow managers

to live within the city and workers to commute from the suburbs, as

they do in other parts of the world. Commuters consume private goods,

housing, and land outside of the city; it is assumed that they

purchase these goods at competitive and constant world prices.

Although commuters work in the city, they have the option of working

in a suburban location. Thus, in order to retain and attract

commuters, not only must city firms pay a wage equal to the commuter's

suburban wage, but these firms must also compensate commuters for all

disamenities of working within the city (such as an additional tax the

city might levy on a commuter's labor income). It is assumed that

there is an infinite supply suburban residents who would become

commuters if they were adequately compensated.

In Philadelphia many skilled workers (such as professors, physicians,

and technical staff) live in the suburbs and commute into the city

because, for them, no regional suburban employment alternatives exist.

Although the argument could be made that the model is flawed because

these workers do not get compensated for working in the city, it is

important to remember that the model assumes perfect mobility of

labor. Thus, even though there may not be another school like the

University of Pennsylvania in greater Philadelphia region, if a Penn

professor felt that he was not adequately being compensated for having

to work in the city he would be free to leave the region and seek

employment at another ivy league institution.

Solving the Model:

All of the model's 18 exogenous characteristics, along with the

parameterized household preference and firm production technologies,

are used to derive the 15 endogenous variables and find an equilibrium

solution. By adjusting these exogenous variables it is possible to

calibrate the model so that it mirrors the economic, fiscal, and

demographic composition of any city in the United States. See Appendix

E for a complete list of exogenous variables and parameters. The model

is solved iteratively using a starting value of G (=G(0)). This yields

a set of private market outcomes which in tern yields a new

equilibrium level of public services. This process is repeated until

the model converges and G(t-1) = G(t) = G. Equilibrium exists within

the model when no mobile firm, resident household, or commuter has an

incentive to change their location, residence, or job.

8. Model Modifications and Simulations

Modifying the original Haughwout and Inman model and running

simulations to answer the research questions set forth at the

beginning of this paper involved three distinct steps. First, it was

necessary to modify the structure of the original model and to

calibrate the reformed model to Philadelphia's economic, fiscal, and

demographic environment. Next, a series of simulations were conducted

to evaluated two distinct policy proposals. Although these policy

proposals closely resemble the ones made by the Philadelphia

Controller's Office, due to the constraints of the model, some

adjustments were necessary.

Both of the policy proposals examined in this paper involve adjusting

tax rates in a revenue neutral manner. By revenue neutral the

Philadelphia Controller's Office means that the revenues generated by

a select group of taxes will be sufficient to meet the current

budgeted revenue projection for those same taxes.[68] General

equilibrium modeling makes it possible to more comprehensively define

revenue neutrality. The model makes it possible to predict how

changing the rate for any one type of tax would alter the tax base

(and thus the revenues collected) for each type of tax. Therefore, in

these simulations, the term revenue neutrality is applied to all taxes

(net government revenues are equal before and after tax reform).

By linking revenue neutrality to current budget projections, the

Controller's Office implicitly assumes that total government

expenditures will remain constant. In this situation household utility

derived from government spending would remain constant if: (1)

changing the city's tax structure did not alter city demographics, (2)

and/or if the all-purpose government produced public good were a pure

public good. However, the modified version of the model assumes full

congestion of public service provision. Thus, household utility

derived from constrained government expenditures would only remain

constant if the city's population remained constant. Because total

city population is endogenously defined, in the model, tax reform

could lead to changes in the city's total population. Therefore, in

order to isolate the true economic impact caused by a tax reform

policy, revenue neutrality must be defined as constant household

government spending (average household tax revenue collection). If

household government spending was not held constant in the face of a

changing city population, it would be impossible to determine if the

city's relative economic "attractiveness" changed because

the tax structure changed or because the level of public service

provision per household changed.

Once the model was properly calibrated a simulation was run in order

to determine the equilibrium baseline residential wage (W), rental

rate of land (R), total city population (N+ D), total number of jobs

(N+M), the value of capital used by firms (K), and the value of the

city's housing stock (H).

8.3 The Second Policy Proposal

The second part of the Controller's proposed land tax reform involves

shifting the tax burden from the Residential Wage Tax onto the Land

Tax. See Appendix B for more information about Philadelphia's Wage

Tax. Rather than running one simulation to examine the effect of the

Controller's proposed 11.86% resident wage tax reduction, five

different simulations were run to identify what would happen if

Philadelphia's Residential and Non-residential Wages Taxes are reduced

by 10%, 20%, 50%, 90%, and 100%.[69] The decision not to strictly

model the Controller's proposal was made because compelling research

indicates that, like the Resident Wage Tax, the Non-Resident Wage Tax

adversely affects job creation and economic growth in

Philadelphia.[70]

9. Results

When general equilibrium modeling is used to analyze a specific

policy proposal, the equilibrium results should be viewed as a crude

indication of the nature and magnitude of any economic change

resulting from the policy's implementation. To reinforce the fact that

the results generated by equilibrium models are not precise numerical

projections, all results in this paper are presented as proportion

changes from an established baseline.

These results indicate that the city's current property tax depresses

land values and stifles economic growth. Reforming the property tax by

decreasing the tax on structures and increasing the tax on land would

stimulate Philadelphia's economy. This stimulation would increase

total city employment, increase the city's population, increase the

amount of capital (both housing and productive) investment in the

city, and increase property values. All economic indicators, except

for residential wage, would be dramatically increased if this tax

policy were implemented. Given that the decrease in residential wage

is relatively negligible (-0.7%), and that total city employment

significantly and simultaneously increases (78%), land tax reform

would cause wage tax revenues to increase.

Initially, the Controller's Office predicted that, in order to

generate half of the current Real Estate Tax revenues from land and

half from buildings, land would have to be taxed at 3.44 times the

rate of structures. The modified general equilibrium model found that

such a split in revenues would occur when land is taxed at 4.36 times

the rate of structures. To understand why the results presented in

this paper differ from the Controller's predictions, it is necessary

to look more closely at the equilibrium results and at the definition

of revenue neutrality. The model found that this type of tax reform

would have significant positive effects on the amount of jobs,

residents, productive capital, housing stock, and land rents in the

city. Even if the Controller's Office took into consideration relative

increase in city land rents, housing stock, and capital stock, their

definition of revenue neutrality would preclude them from looking at

how this type of tax reform would effect revenue collection from other

types of taxes. Although there was a slight decrease in residential

wages, the magnitude of this decrease is insignificant when compared

to the large increase in city employment.

Discrepancy between results put forth in this paper and predictions

made by Controller's Office arises because revenue neutrality is

defined in different ways. In the first policy simulation, government

spending per household is held constant. However, the Controller's

Office holds aggregate government spending constant. If the city

population never changed, or if city services were pure public goods,

aggregate revenues would be an acceptable proxy for per household

government spending. However, empirical research indicates that the

city's population is sensitive to changes in the city's fiscal

structure, and that, at the margins, city services are congestible. If

tax reform caused the city's population to increase, and if aggregate

revenues were held constant, it would be impossible to separate the

impact of the tax reform from the impact caused by a drop in service

provision.

The Second Policy Proposal:

When analyzing the second policy proposal, the general equilibrium

resulting from the first policy proposal are used as a baseline. Five

different simulations were run in order to identify what would happen

when per household tax revenues, lost as a result of wage tax

reduction, are replaced by increasing the land tax. In each

simulation, wage taxes were proportionally reduced by 10%, 20%, 50%,

90%, or 100%. The magnitude of the resulting economic change varied

depending on the size of the wage tax reductions, yet in all

simulation there was a slight reduction in residential wages, a more

significant reduction in land rents, and a large positive increase in

city employment, city population, the value of the housing stock, and

the value of the productive capital. See Table 2 [not provided

here] for the complete simulation results.

These results generally indicate that shifting the wage tax burden

onto a land value tax would stimulate the economy. In fact, these

simulations suggest that, if policy makers were interested in

maximizing the total number of city jobs, or the total city

population, or the total capital stock (both of housing and productive

capital), they would eliminate the wage tax completely and make up

lost revenues by taxing land more heavily.

When interpreting these results, it is important to remember that the

percentage change of each variable is calculated against the values

generated in the first policy proposal. If one were to compare the

equilibrium levels from the second policy proposal to the existing

economic conditions in Philadelphia, the change in city employment,

city population, housing stock, and productive capital stock would be

much larger. Although the change in residential wage would be smaller,

when compared to the magnitude of change experienced by other

variables this finding remains fairly insignificant. Because the first

policy proposal increased land rents by 24%, not until the wage tax

rates are cut in half do land rents drop below their current values.

Because there are sound theoretical reasons for believing that land

taxation is more efficient than wage taxation, it was somewhat

surprising to discover that land rents decrease when the tax burden is

shifted from the taxation of residential and non-residential wages to

a land value tax. In theory, firms and households should be attracted

to the city when a more efficient tax structure is implemented. Thus,

given the significant increase in other economic indicators,

decreasing land rents were unexpected. More than anything else, this

unexpected finding emphasizes the fact that local taxation is

inextricably linked to the size of the local public sector. Thus,

theories which seek to identify an optimal system must also be

concerned with identifying the optimal size of both the city and the

local public sector.

10. A Word of Caution

Before moving on to the paper's conclusion, it is important to issue

a word of caution about the limits of economic modeling techniques.

Modeling inherently involves simplifying, consolidating, and even

ignoring many different variables in hopes of capturing the essence of

the forces that drive the economy. For example, although research

indicates that a whole host of city provided services (well kept

infrastructure, good schools, adequate police protection, etc.) factor

heavily into location decision, in this model these variables have

been condensed into one all purpose public good "G". This

type of consolidation allows researchers to easily take a variety of

different, yet related, variables into account. It would be an error

to assume that these factors are incorporated into the model simply

because the model sheds no light on their individual or relative

importance (e.g. how important are good schools when compared to low

crime rates or low taxes). This being said, even the most

sophisticated models omit a great number of factors that could

potentially affect the outcome. If these omitted factors are not

random, the estimated impact of tax reform on the economy would be

biased.

Another limitation of this paper's general equilibrium model is

related to the fact that the model implicitly assumes that the

structure of the relationship between factors remains constant over

time. If these relationships are not stable, then the inferences

derived from the model simulations may not be warranted. Thus, if the

economic climate of a city were suddenly altered by the introduction

of a new and dramatic type of tax reform, the relationship between

factors might change. This word of caution is not to discredit

economic modeling, but simply to suggest the less policy proposals

differ from the status quo, the more reliable equilibrium estimates

will be. Similarly, the model assumes that there will be no outside

events or influences introduced to change the relationship between

factors. For example, if World War III erupted tomorrow it is likely

that the relationship between tax base and tax rate might change in an

unpredictable way.

When looking at the results of this or any economic model, it is

important to exercise a good deal of caution. Model simulations allow

researchers and policy makers to understand the nature and the

magnitude of the economic change that would result from certain types

of tax reform. As such, the numbers generated by this model should

simply be viewed as general indicator of trends that might happen.

11. Conclusion

The goal of this research was to determine the nature of

Philadelphia's economic response to land tax reform. Analyzing the

effect of a policy proposal which has not yet been implemented can be

difficult, however this was accomplished by studying the theoretical

arguments offered in support of land value taxation, reviewing the

existing body of economic land tax research, and conducting policy

simulations using a general equilibrium model. Economists generally

agree that land value taxation is an economically efficient method of

generating government revenue. Yet, empirical studies of land tax

municipalities provide little insight into how land tax reform would

effect Philadelphia's economy. To truly understand the impact land

taxation could have on Philadelphia's economy, it is necessary to

study this tax in terms of its revenue alternatives. This type of

investigation can be done by running policy simulations on a general

equilibrium model. Although several different economists have used

general equilibrium modeling to examination land value taxation, all

of this research focuses on the elimination of entire classes of

distortionary taxes. Though this type of tax reform can be conducted

in a revenue neutral manner, passage of such radical tax reform would

require strong political support. Throughout this paper, a

comprehensive policy proposal, developed by the Philadelphia

Controller's Office, was set forth as an example of a politically

feasible, modest land tax reform. Using a general equilibrium model,

two policy proposals, similar to the ones designed by the Controller's

Office, were analyzed in terms of their revenue alternatives. A series

of model simulations found that, if these policies were implemented,

Philadelphia would experience significant job creation and population

growth. Assuming that these are considered to be socially desirable

outcomes, city residents and elected officials should embrace the

concept of land value taxation and work towards shifting some of

Philadelphia's tax burden onto land values.

LIST OF APPENDIXES IN THE ORIGINAL PAPER

Appendix A: The Controller's Tax Structure Analysis Report

Appendix B: Arguments for Wage Tax Reduction in Philadelphia

Appendix C: Assessing Land Value

Appendix D: Model Variables

Appendix E: Model Assumptions and Parameterization

|