AMERICAN INSTITUTE FOR ECONOMIC

RESEARCH |

Low taxation of land in relation to taxation of

improvements fosters underutilization of land and a reluctance to

construct and maintain improvements. That the supply of land is

limited ensures that as population and economic activity increase,

demand for land and thus prices will increase. Such low relative

taxes on site values enable owners to leave sites idle or in

uneconomic use. The smaller the land tax, the less incentive

owners have to use land productively or ot sell it to someone who

will. Yet, as general population increases and economic gowth

result in higher prices for land, the private owner reaps the

return on publicly created value.

Thus, a de facto subsidy is provided by payers of the larger tax

on improvements to land.

[Economic Education Bulletin,

February 1987, p.3]

|

Allen,

Charles Grant

(1848-1899)

ENLARGE

|

Not one solitary square inch of English soil remains unclaimed

on which the landless citizen can legally lay his hand without

paying a toll to somebody; in other words, without giving a part

of his own labor or the product of his labor to one of the

squatting and tabooing class in exchange for their permission

(which they can withhold if they choose) merely to go on existing

upon the ground which was originally common to all alike, and has

been unjustly seized upon (through what particular process matters

little) by the ancestors or predecessors of the present

monopolists.

[From: "Individualism and

Socialism," Contemporary Review (1889), p. 732]

|

Allen,

Charles Grant

|

By this time the grave political differences which separated

[Herbert Spencer] from many of his early friends had either

deepened or lessened. He found himself more in accord with those

whom he had quitted, and less in accord with those whom he had

regarded as the faithful few of his followers. The rock on which

he split with his younger disciples was Socialism. Very early,

most of those whom he had profoundly influenced had been led by

the perusal of “Social Statics” into the acceptance of

his original idea of Land Nationalization. Alfred Russel Wallace,

the chief English exponent of the doctrine, founded his argument

entirely on Spencer. Later on Wallace became a convinced

Socialist, as did most of the other thinkers whose opinions

Spencer had most deeply leavened. Two of those whom he specially

regarded as his chosen disciples were Miss Beatrice Potter,

afterwards Mrs Sidney Webb, and myself. I do not think I am going

too far in saying that he looked upon us as his two favorite

followers. But it was a great blow to him when we both, as he

expressed it, “turned socialist.” He himself had been

growing steadily more anti-socialist, and indeed conservative, for

years; and his later publications, such as “The Man versus

the State,” had been violently anti-radical. The following

letter shows well his frame of mind on this moot point between us,

and forms the only one in my collection in which Spencer touches

at all seriously on the crying political differences which now

divided us:

[From: Personal Reminiscences of

Herbert Spencer (1894) ]</45>

|

Allen,

Charles Grant

|

He cannot sleep without paying rent for the ground he sleeps

on. ...The very air, the water and the sunlight are only his in

the public highway. ...His one right recognized by thelaw is the

right to walk along that highway till he reels with fatigue -- for

he must keep moving.

[From: Individualism and

Socialism, Contemporary Review (May 1889), pp. 732-3]

|

Amos,

Sheldon

(1835-1886) |

Sheldon Amos was educated in the law at Clare College,

Cambridge. In 1869 he was appointed to the chair of jurisprudence

in University College, London, and in 1872 became reader under the

council of legal education and examiner in constitutional law and

history to the University of London. Failing health led to his

resignation of those offices, and he took a voyage to the South

Seas. He settled in Egypt, where he was appointed judge of the

court of appeal. He returned to England in the autumn of 1885, and

on his return to Egypt he died suddenly on 3 January, 1886. His

principal publications are: Systematic View of the Science of

Jurisprudence (1872); Lectures on International Law (1873);

Science of Law (1874); Science of Politics (1883); and, History

and Principles of the Civil Law of Rome as Aid to the Study of

Scientific and Comparative Jurisprudence (1883).

The relation of a state to its territory, which in modern times

enters into the essential conception of the state, implies that

the land cannot be looked upon, even provisionally, as a true

subject of permanent individual appropriation.

[From: Science of Law (1874),

Chap. VIII., p. 166]

|

Amos,

Sheldon |

If the land is looked upon as susceptible of

permanent appropriation by some persons, other persons must, by

the same theory, be regarded as possibly excluded fro it -- that

is, banished from the territory of the State..

[From: Science of Law (1874),

Chap. VIII., p. 166]

|

Aristotle

ENLARGE

|

The whole of the land was in the hands of a few, and if the

cultivators did not pay their rents, they became subject to

bondage. ...

|

Aristotle

|

Formerly in many States there was a law forbidding

anyone to sell his original allotment of land.

[From: Politics (Jowett's

Translation), VI, 4, p. 194]

|

Arnold,

Thomas (Dr.)

ENLARGE

|

At Rome, as elsewhere among the free commonwealths

of the ancient world, property was derived from political rights,

rather than political rights from property, and the division by

assignation of lands to the individual member of the state by the

deliberate act of the whole community, was familiarly recognized

as the manner in which property was most regularly acquired.

[From: History of Rome

(1868), Vol. I, pp. 227-8]

|

Asquith,

Herbert H.

ENLARGE

|

"The value of land rises as population grows and

national necessities increase, not in proportion to the

application of capital and labour, but through the development

of the community itself. You have a form of value, therefore,

which is conveniently called 'site value,' entirely independent

of buildings and improvements and of other things which

non-owners and occupiers have done to increase its value - a

source of value created by the community, which the community is

entitled to appropriate to itself. …In almost every aspect

of our social and industrial problem you are brought back sooner

or later to that fundamental fact." [Mr.

H.H. Asquith, at Paisley, 7th June 1923]

"We hold, as we always have held, that, so far as

practicable, local and national taxes which are necessary for

public purposes should fall on the publicly-created value rather

than on that which is the product of individual enterprise and

industry. That does not involve a new or additional burden on

taxation, but it would produce these two consequences - first of

all, that we should cease to be imposing a burden upon

successful enterprise and industry; and next, that the land

would come more readily and cheaply into the best use for which

it is fitted. These two things would be two potent promoters of

industry and progress." [Mr. H.H.

Asquith, at Buxton, 1st June 1923]

|

Bagehot,

Walter

ENLARGE

|

In the early ages of society it would have been

impossible to maintain the exclusive ownership of a feew persons

in what seems at first sight an equal gift to all (the land) -- a

thing to which everyone has the same claim.

[From: Economic Studies,

Essay I, Part I, p. 31]

|

Baker,

Newton D.

ENLARGE

|

I am inclined to believe that no writer of our

times has had a more profound influence upon the thinking of ithe

world. I have read "Progress and Poverty" several times

and have always felt that for beauty of style, elevation of

spirit, and weight of argument, it is one of the great books

written in my lifetime.

|

Barr,

Joseph M.

ENLARGE

|

I believe the Graded Tax plan, which was adopted

here in 1913 by an act of the state legislature, has done a great

deal to encourage the improvement of real estate in general, and

especially the building of homes and apartments. And I think it

has been particularly fair and beneficial to homeowners.

It is generally felt that most of the fine structures erected

through private enterprise and investment as part of the renewal

program, are benefited by the lower tax rate on buildings, ...

Many people now believe the Graded Tax law should be extended.

...It was first sponsored here by a Republican Mayor, William

Magee in 1913, and has since been supported by both Republican and

Democratic mayors.

The law is generally accepted in the community and there is no

significant support for its repeal or modification. In short, the

Graded Tax plan has worked well in Pittsburgh, and we believe it

would prove equally beneficial if tested in other areas.

[Mayor of Pittsburgh; from a

speech at the Henry George Convention, 1962]

|

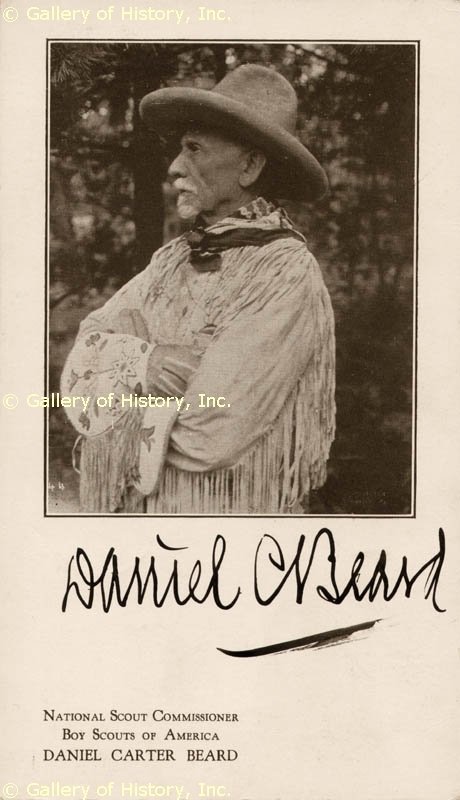

Beard,

Charles A.

(1874-1948)

ENLARGE

|

Of all the American economists since the early

days of the republic, none treated as comprehensively the

interfiliation of economy and civilization as George did. |

Beard,

Daniel C.

(1850-1941)

ENLARGE

|

Beard, who founded the Boy Scouts of America, had

given serious consideration to the proposals of Henry George, who

whom he wrote:

I believe in Henry George... I have long been a worker for the

Single Tax cause. ...When I read Progress and Poverty by Henry

George for the first time I could fancy I had and still have great

reverence for the truths contained in Jefferson's wonderful

Declaration of Independence, truths which, for some reason, could

not be realized or made practical because of some great obstacle,

and I never realized what that obstacle was until I read Progress

and Poverty.

|

Becker,

Gary

ENLARGE

|

The first book I looked at in economics was

Progress and Poverty. It's a wonderful book and had a lasting

impact on me.

[Professor of Economics, University of

Chicago, in a speech at St. John's University, April 23, 1992]

|

Bierce,

Ambrose

ENLARGE

|

LAND: A part of the earth's surface, considered as

property. The theory that land is property subject to private

ownership and control is the foundation of modern society, and is

eminently worthy of the superstructure. Carried to its logical

conclusion, it means that some have the right to prevent others

from living; for the right to own implies the right exclusively to

occupy, and in fact laws of trespass are enacted wherever property

in land is recognised. It follows that if the whole area of terra

firma is owned by A, B and C, there will be no place for D, E, F

and G to be born, or, born as trespassers, to exist.

[from: Devil's Dictionary,

1911]

|

Blackstone,

William

(1732-1780)

ENLARGE

|

The earth, therefore, and all things therein, are

the general property of all mankind from the immediate gift of the

Creator. ...There is no foundation in nature or in natural law why

a set of words upon parchment should convey the dominion of land.

[From: Commentaries on the Laws of

England]

|

Blackstone,

William

|

There is indeed some difference among the writers

on natural law, concerning the reason why occupancy should convey

this right (i.e., to the permanent property of the soil) ... a

dispute that savors too much of nice and scholastic refinement.

[From: Blackstone's Commentaries,

Book II, Chap. I, p.8]

|

Blackstone,

William |

The right of inheritance, or descent to the

children and relations of the deceased, seems to have been allowed

much earlier than the right of devising by testament. We are apt

to conceive at first view that it has nature on its side; yet we

often mistake for nature what we find established by long and

inveterate custom.

[From: Blackstone's Commentaries,

Book II, Chap. I, p.11]

|

Boulding,

Kenneth E.

ENLARGE

|

The sincerity, the passion, the genuine pride in progress

and anguish over its failure to extinguish poverty, and the

attempt to fuse the intellectual rigor of classical economics

with ... a Christian morality, give Henry George a unique place

not only in the literature of economics but in the English

language itself.

[source not identified] |

Bourassa,

Steven C.

ENLARGE

|

My study of housing development in Pittsburgh

demonstrated that small decreases in the tax rate on buildings

resulted in substantial increases in the amount of new housing

constructed in the city. In contrast, increases in the tax rate on

land had no undesirable effects.

The evidence from Pittsburgh strongly supports the idea that

cities concerned with economic development should shift their real

estate taxes from buildings to land [in order to] maintain

revenues while encouraging development.

Given the results of this study, land value taxation seems to be

a desirable strategy for central cities to employ in seeking to

encourage development and attract households. Because households

are relatively mobile within metropolitan areas, land value

taxation may permit central cities to attract households that

would otherwise locate in nearly suburban jurisdictions.

[Professor of Economics, Memphis State

University; quoted from a 1987 study]

ABSTRACT,

Land Value Taxation and Housing Development, Effects of

the Property Tax Reform in Three Types of Cities, from the

American Journal of Economics and Sociology, January 1990,

Vol. 49, Issue 1.

|

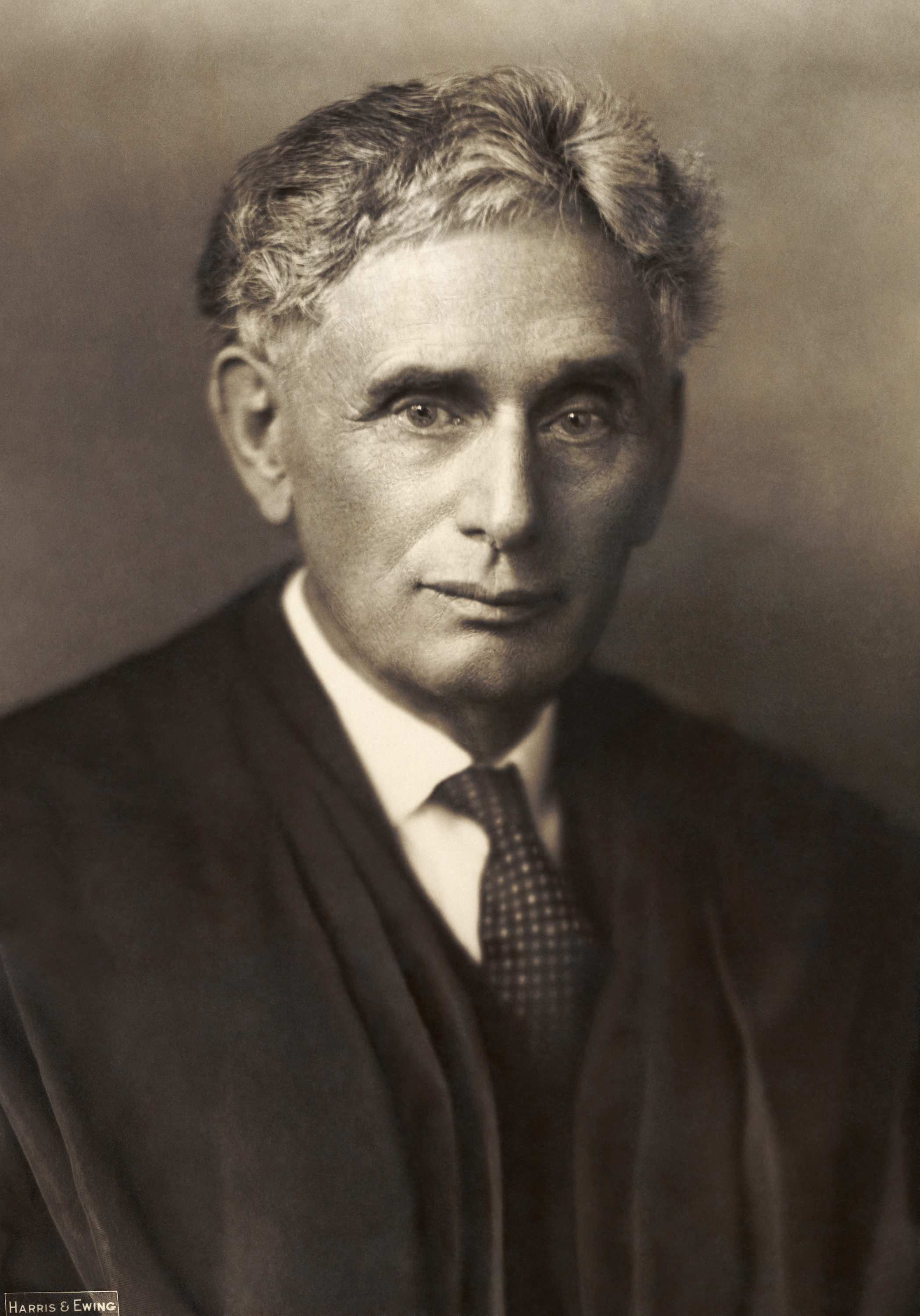

Brandeis,

Louis D.

(1856-1941)

ENLARGE

|

I find it very difficult to

disagree with the principles of Henry George. ...I believe in the

taxation of land values only. |

Bright,

John

ENLARGE

|

I do not pretend to believe, if you examine the

terms strictly, in what is called the absolute property in land.

You may toss a sixpence into the sea if you like, but there are

things with respect to land which you cannot, and ought not, and

dare not do.

[From a Speech in the House of

Commons, 14 March, 1868, Speeches, Vol.I, pp. 397-8

(Edition of 1868)]

|

Bright,

John

|

This being the case, in what manner are the Irish

people to subsist in future? There is the land and there is labor

enough to bring it into cultivation. But such is the state in

which the land is placed, that capital cannot be employed upon it.

You have tied up the raw material in such a manner -- you have

created such a monopoly of land by your laws and by your mode of

dealing with it -- as to render it alike a curse to the people and

to the owners of it.

[From a Speech in the House of

Commons, 2 April, 1849, Speeches, Vol.I, pp. 332 (Edition

of 1868)]

|

Brooks,

Paul

|

We shall never understand the natural environment

until we see it as a living organism. Land can be healthy or sick,

fertile or barren, rich or poor, lovingly nurtured or bled white.

Our present attitudes and laws governing the ownership and use of

land represent an abuse of the concept of private property.

...Today you can murder land for private profit. You can leave the

corpse for all to see and nobody calls the cops.

[From: The Pursuit of Wilderness

(1971)]

|

Brueckner,

Jan K.

ENLARGE

|

... modern theory vindicates George's belief in

the efficiency of site value taxation.

[Associate Professor of Economics,

University of Illinois at Urbana-Champaign; a concluding remark at

the end of a paper on a mathematical analysis of the effects of

site value taxation]

|

Bryan,

William Jennings

ENLARGE

|

Henry George was as guideless as a child, and as

earnest as a martyr.

Have you ever read Henry George’s “Progress and Poverty”?

If not I will send it to you. It ought to be read by every

thinking man & woman. I have not quite finished it but will by

the time you let me know if you have read it or not. You will

perhaps find it rather dry reading at first, but I think you will

get interested in it, and as I have done become a convert to his

theory.

[Boston, Sept, 9, 1887] |

Buchanan,

James

ENLARGE

|

The landowner who withdraws land from productive use to a

purely private use should be required to pay higher, not lower

taxes.

[Professor of economics and winner of

the 1986 Nobel Prize; from a lecture at St. Johns University, New

York City]

|

Buckle,

Henry Thomas

(1821-1862) |

The landlords are perhaps the only great body of men whose

interest is dramatically opposed to the interests of the nation.

[From: "Fragment on the Rise of

Agriculture," Miscellaneous Works(1885), Vol.I,

p.350]

|

Buckley,

William. F. (Jr.)

ENLARGE

|

Henry George said that the rent of all land ought to be

public. ...I am sympathetic with that particular analysis.

[From: Firing Line, PBS, 6 January,

1980]

|

Buckley,

William. F. (Jr.) |

William F. Buckley, Jr., on Henry George and the Single-Tax -

CSpan BookNotes interview with Brian Lamb (aired 4/2-3/2000)

"The Lexicon, A Cornucopia of Wonderful Words for the

Inquisitive Word Lover" by William F. Buckley, Jr. [Arnold

Roth, Illustrator, Jesse Sheidlower , Introduction.] Norwell,

Massachusetts. Go ahead, please.

CALLER: Mr. Buckley, it's a pleasure to talk to you. I've

heard you describe yourself as a Georgist, a follower of Henry

George, but I haven't heard much in having you promote land value

taxation and his theories, and I'm wondering why that is the case.

William F. Buckley: It's mostly because I'm beaten down by my

right-wing theorists and intellectual friends. They always find

something wrong with the Single-Tax idea. What I'm talking about

Mr. Lamb is Henry George who said there is infinite capacity to

increase capital and to increase labor, but none to increase land,

and since wealth is a function of how they play against each

other, land should be thought of as common property. The effect of

this would be that if you have a parking lot and the Empire State

Building next to it, the tax on the parking lot should be the same

as the tax on the Empire State Building, because you shouldn't

encourage land speculation. Anyway I've run into tons of

situations were I think the Single-Tax theory would be applicable.

We should remember also this about Henry George, he was sort of

co-opted by the socialists in the 20s and the 30s, but he was not

one at all. Alfred J. Nock's book on him makes that plain. Plus,

also, he believes in only that tax. He believes in zero income

tax. You look bored (addressing Brian Lamb)!

Brian Lamb: No, no. As a matter of fact I was going to ask

you about this little book ("Lexicon, A Cornucopia of

Wonderful Words for the Inquisitive Word Lover"). I'm

fascinated by it. I'm going to see if you can pronounce the word,

the-fear-of-having-peanut-butter-stuck-to-your-roof-of-your-mouth,

This little book starts off and the fellow's name, is it Jesse

Sheidlower?...

William F. Buckley: I think so.

Brian Lamb: S-H-E-I-D-L-O-W-E-R? You've never read it (the

Introduction to "The Lexicon").

William F. Buckley: No. I never have.

Brian Lamb: (Quoting the book) "The first time I met

William F. Buckley, we were both members of a televised panel

discussing word. The moderator introduced me with a pop-quiz to

test my credentials asked me to define the word..." Is it

USUFRUCT?

William F. Buckley: Usufruct, yeah.

Brian Lamb: (Quoting the book) "I felt smug as I recite

the right to enjoy another's property as long as you don't damage

it. Then Mr. Buckley leaned into his microphone and quoted an

entire paragraph on usufruct from the political economist, Henry

George.

William F. Buckley: Oh for heaven's sake!

Brian Lamb: And this little book has..

William F. Buckley: The land belongs to those in usufruct.

This passage is available to print out as a distinct page. Click

here.

|

Burgess,

Edwin

|

Edwin Burgess was a tailor living in Racine,

Wisconsin. In 1848 he wrote a letter which appeared in "Excursion

No. 45, Clearance No. 3, of the Portland [Maine] Pleasure boat, J.

Hacker, Owner, Master, and Crew," in which he said:

I want now to say a few words on the best means of raising

revenue or taxes so as to prevent land monopoly. I know not what

are your views on the subject, but should like to have you inquire

whether raising all the taxes off the land in proportion to its

market value would not produce the greatest good to mankind with

the least evil, of any means of raising revenue. Taxing personal

property has a tendency to limit its use by increasing its price,

and the consequent difficulty of obtaining it.

In 1859-60 Burgess gave a more extensive presentation of these

ideas in a series of eleven letters to the Racine Advocate,

in which he urged that land should be taxed and improvements

exempted. These letters aroused considerable discussion and some

opposition. Burgess believed that his policy would force idle land

into use, would encourage the production of wealth and increase

opportunities for employment, and would do away with the evasion

and fraud which accompany other taxes.

Were all the taxes on the land, and the people's land free,

then the hitherto landless could soon build their own homes on

their own land, and raise all they needed to consume or exchange,

and no longer need the land, house, or capital of others; then

rent, interest, and even usury would cease for want to poverty to

sustain them, for the curse, land monopoly, being removed, the

effect would case with the cause. Thus would the happiness of

mankind be immeasurably increased, and misery be proportionately

diminished; then would earth be redeemed from the giant sin of

land robbery, and the Paradise of the present or future be far

above that of the past.

[from: The Edwin Burgess Letters

on Taxation, p. 14.]

|

Burke,

Edmund

ENLARGE

|

Instead of putting themselves in this odious point

of light, one would think they would wish to let Time draw his

oblivious veil over the unpleasant modes by which lordships and

demesnes have been acquired in their and almost in all other

countries.

[From a letter to Richard Burke, Works,

Vol.VI, pp.75-6] |

Cable,

George Washington

ENLARGE

ENLARGE

|

He thought again of that deep store of the earth's largess

lying under the unfruitful custody, ... that root of so many

world-wide evils -- the calling still private what the commons

need has made public.

[From: John March, Southerner

(1895), Chap. XXVIII., p. 164]

|

Cairnes,

John Elliot

ENLARGE

|

Sustained by some of the greatest names -- I will say by every

name of the first rank in Political Economy, from Turgot and Adam

Smith to Mill -- I hold that the land of a country presents

conditions which separate it economically from the great mass of

the other objects of wealth, -- conditions which, if they do not

absolutely and under all circumstances impose upon the State the

obligation of controlling private enterprise in dealing with land,

at least explain why this control is in certain stages of social

progress indispensable.

[From: "Political Economy and

Land," published in Essays in Political Economy,

Theoretical and Applied, London 1873, p. 189. The essay here

quoted was first published in 1870, in the Edinburgh Rev.]

|

Cairnes,

John Elliot |

Little impression has been made on the rate of wages and

profits by the universal industrial progress of recent times.

...The large additions to the wealth of the country (England) has

gone neither to profits nor to wages, nor yet to the public at

large, but to swell a fund ever growing even while its proprietors

sleep -- the rent roll of the owners of the soil.

[From: Some Principles of

Political Economy]

|

Cairnes,

John Elliot |

Sustained by some of the greatest names -- I will

say by every name of the first rank in Political Economy from

Turgot and Adam Smith to Mill -- I hold that the land of a country

presents conditions which separate it economically form the great

mass of the other objects of wealth.. <

[From: Essays in Political Economy

(1870), Essay VI, p. 189]

|

Cairnes,

John Elliot |

A bale of cloth, a machine, a house, owes its

value to the labor expended upon it, and belongs to the person who

expends or employs the labor; a piece of land owes its value, so

far as its value is affected by the causes I am now considering,

not to the labor expended on it, but to that expended upon

something else -- to the labor expended in making a railroad or

building houses in an adjoining town. ...How many landlords have

their rent rolls doubled by railways made in their despite!

[From: Essays in Political Economy

(1870), Essay VI, p. 193]

|

Cameron,

Clyde

ENLARGE

|

I am certain that the ALP will once again produce

the kind of statesmen who in yesteryears had the intelligence and

the integrity to be right (and support the economic philosophy of

Henry George). ...That will one day make it possible for Christmas

to truly say, "Thy will be gone on earth as it is in heaven."

[Mr. Cameron served as the Federal

Minister for Labour in the 1972-1975 Whitlam government,

Australia] |

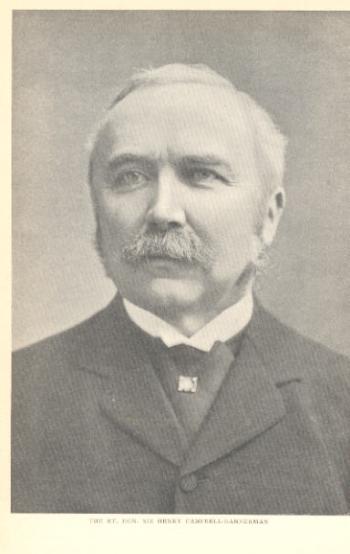

Campbell-Bannerman,

Henry

ENLARGE

|

"Let the value of the land be assessed independently of

the buildings upon it, and upon such valuation let contribution be

made to those public services which create the value. This is not

to disturb the balance of equity, but to redress it. …There

is no unfairness in it. The unfairness is in the present state of

things. Why should one man reap what another man sows? We would

give to the landowner all that is his, but we would prevent him

taking something which belongs to other people."

[Sir Henry Campbell-Bannerman, at

Leeds, 19th March 1903]

"Our present rating system operates as a hostile tariff

on our industries, it goes in restraint of trade, it falls with

severity on the shoulders of the poorer classes in the very worst

shape, in the shape of a tax upon house-room. …So long as

this system is left unamended, we are consenting - you and I, by

allowing it to remain unamended - to the aggravation of these

appalling evils of over-crowding, which are a disgrace to our

humanity and a blot upon our record as a capable self-governing

community."

[Sir Henry Campbell-Bannerman, at

Dunfermline, 22nd October 1907]

"We desire to develop our undeveloped estates in this

country - to colonise our own country - to give the farmer greater

freedom and greater security in the exercise of business - to

secure a home and a career for the labourer, is now in many cases

cut off from the soil. We wish to make the land less of a

pleasure-ground for the rich and more of treasure-house for the

nation."

[Sir Henry Campbell-Bannerman, at

the Albert Hall, 21st December 1905]

|

Cannan,

______ |

The movement for 'nationalizing' land without compensation to

present owners, on which Mr. Henry George and others have wasted

immense energy, would probably never have been heard of, if the

Ricardian economists had not represented rent as a sort of vampire

which continually engrosses a larger and larger share of the

produce, and if they had not failed to classify rent and interest

together as two species of one genus.

[From: Theories of Production and

Distribution, London (1903), p. 393]

|

Cantillon,

Richard |

It does not appear that Providence has given the right of the

possession of land to one man preferably to another: the most

ancient titles are founded on violence and conquest.

[From: Essay on the Nature of

Commerce (1755), Chapter 11]

|

Carlson,

Gary |

Specific changes in the state's property tax laws to allow

local governments to set separate higher tax rates on land and

lower tax rates on improvements could encurage economic

development.

[Community Development Director,

Newton, Iowa; from a research thesis abstract]

|

Carlyle,

Thomas

ENLARGE

|

Properly speaking, the land belongs to these two: the almighty

God and to all his children of men.

[From: Past and Present]

While the widow is gathering nettles for her children's dinner

a perfumed seigneur, delicately lounging in the Oeil de Beouf,

hath an alchemy whereby he will extract from her the third nettle,

and call it rent. <

[Source not identified]

"The Land is Mother of us all; nourishes, shelters,

gladdens, lovingly enriches us all; in how many ways, from our

first wakening to our last sleep on her blessed mother-bosom, does

she, as with blessed mother-arms, enfold us all! ... Properly

speaking, the Land belongs to these two: to the Almighty God; and

to all his Children of Men. …It is not the property of any

generation, we say, but that of all the past generations that have

worked on it, and of all the future ones that shall work on it."

[Thomas Carlyle, Past and Present, iii, 8]

"We hear it said, the soil of England, or of any country,

is properly worth nothing, 'except the labour bestowed on it,'

This, speaking even in the language of Eastcheap, is not correct.

The rudest space of country equal in extent to England - could a

whole English nation, with all their habitudes, arrangements,

skills, with whatsoever they do carry within the skins of them and

cannot be stript of, suddenly take wing and alight on it - would

be worth a very considerable thing! . . . On the other hand, fancy

what an English nation, once 'on the wing,' could have done with

itself, had there been simply no soil, not even an inarable one,

to alight on? Vain all its talents for ploughing, hammering, and

whatever else; there is no Earth-room for this nation with its

talents. …Soil, with or without ploughing, is the gift of

God. The soil of all countries belongs evermore, in a very

considerable degree, to the Almighty Maker! The last stroke of

labour bestowed on it is not the making of its value, but only the

increasing thereof."

[Thomas Carlyle, Past and Present, iii, 8]

|

Carlyle,

Thomas

|

Properly speaking, the land belongs to these two -- to the

Almighty God and to all the children of men that have ever worked

well on it, or that shall ever work well on it.

[From: Past and Present, Book

III, Chap.8]

|

Carnegie,

Andrew

ENLARGE

|

The most comfortable, but also the most unproductive, way for

a capitalist to increase his fortune is to put all his monies in

sites and await that point in time when a society, hungering for

land, has to pay his price.

[source unknown]

|

Carpenter,

Edward

ENLARGE

|

Are they not mine, saith the Lord, the everlasting

hills? ...

Are they not mine, where I dwell -- and for my children?

How long, you, will you trail your slime over them, and your talk

of rights and of property?

[From: Towards Democracy

(1894), p. 340] |

Chamberlain,

Joseph

ENLARGE

|

"There is a trade at present in our midst which would

return to the wealth England £250,000,000 per annum, which

would give employment to I know not how many families of the

working classes. And that trade we might win, not by conciliating

barbarous potentates with slavery circulars, not by exporting

civilisation in chests of opium, nor by forcing it upon ignorant

people at the bayonet's point, but by freeing the land of England

from the trammels of a bygone age."

[From a speech delivered at

Birmingham, England in 1876]

|

Cheng,

Wen-Hui |

Raising the effective rates of the Land Value Tax not only

benefits local finance, but also improves the equity and

efficiency of the whole property taxation system.

[Professor of Public Finance, National

Chengchi University, Taiwan; from a paper written with Tzer-Ming

Chu, presented at the L.R.T.I. conference, November 1988]

|

Churchill,

Winston S.

ENLARGE

|

I have made speeches by the yard on the subject of land value

taxation, and you know what a supporter I am of that policy.

It is quite true that the land monopoly is not the only monopoly

which exists, but it is by far the greatest of monopolies -- it is

a perpetual monopoly, and it is the mother of all forms of

monopoly.

Nothing is more amusing than to watch the efforts of our

monopolist opponents to prove that other forms of property and

increment are exactly the same, and are similar in all respects to

the unearned increment in land.

|

Clark,

Colin

ENLARGE

|

What gives urban land its value, apart form the

few cents per square foot which the developer has to spend on

roads, wate rand sewerage connection, is its proximity to

opportunities for employment, shopping, education, etc. In other

words, the seller of urban land is mainly selling the fruits of

other people's labour. The requirements of social justice would

therefore indicate that heavy taxes should be imposed on land.

[Professor of Economics, November

1974] |

Clark,

Colin |

Land taxation reduces the price of land. This can

be shown by mathematical demonstrations and by practice.

[Quote from comments made by Prof.

Clark at a Colloquium on Land Values held in London during March,

1965]

|

Clark,

P.H. |

I have stressed the moral aspect of imposing a levey on site

values since I believe this to be fundamental to both site-value

rating and the recovery of betterment. Both principles rest on a

sound moral basis and on this ground alone, are valid.

[Quote from comments made by Prof.

Clark at a Colloquium on Land Values held in London during March,

1965]

|

Clemens,

Samuel

(1835-1910)

ENLARGE

|

Writing under the penname Mark Twain, Clemens authored the essay

Archimedes which on July 27, 1889 appeared In the San

Francisco newspaper, The Standard (edited by Henry

George). In this essay, Clemens joined Henry George by criticizing

private individual ownership of land without payment of the full

ground rent to society. Clemens became personally invovled in the

effort to publicize George's cause, actually helping to sell

tickets at Henry George lectures. In Archimedes, Clemens

writes:

The earth belongs to the people. I believe in the gospel of

the Single Tax.

|

Cobden,

Richard

ENLARGE

|

For a period of one hundred fifty years after the [Norman]

Conquest, the whole of the revenue of the country was derived from

the land. During the next one hundred and fifty years it yielded

nineteen-twentieths of the revenue. For the next century down to

the reign of Richard III it was nine-tenths. During the next

seventy years to the time of Mary it fell to about three-fourths.

From this time to the end of the Commonwealth, land appeared to

have yielded one half of the revenue. Down to the reign of Anne it

was one-fourth. In the reign of George III it was one-sixth. For

the first thirty years of his reign the land yielded one-seventh

of the revenue. From 1793 to 1816 (during the period of the land

tax), land contributed one-ninth, from which time to the present

[1845] one-twenty-fifth only has been derived from the land.

...Thus, the land which anciently paid the whole of taxation paid

now only a fraction. ...The people had fared better under the

despotic monarchs than when the power of the state had fallen into

the hands of a landed oligarchy who had first exempted themselves

from taxation, and next claimed compensation for themselves by a

corn law for their heavy and peculiar burdens.

[From a speech delivered during the

Parliamentary debate on the Corn Laws, 1845]

|

Cobden,

Richard |

You who shall liberate the land will do more for your country

than we have done in the liberation of its trade.

[source not identified]

|

Coleridge,

Samuel Taylor

ENLARGE

|

Nothing but the most horrible perversion of humanity and moral

justice, under the specious name of political economy, could have

blinded men to this truth as to the possesion of land, -- the law

of God having connected indissolubly the cultivation of every rood

of earth with the maintenance and watchful labor of man. But

money, stock, riches by credit, transferable and convertible at

will, are under no such obligations, and, unhappily, it is from

the selfish, autocratic possession of such property, that our

landholders have learned their present theory of trading with that

which was never meant to be an object of commerce.

[From: Table Talk, March 31,

1833]

|

Coleridge,

Samuel Taylor |

These Islands are not very large. It is plainly conceivable

that estates might grow to fifteen million acres or more. ...These

things might be for the general advantage, ...but if not, does any

man possessing anything which he is pleased to call his mind, deny

that a state of law under which such mischiefs should exist, under

which the country itself would exist, not for its people but for a

mere handful of them, ought to be instantly and absolutely set

aside?

[From: "The Laws of Property,"

an address before the Glasgow Juridical Society, Macmillan's

Magazine, April, 1888, p. 406]

|

Coleridge,

Samuel Taylor |

I should myself deny that the mineral treasures

under the soil of a country belong to a handful of surface

proprietors in the sense in which these gentlemen appeared to

think they did.

[From: "The Laws of Property,"

an address before the Glasgow Juridical Society, Macmillan's

Magazine, April, 1888, p. 467]

|

Confucius

(B.C. 551-479)

ENLARGE

|

The great Chinese philosopher and teacher observed of his own

society's past and present:

When the Great Way prevailed, natural resources were fully

used for the benefit of all and not appropriated for selfish

ends... This was the Age of the Great Commonwealth of peace and

prosperity.

|

Cranston,

Alan

ENLARGE

|

A potentially important application of the societal collection of

rent takes the form of the eventual removal of taxes from location

improvements, so that only the rental value of the location itself

-- but all of that value -- is collected for societal use.

Cranston, a long-time member of the U.S. Senate, expressed support

for this gradual reform in the Los Angeles Times (Nov. 20, 1967):

Higher taxes on land and lower taxes on improvements have

already been tested successfully.

|

Currie,

Lauchlin

ENLARGE

|

Lauchlin Currie was an early advocate of treating housing as a "leading

sector" in the advance of under-developed economies. In a

paper he prepared for Habitat, the UN Conference on Human

Settlements, in 1976, he wrote:

It is a striking example of our economic illiteracy that we

have more or less quietly acquiesced in the private appropriation

of socially created gains, letting fortunate owners and their

heirs levy tribute or claim a share of the national income to

which they have contributed nothing. [The case for capturing] all

or a large portion of the pure monopoly gain of rising urban land

has been impaired by failure to distinguish between land and

capital in general, between land and building, and between the

rise reflecting inflation and that traceable to pure scarcity.

The rise in land values ... that results from the growth in

numbers and income of a community is a reflection of pure

scarcity. It arises from the community and should belong to the

community. It does not in any way arise form the work or saving of

an individual owner and does not provide any incentive to work or

save, since the supply of land is fixed.

[See: Lauchlin Currie, "Controlling

land use: the key to urbanization," Ekistics, 244,

March 1976, pp.137-143. ]

|

|