Daly,

Herman

ENLARGE

|

Herman Daly is professor of economics in the School of Public

Affairs, University of Maryland. The following excerpts are from a

speech delivered 30 April 2002 at the World Bank:

Value added belongs to whoever added it. But the original

value of that to which further value is added by labor and capital

should belong to everyone. Scarcity rents to natural services,

nature's value added, should be the focus of redistributive

efforts. Rent is by definition a payment in excess of necessary

supply price, and from the point of market efficiency is the least

distorting source of public revenue.

Appeals to the generosity of those who have added much value by

their labor and capital are more legitimate as private charity

than as a foundation for fairness in public policy. Taxation of

value added by labor and capital is certainly legitimate. But it

is both more legitimate and less necessary after we have, as much

as possible, captured natural resource rents for public revenue.

The above reasoning reflects the basic insight of Henry George,

extending it from land to natural resources in general.

Neoclassical economists have greatly obfuscated this simple

insight by their refusal to recognize the productive contribution

of nature in providing "that to which value is added".

In their defense it could be argued that this was so because in

the past economists considered nature to be non-scarce, but now

they are beginning to reckon the scarcity of nature and enclose it

in the market. Let us be glad of this, and encourage it further.

The modern form of the Georgist insight is to tax the resources

and services of nature (those scarce things left out of both the

production function and GDP accounts) -- and to use these funds

for fighting poverty and for financing public goods. Or we could

simply disburse to the general public the earnings from a trust

fund created by these rents, as in the Alaska Permanent Fund,

which is perhaps the best existing institutionalization of the

Georgist principle. Taking away by taxation the value added by

individuals from applying their own labor and capital creates

resentment. Taxing away value that no one added, scarcity rents on

nature¹s contribution, does not create resentment. In fact,

failing to tax away the scarcity rents to nature and letting them

accrue as unearned income to favored individuals has long been a

primary source of resentment and social conflict.

|

Darrow,

Clarence

(1859-1938)

ENLARGE

|

Darrow, an attorney in the United States, made his reputation, in

part, by his defense of a schoolteacher who dared to teach the

scientific basis for evolution to students in a Southern school.

Of Henry George, Darrow wrote:

Henry George was one of the real prophets of the world; one of

the seers of the world. ...His was a wonderful mind; he saw a

question from every side. ...When we learn that the value or land

belongs to all of us, then we will be free men -- no need to

legislate to keep men and women from working themselves to death;

no need to legislate against the white slave traffic. ...The "single

tax" is so simple, so fundamental and so easy to carry into

effect that I have no doubt that it will be about the last land

reform the world will ever get. People in this world are not often

logical.

|

Darrow,

Clarence |

The single tax is so simple, so fundamental, and so easy to

carry into effect that I have no doubt that it will be about the

last land reform the world will ever get.

|

Davenport,

Herbert J.

ENLARGE

|

It is obvous that the bare land with its contents and the

waters that flow through and about it constitute the

nature-provided environment of human beings and are rightly the

subject of their equal claims. Also that the value-for-use of

these natural resources is conditioned on population. It follows

populaton as its shadow. It appears with the people and disappears

when they go. This value, therefore, should, by the best of

titles, be retained by the community as its most excellent source

of public revenue. The more the community draws upon this vast,

community-conditioned fund the less will be the forced

contributions from labour and capital. this means that the greater

and better distributed wil be the purchasing power of the people..

[H.J. Davenport, Professor of

Economics, Cornell University]

|

Day,

Alan

(Professor) |

It is arguable that the whole of the rent of land, or

alternatively, of the capitalised value of rents, could be taxed

away and yet the community would not suffer. In this respect land

is different from the other factors of production.

[From comments made at a Colloquium on

Land Values held in London, March, 1965. Professor Day taught at

the London School of Economics from 1949 to. 1983. ]

|

Deakin,

Alfred

(1857-1919)

ENLARGE

|

The whole of the people have the right to the ownership of

land and the right to share in the value of land itslef, though

not to share in the fruits of land which properly belong to the

individuals by whose labour they are produced.

[Australian Prime Minister] |

Dewey,

John

(1859-1952)

ENLARGE

|

Dewey is considered to have possessed one of the great minds of

the twentieth century. His ideas regarding education were and are

controversial, if often misrepresented by opponents. In the early

1930s, Dewey became the first honorary president of the Henry

George School of Social Science in New York City. His attachment

to the ideas of Henry George was life-long:

Henry George is one of the great names among the world's

social philosophers. It would require less than the fingers of the

two hands to enumerate those who, from Plato down, rank with him.

... No man, no graduate of a higher educational institution has a

right to regard himself as educated in social thought unless he

has some firsthand acquaintance with the theoretical contribution

of this great American thinker.

|

Douglas,

Paul

ENLARGE

|

We ask only that the men and women who make up society should

be allowed to share in the increases in value which their presence

and productivity have created. Unless there is such a public

awareness and commitment, we shall repeat the history of the past

and permit those who sit tight and hold on to a scarce factor of

production to reap a large part of the product created by others.

We are becoming properly aware of the need for land reform in the

countrysides of Asia and Latin America. There is an even greater

need for land reform in the cities and suburbs all over the world

-- our own country included.

[U.S. Senator from Illinois and

Chairman, U.S. Natinal Commission on Urban Problems, 1968]

|

Dove,

Patrick Edward |

Patrick Edward Dove, a Scotchman, was the most remarkable

anticipator of Henry George. In 1850 he published anonomously The

Theory of Human Progression, and Natural Probability of a Reign of

Justice. This is a diffuse work largely taken up with

philosophical and theologial specualation; economic problems

hardly seem to be the main issue. However, Dove referred to the

land question as "the main question of England's welfare."

How comes it that, notwithstanding man's vast achievements,

his wonderful efforts of mechanical ingenuity, and the amazing

productions of his skill, ... a large portion of the population is

reduce to pauperism? ...To charge the poverty of man on God, is to

blaspheme the Creator. ...He has given enough, abundance, more

than sufficient; and if man has not enough, we must look to the

mode in which God's gifts have been distributed.

[from: The Theory of Human

Progression, pp. 322, 320, 387]

Dove diagnosed the cause of poverty as the denial of the natural

right of all to the land of their birth, "the alienation of

the soil form the state, and the consequent taxation of the

industry of the country."

Dove believed that the actual division of the land, even if

possible, would be futile as a remedy. The solution was to be

found in "the division of its annual value or rent,"

which could best be done "by taking the whole of the taxes

out of the rents of the soil, and thereby abolishing all other

kinds of taxation whatever." If this were done "all

industry would be absolutely emancipated from every burden, and

every man would reap such natural reward as his skill, industry,

or enterprise rendered legitimately his, according to the natural

law of free competition."

"The rent of any one portion of soil does not depend on

the labour or capital that has been expended on that portion.

...For instance, if, in the heart of London, a space of twenty

acres had been enclosed by a high wall at the time of the Norman

Conquest, and if no man had ever touched that portion of soil,"

or even seen it from that time to this, it would, if let by

auction, produce an enormously high rent."

[Patrick Edwrd Dove, Elements of Political Science

(1854), p. 283]

"Political economists have insisted much on the small

matters that affect the value of labour. By far the most important

is the mode in which the land is distributed. Wherever there is a

free soil, labour maintains its value. Wherever the soil is in the

hands of a few proprietors, or tied up by entails, labour

necessarily undergoes depreciation. In fact, it is the disposition

of the land that determines the value of labour. If men could get

the land to labour on, they would manufacture only for a

remuneration that afforded more profit than God has attached to

the cultivation of the earth. Where they cannot get the land to

labour on, they are starved into working for a bare subsistence."

[Patrick Edward DOVE, Theory of Human Progression

(1850), p. 406 n]

|

Dove,

Patrick Edward |

We are fully aware that there exists in the minds of many

persons a vague apprehension, tht if the present laws relating to

landed property were to be disturbed, evils of the most malignant

character would invade the society of Britain. Nothing could be

more absurd, more puerile, more dastardly. The very same fears

have prevailed with regard to every other change that has taken

place.

[From: Theory of Human

Progression (1850), Chap. III., Sec. 3, pp. 294-5 (Edition of

1895)]

|

Dove,

Patrick Edward |

The great social problem, then, that cannot fail ere long to

appear in the arena of European discussion is, "to discover

such a system as shall secure to every man his exact share of the

natural advantages which the Creator has provided for the race;

while, at the same time, he has full opportunity, iwhtout let or

hindrance, to exercise his skill, industry, and perseverance for

his own advantage."

[From: Theory of Human

Progression (1850), Chap. III., Sec. 3, p. 305]

|

Dove,

Patrick Edward |

Let it be observed that when land is taxed, no man is taxed;

for the land produces, according to the law of the Creator, more

than the value of the labor expended on it, and on this account

men are willing to pay a rent for land.

[From: Theory of Human

Progression (1850), Chap. I., Sec. 2, p. 44 (American Edition

of 1895)]

|

Downs,

Anthony

ENLARGE

|

Anthony Downs is a Senior Fellow at the Brookings Institution and

member of the HUD Commission on Regulatory Barriers to Affordable

Housing.

We should make a fuller case for stronger land taxation as a

means of reducing housing costs.

[Source not known]

There has been too much money flowing into real estate and

that this excessive cash flow has created many money-driven rather

than demand-driven markets.

[From: "Tax Reform: What About

Real Estate?," Urban Land, August, 1985, p. 14.]

|

Downs,

Anthony

and

Stanley,

Knighton |

This seemingly modest reform [a 2-rate building-to-land

property tax shift] enabled Pittsburgh, Scranton, Harrisburg and a

dozen smaller cities to keep housing costs down, and renew and

revive blighted neighborhoods. These activities, in turn, unlocked

job opportunities. If the District [of Columbia] went to a

split-rate [2-rate] system, the experience in Pennsylvania cities

indicates that: (a) homes and apartments on average would enjoy

lower taxes; (b) owners of vacant lots and blighted buildings

would pay substantially higher taxes; and (c) poor precincts would

reap the proportionately greatest reductions.

[Washington Post, 24

September, 1995, p.C.8]

|

Durning,

Alan

ENLARGE

|

Taxes on income, payroll, property and retail sales discourage

entrepreneurship, hiring, investment, savings and work ... they

also encourage sprawl, depletion of natural resources and

pollution of land, air and water. ...They could be replaced with

taxes on land values and on actions that pollute, deplete or

destroy habitat.

[From: "This Place on Earth"

(1996)]

|

East,

Ronald

ENLARGE

|

We have gone wrong on the land question, and everything else

has gone wrong automatically. I believe that there is no greater

or more urgent task of leadership for the engineer than to help

the community to a clear understanding of the simple economic laws

that govern distribution of benefits from human activities.

[The source of the quote is not known.

SCI believes this comes from Ronald East, who served Australia as

President of the Institution of Engineers in the 1950s with an

expertise on water usage]

|

Eckert,

Charles |

Now, what about tax on land values? We have observed that land

values are the result of community growth and advancing

civilization. They do not come into being as a result of the

activity of any particular individual, but by the activity of all

the people functioning as a social organism. Therefore, since no

particular individual is responsible for the origin and growth of

land values, but are due to the activity of all the people, it is

clear that the profits issuing from land values belong to all the

people.

[Member of the U.S. House of

Representatives during the 1930s, and one-time President of the

Henry George Foundation of America]

|

ECONOMIST

MAGAZINE |

By cutting taxes on labour, governments can remove one

disincentive to join the job market; by cutting taxes on capital,

one disincentive to save.

But by taxing the use of natural resources -- be they oil, or

cadium, or the dirt-absorbing capacity of the atmosphere --

governments can not only pay for lower taxes on labour and saving;

they can also make markets work better, by ensuring that prices

reflect the full costs of economic activity.

[From: The Economist, May 5,

1990]

|

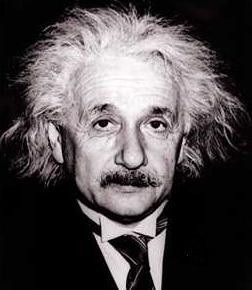

Einstein,

Albert

(1879-1955)

ENLARGE

|

I have already read Henry George's great book and really

learnt a great deal from it. Yesterday evening I read with

admiration -- the address about Moses. Men like Henry George are

rare, unfortunately. One cannot imagine a more beautiful

combination of intellectual keenness, artistic form, and fervent

love of justice. Every line is written as if for our generation.

The spreading of these works is a really deserving cause, for our

generation especially has many and important things to learn from

Henry George.

[From: a letter to a Pennsylvania

women in response to a letter inquiring whether Einstein had read

Progress and Poverty, 1931. A copy of this letter is

available in the SCI library]

|

Eisenhower,

Dwight D.

(1890-1969)

ENLARGE

|

At the end of the Second World War, Eisenhower held a unique

vision of the future, one that would ensure both peace and

prosperity. He asked:

Why the world's resources could not be internationalized,

since raw materials represented the world's basic needs, they

should belong to and serve everybody.

[From: Blanche Cook. The

Declassified Eisenhower, 1985, p.229]

|

Ely,

Richard T.

ENLARGE

|

One of the factors leading to the confusion which has

surrounded the taxation of land values is the old theory of

economic rent. Those who hold this theory regard land income as

the result of the spontaneous action of nature and land values as

the consequence of the niggardliness of nature in failing to

provide an adequate supply of land in relation to man's need for

it. Economic evoluton has disproved many of the hypotheses on

which the Richardian theory of rent is based. ...The concept of

economic relativity must lead us to draw up plans for the taxation

of land vlaues which will meet the needs of different times and of

different places.

[From: "Taxing Land Values and

Taxing Building Values," The Annals of The American

Academy of Political and Social Science, Vol. CXLVIII, No.

237, March, 1930, p.169]

|

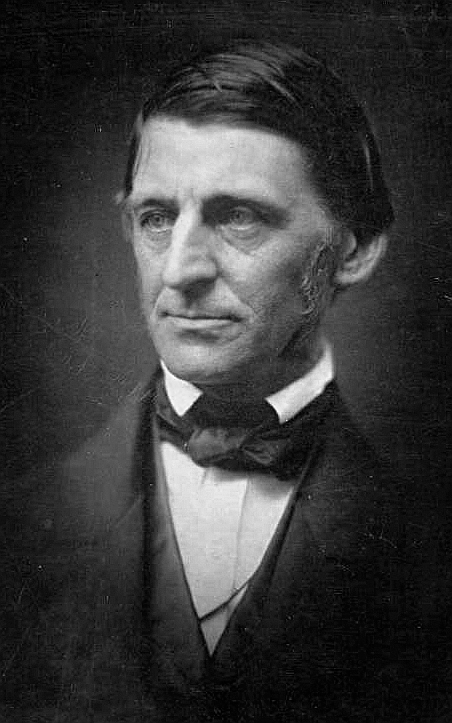

Emerson,

Ralph Waldo

ENLARGE

|

Whilst another man has no land, my title to mine, and your

title to yours, is at once vitiated.

[source not identified]

|

Emerson,

Ralph Waldo |

As I am born to the earth, so the earth is given to me, what I

want of it to till and to plant; nor could I without pusillanimity

omit to claim so much.

[From: The Conservative, A

Lecture delivered at the Masonic Temple, Boston, December 9, 1841]

|

Emerson,

Ralph Waldo |

Grimly the same spirit (of progress) looks into the law of

property and accuses men of driving a trade in the great,

boundless providence which has given the air, the water and the

land to men to use and not to fence in and monopolize.

[From: On the Times (1841)]

|

Emerson,

Ralph Waldo |

I find this vast net-work, which you call property, extending

over the whole planet. I cannot occupy the bleakest crag of the

White Hills or the Allegheny Range, but some man or corporation

steps up to me to show me that it is his.

[From: The Conservative, A Lecture

delivered at the Masonic Temple, Boston, December 9, 1841]

|

Emerson,

Ralph Waldo |

Then he says: "If I am born into the earth, where is my

part? Have the goodness, gentlemen of this world, to show me my

wood lot, where I may fell my wood, my field where to plant my

corn, my pleasant ground where to build my cabin." ..."Touch

any wood or field or house-lot on your peril," cry all the

gentlemen of this world; "but you may come and work in ours

for us, and we will give you a peice of bread."

[From: The Conservative, A Lecture

delivered at the Masonic Temple, Boston, December 9, 1841]

|

Erskine,

John

ENLARGE

|

I would say that the single tax theories of Henry George have

always seemed to me unanswerable, and I believe that when we have

tried other forms of taxation long enough to be convinced of their

injustice -- and I don't know how many centuries that will take --

we shall be ready for his simple and convincing ideas.

[John Erskine was a professor of english at Columbia University.

During the 1920s he introduced a "great books" program,

writing: “If the faculty believed that the boys in college

ought to be familiar with more than the titles of great books,

that happy result could be achieved in a new kind of course,

extending through two years, preferably the junior and senior

years, and devoted to the simple principle of reading one great

book a week, and discussing it in a weekly meeting which would

last two or three hours.”]

|

Evans,

George Henry

ENLARGE

|

"Evans subscribed to the idea that property rights

derived their legitimacy from the right of every human being to

himself and the fruits of his labor. But land was the gift of God,

not the product of toil. It followed that 'the land should not be

a matter of traffic, gift, or will' and government's duty to

preserve natural rights entailed a duty to regulate land tenure

for the common good. 'If any man has a right on earth, he has a

right to land enough to raise a habitation on,' Evans wrote in

1841. 'If he has a right to live, he has a right to land enough

for his subsistance. Deprive anyone of these rights, and you place

him at the mercy of those who possess them.' National Reformers

claimed that the doctrine of natural rights provided both a

diagnosis and a cure for the crisis of republican government in

America -- a crisis manifested by 'the haggard, care-worn

countennace of the daily laborer, the wasting form of the

overtasked seastress . . . [and] the squalid children trained to

beggary and deceit.' The surplus of 'white slaves' caused by the

mechanization of labor meant that working people were rapidly

losing the autonomy necessary for responsible citizenship. 'By

restoring his natural right to the soil,' Evans insisted, 'the

laborer would not be dependent on the employer, and would

consequently rise to his proper rank in society.' All the people's

representatives had to do was fix a limit on the amount of land

any individual might own."

[from: p. 172 of Charles McCurdy's

Anti-Rent Era in New York Politics: 1839-1865]

|

|