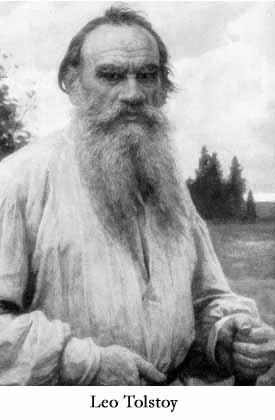

Taussig,

Frank W.

ENLARGE

|

Frank W. Taussig (1859 - 1940) was a U.S. economist and educator,

born in St. Louis. He graduated from Harvard in 1879, where

remained to become professor of economics in 1892. He served as

editor of the Quarterly Journal of Economics from 1889 to

1890 and from 1896 to 1935. He was elected president of the

American Economic Association in 1904 and 1905.

A tax imposed on a dwelling tends to be borne by the occupier.

If the owner is also the occupier, the situation is simple enough;

the burden clearly must be borne by him. But if, as is commonly

the case, the dwelling is let and is built with the expectation of

letting, the burden is likely to be shifted to the occupier

(tenant) in the shape of higher rent. the building will not be put

up unless the owner has reason to believe that the rents will

yield him the current return on investment, and will yield that

return net; that is, after payment of all expenses. Taxes are

reckoned by him among th expenses. ...A remission of taxes would

not necessarily lower rents at once; this consequence would ensue

only after the greater return to the owners had stimulated an

increase in the supply of houses.

[From: Principles of Economics

(New York: The Macmillan Company, 1912), p.518.]

|

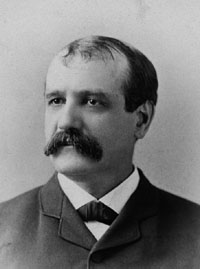

Thomas,

Norman

ENLARGE

|

Henry George stands high in any list of Americans who have

greatly served the world. No man ever wrote on economic matters

with a greater passion for humanity or with more genuine

eloquence. I am a Socialist and not a single taxer, but Henry

George's position that the rental value of land belongs to society

is incontroversial, and his method of a land value tax is, at

least in urban areas, the best way I know to assert the principle

that land is a social resource.

[Source of this quote not identified]

|

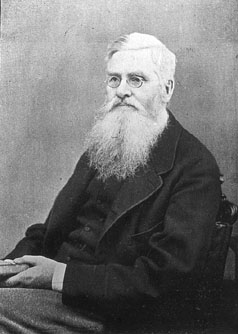

Thoreau,

Henry David

ENLARGE

|

At present n this vicinity the best part of the land is not

private property; the landscape is not owned. But possibly the day

will come when ... fences shall be multiplied and man-traps and

other engines invented to confine men to the public road, and

walking over the surface of God's earth shall be construed to mean

trespassing on some gentleman's grounds.

[From: "Essay on Walking,"

in Excursons (1862), p. 264]

|

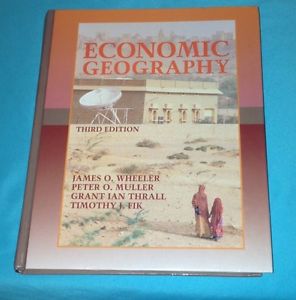

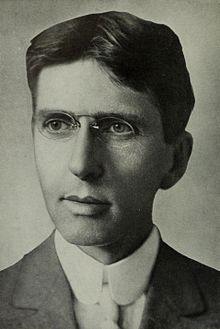

Thrall,

Grant Ian

ENLARGE

ENLARGE

|

Professor Grant Thrall has been on the faculty of McMaster

University in Canada, and the State University of New York at

Buffalo. In 1989, he was Resident Scholar of the Homer Hoyt

Institute in Washington DC. In 1990, he was Visiting Distinguished

Professor at San Diego State University. Since 1983, he has been

Professor of Geography at University of Florida.

The following excerpt from Land Use and Urban Forms: The

Consumption Theory of Land Rent (1987, p.149) points to the

deficiency in data to support the dynamic impact on communities

that Henry George forecasted would occur as property improvments

(including residential buildings) are exempted from annual

taxation and the proportion of location rent collected via

taxation increases. This passage is included here as an important

theoretical issue to resond to for proponents of the public

collection of rent. Thrall wrote:

... the property tax would return to the community exactly the

value that land received because of the community. This was

demonstrated in the above Consumption Theory of Land Rent analysis

to be a special case of the open city (one whose residents are

willing and able to move in and out). It is not, then, surprising

that empirical evidence has failed to confirm the Henry George

theorem; empiricists should look for support in those cities that

conform most closely to being open.

|

Tobin,

James

ENLARGE

|

I think in principle it's a good idea to tax unimproved land,

and particularly capital gains (windfalls) on it. Theory says we

should try to tax items with zero or low elasticity, and those

include sites.

[source not identified]

|

Tocqueville,

Alexis de

ENLARGE

|

The American man of the people has conceived a high idea of

political rights because he has some; he does not attack those of

others, in order that his own may not be violated. Whereas the

corresponding man in Europe would be prejudiced against all

authority, even the highest, the American uncomplainingly obeys

the lowest of his officials.

[From: "The Advantages of

Democratic Government," Democracy in America (1848),

Harper & Row edition, 1966, Vol.I, Chap.6, p.238]

|

Tocqueville,

Alexis de |

Democratic government makes the idea of political rights

penetrate right down to the least of citizens, just as the

division of property puts the general idea of property rights

within reach of all. That, in my view, is one of its greatest

merits.

[From: "The Advantages of

Democratic Government," Democracy in America (1848),

Harper & Row edition, 1966, Vol.I, Chap.6, p.239]

|

Tocqueville,

Alexis de |

In aristocracies rents are not paid in money only, but also by

respect, attachment, and service. In democracies money only is

paid.

[From: "Rents Raised and Terms

of Leases Shortened," Democracy in America (1848),

Harper & Row edition, 1966, Vol.II, Chap.6, p.580]

|

Tocqueville,

Alexis de |

Any revolution is more or less a threat to property. Most

inhabitants of a democracy have property. And not only have they

got property, but they live in the conditions in which men attach

most value to property.

[From: "Why Great Revolutions

Will Become Rare," Democracy in America (1848),

Harper & Row edition, 1966, Vol.II, Chap.21, p.636]

|

Tocqueville,

Alexis de |

In no other country in the world is the love of property

keener or more alert than in the United States, and nowhere else

does the majority display less inclination toward doctrines which

in any way threaten the way property is owned.

[From: "Why Great Revolutions

Will Become Rare," Democracy in America (1848),

Harper & Row edition, 1966, Vol.II, Chap.21, pp.638-639]

|

Todd,

Ralph H.

|

[Ralph H. Todd is Director, Center for Applied Urban Research,

University of Nebraska, Omaha]

Obviously, heavy taxes on the location will not discourage or

inhibit improvements; on the contrary, heavy taxes on locations

should put effective pressure on the owners to put their sites to

better use. A heavier tax on unimproved land would allow a city to

expand in an orderly manner without relying on growth policies and

huge subsidies, by simply allowing the profit moive and the free

enterprise market system to function more effectively.

[Source of this quote not identified]

|

Tolstoy,

Leo

(1828-1910)

ENLARGE

|

Tolstoy attempted, unsuccessfully, to convince Czar Nicholas II

to introduce reforms that incorporated the proposals of Henry

George. Of Henry George, he wrote:

People do not argue with the teachings of [Henry] George, they

simply do not know it. And it is impossible to do otherwise with

his teaching, for he who becomes acquainted with it cannot but

agree. ...Solving the land question means the solving of all

social questions. ...Possession of land by people who do not use

it is immoral -- just like the possession of slaves.

Solving the land question means the solving of all social

questions. ...Possession of land by people who do not use it is

immoral -- just like the possession of slaves.

[Source not identified]

|

Tolstoy,

Leo

(1828-1910)

|

"Certain persons have driven a herd of cows, on whose

milk they live, into an enclosure. The cows have eaten and

trampled the forage, they have chewed each others' tails, and they

low and moan, seeking to get out. But the very men who live on the

milk of these cows have set around the enclosure plantations of

mint, they have cultivated flowers, laid out a race-course, a

park, and a lawn-tennis ground, and they do not let out the cows

lest they should spoil these arrangements. …The cows get

thin. Then the men think that the cows may cease to yield milk,

and they invent various means for improving the condition of the

cows. They build sheds over them, they gild their horns, they

alter the hour of milking, they concern themselves with the

treatment of old and invalid cows … but they will not do the

one thing needful, is to remove the barrier and let the cows have

access to-S pasture."

[Leo Tolstoy, A Great Iniquity]

|

Tolstoy,

Leo

(1828-1910)

|

"The only indubitable means of improving the position of

the workers, which is at the same time in conformity with the will

of God, consists in the liberation of the land from its usurpation

by the landlords. …The most just and practicable scheme, in

my opinion, is that of Henry George, known as the single-tax

system."

[Leo Tolstoy, To the Working

People, xiii]

|

Tolstoy,

Leo

(1828-1910)

|

"The injustice of the seizure of the land as property has

long ago been recognised by thinking people, but only since the

teaching of Henry George has it become clear by what means this

injustice can be abolished."

[Leo Tolstoy, Letter to Single-Tax

Leagues of Australia]

|

Tolstoy,

Leo

(1828-1910)

|

"It is Henry George's merit that he not only exploded all

the sophism whereby religion and science justify landed property

and pressed the question to the farthest proof, which forced all

those who had not stopped their ears to acknowledge the

unlawfulness of ownerships in land, but also that he was the first

to indicate a possibility of solution for the question. He was the

first to give a simple, straightforward answer to the usual

excuses made by the enemies of all progress, who affirm that the

demands of progress are illusions, impracticable, inapplicable.

The method of Henry George destroys these excuses by so putting

the question that by to-morrow committees might be appointed to

examine and deliberate on his scheme and its transformation into

law."

[Leo Tolstoy, Letter to a German

Reformer]

|

Tolstoy,

Leo

(1828-1910)

|

"The land is common to all. All have the same right to

it; but there is good land and bad land, and everyone would like

to take the good land. How is one to get it justly divided? In

this way: he who will use the good land must pay those who have

got no land of the value of the land he uses," Nekhludoff

went on, answering his own question. ..."Well," he had a

head, this George," siad the oven builder, moving his brows. "he

who has good land must pay more."

[Leo Tolstoy, Resurrection,

Book II., Chap. 9]

|

Tolstoy,

Leo

|

If the new Czar were to ask me what I should advise him to do,

I would say to him: Use your autocratic power to abolish landed

property in Russia, and to introduce the single-tax system, and

then give up your power and give the people a liberal

constitution.

[From: Progressive Review,

August, 1897, p. 419, note]

|

Turgot,

Anne Robert Jacques

ENLARGE

|

The labor of the tiller of the soil gives the first impulse.

That which his work makes the land produce beyond his personal

needs is the sole fund for the wages which all the other members

of society receive in exchange for their work.

[From: On the Formation and

Distribution of Wealth (1766), Sec. 5]

|

Turgot,

Anne Robert Jacques

|

Land is always the first and only source of all wealth.

[From: On the Formation and

Distribution of Wealth (1766), Sec. 55]

|

URBAN LAND INSTITUTE |

In the redevelopment situation the site value tax system acts

to increase the supply of sites for redevelopment. ...The site

value tax system thus operates to accelerate the transition of

marginal properties to the status of economic redevelopment sites.

...Probably the most important effects of a site value tax system

is the pressure on owners to sell their property for redevelopment

if they cannot or will not redevelop it themselves.

[from: Research Report No. 19]

|

Urbanski,

Adam

ENLARGE

|

The materials about the two-rate real estate tax that you left

for me are quite instructive and persuasive. It makes good sense

to pursue the changes you advocate and I would be glad to lend my

support to the effort.

[President, Rochester Teachers Association, from a letter to

Marvin Morris, July 10, 1991]

|

Vauban,

Marshall

|

Marshall Vauban published in 1707 his Projet d'une Dixme

Royale. His travels through France had given him an

opportunity to see the poverty of the peasants, which he believed

was due largely to heavy and unequal taxation. He proposed a

reform of France's tax system in the form of a dixme royle,

or royal tithe. This was a comprehensive proposal for simiplifying

the existing tax system calling for proportional taxes on the

produce of land and on the revenue of wealth in general.

|

Vaughn,

Herbert

(Cardinal)

|

Cardinal Herbert Vaughn, who was the spiritual leader of the Mill

Hill Order of England, arrived in the United States in 1871. By

the latter part of 1888, Cardinal Vaughn formed St. Joseph

Seminary in Baltimore.

Without ties to bind the people to the land, they have been

driven, especially of late years, in ever increasing multitudes to

the towns. Here they have herded apart from the better classes,

forming an atmosphere and a society marked on the one hand by an

absence of all the elevating influences of wealth, education and

refinement, and on the other by the depressing presence of almost

a dead level of poverty, ignorance and squalor. they are not

owners either of the scraps of land on which they live or of the

tenements which cover them; but they are rackrented by the agents

of absentee landlords, who know less of them than Dives knew of

Lazarus.

[From: An Inagural Address to the

Annual Conference of the Catholic Truth Society, Stockport;

published in the St. Vincent de Paul Quarterly, New York,

November, 1899; p. 286]

|

Vickrey,

William

ENLARGE

|

William Vickrey, in 1993 a Professor-Emeritus, Columbia

University and President of the American Economic Assocation, made

the following remarks at the Henry George School in New York:

Economists are almost unanimous in conceding that the land tax

has no adverse side effects. ...Landowners ought to look at both

sides of the coin. Applying a tax to land values also means

removing other taxes. This would so improve the efficiency of a

city that land values would go up more than the increase in taxes

on land.

Landlords ought to be in favor of this proposal. If taxes on

structures were removed, land values in New York City would go up

much more.

There is also a strong equity argument in its favor. Consider the

example of a tennis court. Even though people playing tennis have

no use for electric, water and communication facilities, these

services must be provided anyway. ...In effect we have to pay for

utilities twice: once to the provider and once to the landowners

who benefit by them.

|

Villard,

Oswald Garrison

ENLARGE

|

Oswald Garrison Villard, publisher of The Nation in the

early twentieth century, wrote:

Few men made more stirring and valuable contributions to the

economic life of modern America than did Henry George. What he has

written about protection and free trade is as fresh and as

valuable today as it was at the hour in which it was penned.

|

Voltaire

(Francois-Marie Arout de Voltaire)

ENLARGE

|

In the Age of Enlightenment, Voltaire gave the following

words to one of his characters, Candide:

The fruits of the earth are a common heritage of all, to which

each man has equal right.

|

Voltaire

(Francois-Marie Arout de Voltaire) |

Each individual owns that part of the national territory and

revenue which the laws secure to him, and no possession or

enjoyment can at any time be withdrawn from the operation of the

law.

[From: Dictionnaire Philosophique,

tit. Droit Cononique, Sec. 2, Oeuvres, Vol. LIV.,

p. 138]

|

Voskuil,

W.H.

|

In 1930, he held the position of Assistant Professor of Industry

and the University of Pennsylvania, Philadelphia, Pennsylvania.

Land is valued because of its productive power, ... widely

defined to include its usefulness for dwellings, offices, and

factory sites, crops, forests, and mineral products. Differences

in land values arise out of differing degrees of productive power

for each or any of the above purposes..

[From: "The Indestructible

Properties of Land," The Annals of the American Academy

of Political and Social Science, Vol. CXLVIII, No. 237, March,

1930, p.50]

|

Voskuil,

W.H.

|

The productivity of urban lands consists of benefits derived

from the use of such land for residential purposes, office

buildings, factory sites, terminal facilities, and so forth. The

properties of the land which give it value are standing-room and

situs. By situs is meant the location of a plot of land with

reference to those activities of man in its vicinity which of its

use for profit-taking purposes.

[From: "The Indestructible

Properties of Land," The Annals of the American Academy

of Political and Social Science, Vol. CXLVIII, No. 237, March,

1930, p.54]

|

Walker,

Francis A.

ENLARGE

|

First President of the American Economic Association:

A highway man points a pistol at my head, but offers to spare

me if I shall give him $500, which I proceed to do with the

greatest alacrity. In sparing my life he renders me the greatest

possible service. ...Still the question will arise, "How came

the highway man to be in a position to do me such a vital service,

and, after all, what right has he to what way my $500?" In

like manner, while the owner of land ... undoubtedly does me a

great service [the use of the land] ... it will still be rational

and pertinent for me to inquire, at least under my breath, what

business he has with the land, more than I or any one else.

|

Walker,

Francis A.

|

The unqualified ownership of land thus established (viz., "in

a way which in this age would be regarded as monstrous and corrupt"),

enables the land-owning class to reap a wholly unearned benefit at

the expense of the general community.

[From: Political Economy,

Part VI, Chap.7, Sec. 418]

|

Wall Street Journal editors |

In an article appearing March 5, 1987, the Wall Street Journal

published this:

As explained in the greatest economics treatise ever written

by an American -- Henry George's "Progress and Poverty"

(1879) -- money diverted to pay for the use of natural resources

is like a dead weight or tax on the productive factors in the

economy, capital and labor.

|

Wallace,

Alfred Russel

ENLARGE

|

Unrestricted private property in land is inherently wrong, and

leads to serious and wide-spread evils.

[From: Land Nationalization,

Chap. VIII, p. 229]

|

Wallace,

Alfred Russel

|

Unrestricted private property in land gives to individuals a

large proportion of the wealth created by the community at large.

[From: Land Nationalization,

Chap. VIII, p. 231-2]

|

Wallace,

Alfred Russel

|

We permit absolute possession of the soil of our country, with

no legal rights of existence on the soil to a vast majority who do

not possess it.

[From: Malay Archipelago

(1969), Vol. II, p. 464]

|

Wedgwood,

Josiah

ENLARGE

|

"It was in 1904 when Henry George and Progress and Poverty

wre both enjoying a great popularity that Josiah Wedgwood fell in

love with both to remain a stout and incendiary Georgist to the

end of his life. Nearly forty years later he wrote a matchless

tribute to his leader, the greatest single influence inhis life:

"From those magnificent periods, unsurpassed in the whole

of British literature, I acquired the gift of tongues. Ever since

1905, I have known there was a man from God and his name was Henry

George. I had no need henceforth for any other faith."

|

Whelan,

James

ENLARGE

|

James Whelen, mayor of Atlantic City, New Jersey, wrote in N.J.

Municipalities, January 1998, p.18:

Let us tax land, not improvements. While the notion that

owners of vacant land would pay the same tax as owners of a fully

developed office complex next door may seem strange at first, it

would be a great anti-speculation tool that would encourage

development.

|

Whitlock,

Brand

(1869-1934)

ENLARGE

|

Brand Whitlock was born in Urbana, Ohio, in 1869. He became a

journalist and worked for the Chicago Herald. He was later

employed by John P. Altgeld, the reforming governor of Illinois.

Whitlock also worked closely with Samuel Jones, the radical mayor

of Toledo.

br> Whitlock became increasingly involved in politics and

eventually served four terms as mayor of Toledo (1906-14). Like

Samuel Jones, Whitlock developed a reputation as an honest and

efficient mayor. He served as United States ambassador to Belgium

during the First World War.

Whitlock expressed his frustration with the inability of so many

so-called public servants to rise above the vested interests who

used personal and corporate wealth to see to that the status quo

-- and their deep-rooted privileges, remained in place:

Henry George's proposition, the Single Tax, will wait, I

fancy, for years, since it is so fundamental and mankind never

attacks fundamental problems until it has exhausted all the

superficial ones.

[source not provided]

|

Whitman,

Walt

ENLARGE

|

Many sweating, ploughing, threshing, and then the chaff for

payment receiving,

A few idly owning, and they the wheat continually claiming.

[From: "Song of Myself," in

Leaves of Grass, p. 68]

|

Willis,

Nathaniel Parker

(1806-1867)

|

Nathaniel Parker was born in Portland, Maine the eldest son of a

newspaper proprietor in Boston. After attending Boston grammar

school and Phillips Academy at Andover, he entered Yale College in

October 1823. In 1829 he started the American Monthly Magazine,

which was continued from April of that year to August 1831, but

failed to achieve success. On its discontinuance he went to Europe

as foreign editor and correspondent of the New York Mirror.

To this journal he contributed a series of letters, which, under

the title Pencillings by the Way,/i>, were published at

London in 1835.

How can you buy the right to exclude at will every other

creature made in God's image from sitting by this brook, treading

on this carpet of flowers, or lying listening to the birds in the

shade of these glorious trees -- how can I sell it to you? is a

mystery not understood by the Indian, and dark, I must say, to me.

[From: Voices of the True-Hearted

(1846), Philadelphia, p. 98]

|

Wilson,

Woodrow

(1856-1924)

ENLARGE

|

All this country needs is new and sincere body of thought in

politics, coherently, distinctly and boldly uttered by men who are

sure of their ground. The power of men like Henry George seems to

me to mean that; and why should not men who have sane purposes

avail themselves of this thirst and enthusiasm for better, higher,

more hopeful purpose in politics than either of the present,

moribund parties can give?

(Quoted from "Life and Letters of

Woodrow Wilson" by Raoy Stanndard Baker, Doubleday, Page &

Co.)

|

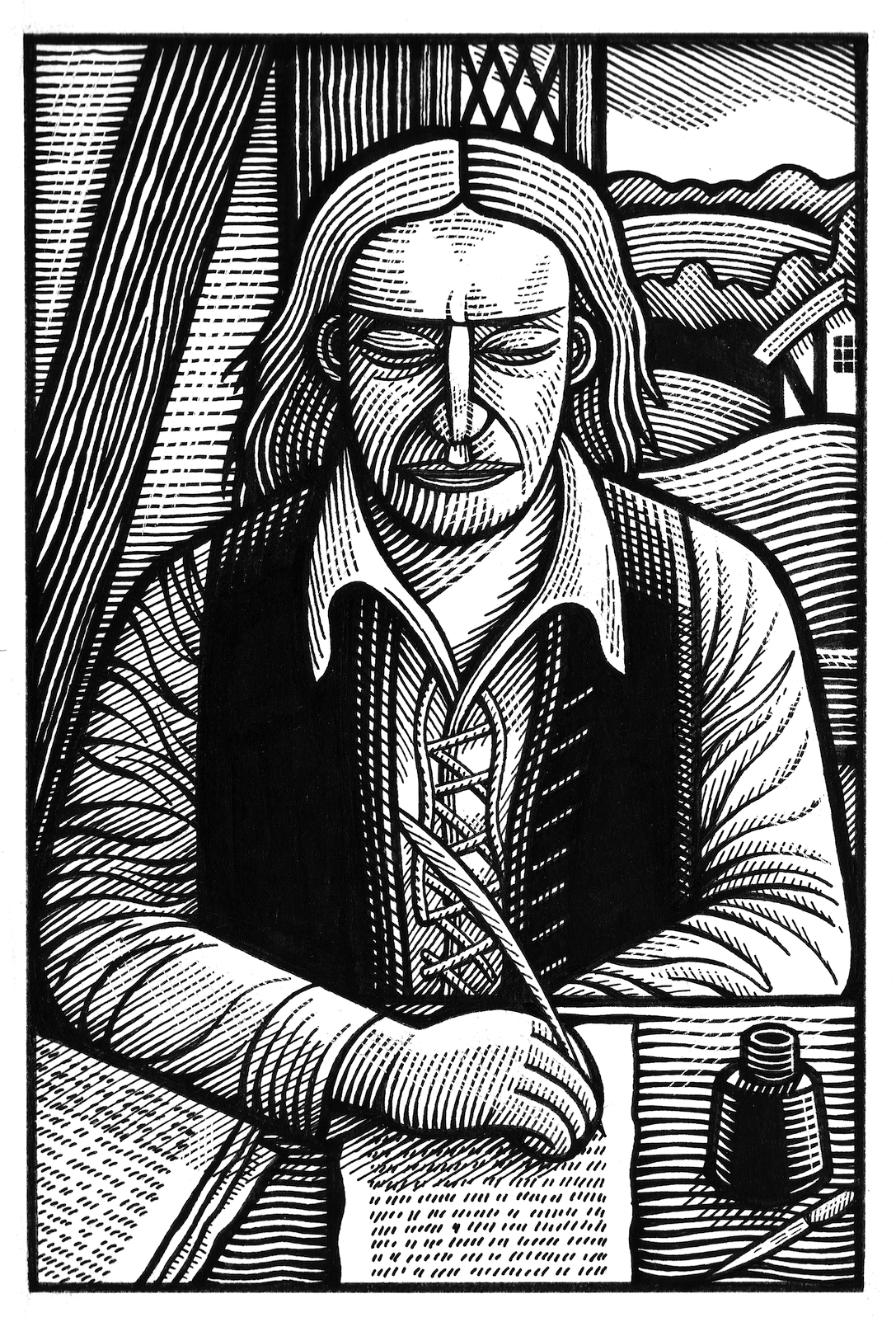

Winstanley,

Gerrard (Jerrard)

ENLARGE

|

Winstanley was the primary leader of the 17th century English

agrarian reformers, the Diggers. In 1649, he wrote:

The Earth (which was made to be a Common Treasure of relief

for all) has been hedged in to Enclosures by the teachers and

rulers, and others have been made Servants and Slaves: And that

Earth that is within this Creation, made a Common Storehouse for

all, is bought and sold, and kept in the hands of a few. ...Though

a man be brought up in the land, yet he must not work for himself

but for him that bought the Land; He that has no Land must work

for small wages for those who call the Land theirs.

|

Winstanley,

Gerrard |

Here, O thou Righteous Spirit of the whole creation, and judge

who is the thief, he who takes away the freedom of the common

earth from me, which is my creation-rights; ...or I, who take the

common earth to plant upon for my free livelihood, endeavoring to

live as a free commoner in a free commonwealth, in righteousness

and peace.

And is not this slavery, say the people, that though there be

land enough in England to maintain ten times as many people as are

in it; yet some must beg of their brethren, or work in hard

drudgery for day wages for them, or starve, or steal, and so be

hanged out of the way, as men not fit to live on the earth?

[From: The Law of Freedom in a

Platform or True Magistracy Restored (1652)]

|

Winstanley,

Gerrard |

We demand, yea or no, whether the earth with her fruits, was

made to be bought and sold from one to another? And whether one

part of mankind was made lord of the land, and another part a

servant by the Law of Creation before the Fall.

[From: a Letter to Lord Fairfax (1649),

cited in the New Age, 24 February, 1898, p.333]

|

Wood,

Robert

(1924 - 2005)

ENLARGE

|

Robert Wood, was Professor of Government at Wesleyan University,

who also taught political science at M.I.T., after which he served

as Secretary of the U.S. Department of Housing and Urban

Development, under President Lyndon Johnson, wrote in Domestic

Affairs, May 1991:

What has pushed the price of housing out of reach for many

Americans is the spiraling cost of land. Over the past thirty

years, land values have increased three times faster than the

consumer price index; they now exceed one-quarter of the total

cost of the typical housing unit.

Our persistent practice of taxing real estate development more

than undeveloped or underdeveloped land nad our failure to

recapture the costs of new roads and community facilities that

open up vacant land for development have been major impediments to

the provision of affordable housing. In short, what urban America

needs most is a land reform program.

|

WORLD BANK |

A more effective system of agricultural land taxation would

offer one means of obtaining a reasonable contribution from the

richer members of the rural community without destroying

incentives related to agricultural output.

In designing a system of land taxation, the Government should

focus not only on raising revenues, but also on nonfiscal

developmental objectives, such as distributing income better in

the rural areas, using agricultural land more effectively.

|

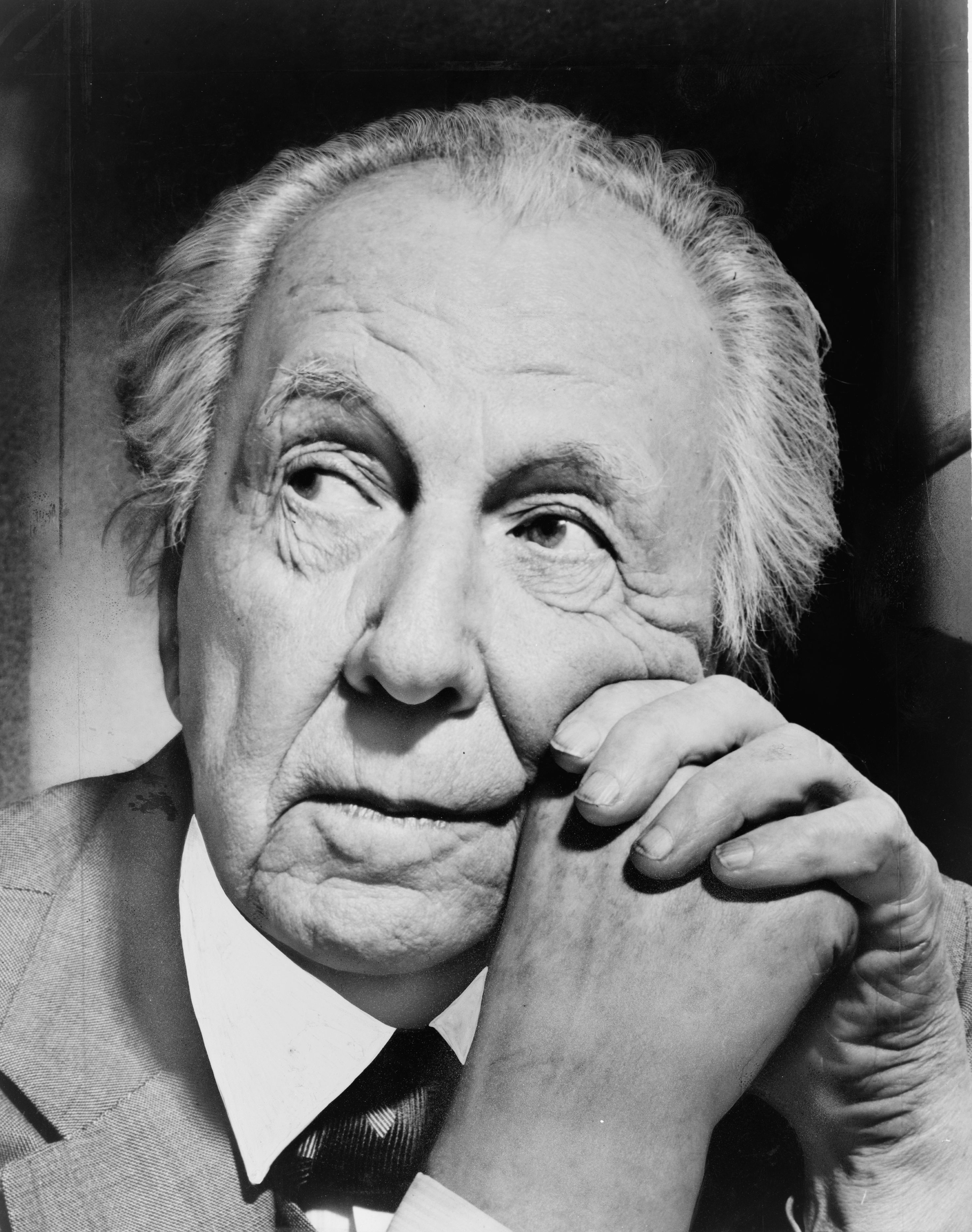

Wright,

Frank Lloyd

(1869-1959)

ENLARGE

|

Wright, one of the most heralded architects in United

States history, wrote in The Living City (c. 1958, p.162):

Henry George showed us ... the only organic solution of the

land problem ...

|

Wright,

Frank Lloyd

|

Frank Lloyd Wright delivered an address to the Henry George

School Commerce and Industry luncheon on 4October, 1951, in

Chicago. In that address, he said:

"Democracy can be only one thing: a thing that would

enable a man like Henry George to hae had some effect in his day.

Democracy is, inevitably -- the gospel of individuality. It is the

supreme encouragement and protection of the individual as such,

first of all... Men like Henry George knew what it meant and

fought for a basis for it. It's the highest and finest ideal on

earth today or in the mind of man because it is predicated on the

basis of freedom."

|

Yat-sen,

Sun

ENLARGE

|

The teaching of Henry George will be the basis of our program

of reform. ...The (land tax) as the only means of supporting the

government is an infinitely just, reasonable and equitably

distributed tax, and on it we will found our new system. The

centuries of heavy and irregular taxation for the benefit of the

Manchus have shown china the injustice of any other system of

taxation.

[source not identified]

|

Yat-Sen,

Sun |

Sun Yat-Sen realized that solving the many problems of the

Chinese people was intimately linked to the land question.

In the Principle of the Peoples' Livelihood, published in

1924, he wrote:

When modern, enlightened cities levy land taxes, the burdens

upon the common people are lightened, and many other advantages

follow. If Canton city should now collect land taxes according to

land values, the government would have a large and steady source

of funds for administration. The whole place could be put into

good order

But at present, the rising land values in Canton all go to the

landowners themselves -- they do not belong to the community. The

government has no regular income, and so to meet expenses it has

to levy all sorts of miscellaneous taxes upon the common people.

This burden upon the common people is too heavy; they are always

having to pay out taxes and so are terribly poor -- and the number

of poor people in China is enormous. The reasons for the heavy

burdens upon the poor are the unjust system of taxation practiced

by the government, and the unequal distribution of land power and

the failure to solve the land problem. If we can put the land tax

completely into effect, the land problem will be solved and the

common people will not have to endure such suffering.

|

Yinger,

John

ENLARGE

|

Professor Yinger of the Maxwell School of Citizenship and Public

Affairs, Syracuse University has provided his students with

extensive class notes on land markets.

|

Zacharia,

Karl E.

(Professor)

|

Zacharia was a professor at Heidelberg University, writing on the

nature of ancient law. Other biographical information has not been

found.

Nature has not herself divided the good things of the earth

between individual men, and this is the source of all wrangling

and quarreling among them.

[From: Vierzig Bucher vom Staate

(1841), Book XXI, Part I, Divison 1, Sec. 2, p. 146]

|

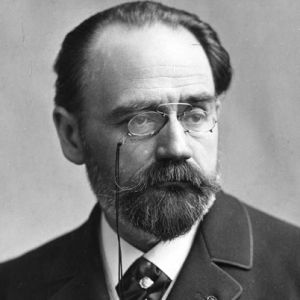

Zola,

Emile

ENLARGE

|

As, I see it clearly before my eyes, the city of justice and

happiness! ...No more idlers of any kind, and hence no more

landlords supported by rent, no more men of fortune kept like

mistresses by fortune -- in short, no more luxury and no more

misery! Ah, is not this the ideal of equity, the supreme wisdom,

no privileged classes, and none doomed to wretchedness; everyone

creating his welfare by his own effort, the average of human

welfare!

[From: L'Argent, Chap. XII, pp.

438-9 (Last words of Sigismond)]

|

Zuckerman,

Mortimer B.

ENLARGE

|

Henry George, the great 19th-century economist, put it best: "Protective

tariffs are as much applications of force as are bockading

squadrons, and their objective is the same -- to prevent trade.

The difference between the two is that blockading squadrons are a

means whereby nations seek to prevent their enemies from trading;

protective tariffs are a means whereby nations attempt to prevent

their own people from trading. What protection teaches us, is to

do to ourselves in time of peace what enemies seek to do to us in

time of war.

[From an editorial, "That Other

Deficit," in U.S. News & World Report, 23 December

1985]

|

BROWSE BY AUTHOR

|

THRU

THRU