Fairchild,

Fred Rogers |

Fred Fairchild was a member of the economics faculty at Yale

University. He was also a founder (1946) and board member of the

Foundation for Economic Education, Irvinton-on-Hudson, New York.

In May of 1943, at the annual meeting of the U.S. Chamber of

Commerce, he argued that the U.S. must abandon "grandiose

notions of policing, feeding, reconstructing the world," give

up "certain parts of the Atlantic Charter and the Four

Freedoms which imply performing, indefinitely, costly services for

the rest of the world and doing it for nothing." He died in

1959.

The taxing power is among the most powerful and far-reaching

of the attributes of sovereignty. Even when applied only for the

purposes of securing government income, its indirect effects may

be, indeed, certainly will be, very great. When consciously used

for the accomplishment of other ends its power can scarcely be

exaggerated..

[From: Elementary Economics

(New York: The Macmillan Company, 1930 edition), p.372.]

|

Faltermayer,

Edmund K. |

Edmund Faltermayer also wrote on personal finance, industrial

competitiveness and the health-care crisis for Fortune. Though he

retired from Fortune’s full-time staff in 1994, he

continued as a contributing editor until shortly before he died in

2003, at age 75.

To discourage sprawl, many experts have long urged the

property taxes be levied on land exclusively, or that communities

at least tax the land component at a higher percentage of assessed

value than buildings, as the city of Pittsburgh has done for

several decades. To keep over-all revenues the same, communities

would have to compensate for the total or partial untaxing of

buildings by raising taxes on all land, whether built upon or not,

and this would tend to produce two beneficial results:

On the one hand, owners of existing buildings would incur no

increase in taxes, or less of an increase in taxes than at

present, for renovating them.

On the other hand, the taxes on vacant land would rise, forcing

speculators to build on it, or sell to others who would.

A good deal of research is needed on how American municipalities

might switch entirely to a site-value form of taxation, or at

least move partly in that direction. But it is clear that such a

reform would tend to promote compact, intensively developed

metropolitan areas that would be easy to service and get around in

with more of the nearby countryside kept open for scenic and

recreational purposes. Because we have failed to revamp the

property tax, we have been promoting exactly the opposite effects.

[Associate Editor of Fortune

Magazine; from Redoing America, Harper & Row, 1968.]

|

Feldstein,

Martin

ENLARGE

|

The classic example of an unshiftable tax is the general tax

on pure rental income. Since Ricardo, economists have believed

that the annual net rental income of unimproved land falls by the

amount of the annual tax and its price by the capitalized value of

this tax. This paper shows that these conclusions are false, that

the tax on pure land rents is at least partly shifted, and that

the price of land may be increased by the imposition of a tax.

Implications are suggested for the analysis of the corporate

income tax and the taxation of natural resources.

[From: "The Surprising Incidence

of a Tax on Pure Rent: A New Answer to an Old Question," The

Journal of Political Economy, Vol. 85, No. 2 (Apr., 1977), pp.

349-360. Quoted in Land & Liberty, November 12, 1994]

|

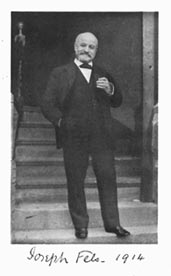

Fels,

Joseph

ENLARGE

|

Joseph Fels devoted much of his share of profits from the Fels

Naptha Soup Co. to ending land monopoly. He sought to demonstrate

the validity of Henry George's analysis by establishing

experimental communities where all public revenue would come from

the rental value of land. Fels wrote:

The fundamental evil, the great God-denying crime of society,

is the iniquitous system under which men are permitted to put into

their pockets the community-made values of land, while organized

society confiscates for public purposes a part of the wealth

created by individuals.

[19--]

|

Fichte,

Johann G.

(1762-1814)

ENLARGE

|

Johann Gottlieb Fichte developed a systematic version of

transcendental idealism, which he called Wissenschaftslehre (or “Doctrine

of Scientific Knowledge”). He based his system upon the

concept of subjectivity. From 1794 to 1799 he taught at the

University of Jena, where he applied his philosophy to an

elaborate transcendental system that embraced the philosophy of

science, ethics, philosophy of law (i.e., of “right”)

and religion.

Only the products of his hands are therefore the absolute

property of the agriculturist. They belong to him substance and

all, whereas of the lands he has only an accidence.

[From: Science of Rights

(1889), Part II, Book 3, Sec. I (On Property in Land)]

|

Fitch,

Robert

ENLARGE

|

Best of all, a differential tax -- one that is higher on land

than on buildings -- does away with the usual disadvantage of

taxes. Almost invariably, if you tax something the capitalists

will produce less of it and charge you more for it. But land is

different. Most of it was produced once and for all by God. ...If

you tax cigarettes the price will go up; if you tax the land you

lower its price. It's no coincidence, then, that the one large

city in the country with such a tax, Pittsburgh, has the lowest

housing prices of any major city in America.

[From: the Nation, October 29,

1990]

|

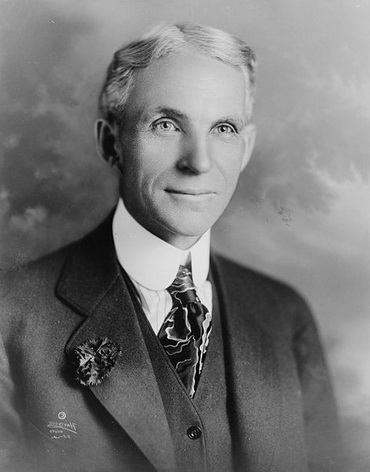

Ford,

Henry

(1863-1947)

ENLARGE

|

Ford was quoted in Liberty magazine in an article by Donald

Wilheim, saying:

We ought to tax all idle land the way Henry George said -- tax

it heavily, so that its owners would have to make it productive.

|

Forrester,

Jay W.

ENLARGE

|

Jay W. Forrester is Germeshausen Professor Emeritus and Senior

Lecturer at the Sloan School of Management, Massachusetts

Institute of Technology. He began his career as an electrical

engineer working on servomechanisms and large-scale digital

computers. While Director of the MIT Digital Computer Laboratory

from 1946 to 1951, he was responsible for the design and

construction of Whirlwind I, one of the first high-speed digital

computers.

The tax on improvements rather than on land favors old

buildings whose aging is an ultimate part of the urban decline

process.

[Source of quote not known]

...the complex system is even more deceptive than merely

hiding causes. In the complex system, when we look for a cause

near in time and space to a symptom, we usually find what appears

to be a plausible cause. But it is usually not the cause. The

complex system presents apparent causes that are in fact

coincident symptoms. The high degree of time correlation between

variables in complex systems can lead us to make cause-and-effect

associations between variables that are simply moving together as

part of the total dynamic behavior of the system. Conditioned by

our training in simple systems, we apply the same intuition to

complex systems and are led into error. As a result we treat

symptoms, not causes. The outcome lies between ineffective and

detrimental.

[From: Urban Dynamics (1969),

Pegasus Communications, pp. 8-9]

|

Fortune

Magazine |

The editors of Fortune Magazine, August 8, 1983,

observed:

Higher land taxes, especially when accompanied by reduced

taxes on structures, look like an idea businessmen ought to

embrace and promote. The benefits in the form of more jobs and

increasingly compact development are not only lasting, but flow to

the whole community.

|

Fox,

Homer |

Land value taxation spurs development because a

landlord can hardly sit and hold vacant land. The tax forces the

rehabilitation of boarded-up buildings and the construction of new

ones on vacant land, thus creating jobs.

[Visiting professor, Wayne State

University, Detroit, MI, 1990]

|

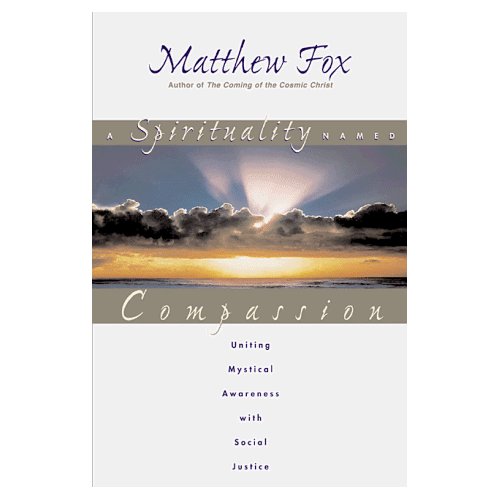

Fox,

Matthew

ENLARGE

|

Matthew Fox is a theologian, educator and former Dominican

priest. He also the founder and president of the University of

Creation Spirituality and codirector of The Naropa Institute's

master's program in Creation Spirituality, both in Oakland,

California.

A land tax would tax all land but not improvements on the land

and in this way would encourage initiative and jobs, rather than

discourage them. It would run the land speculator and the absentee

landlord out of town.

A land tax would encourage farmers who actually farm instead of

those who speculate and it would increase productivity, ingenuity

and the creation of jobs. It would also lessen bureaucratic

interference since basically it is simplifying the law code.

[From: A Spirituality Named

Compassion: Uniting Mystical Awareness with Social Justice]

ENLARGE

|

Franklin,

Benjamin

ENLARGE

|

Our legislators are all landowners, and they are not yet

persuaded that all taxes are finally paid by the land ...

therefore, we have been forced into the mode of indirect taxes.

...All the property that is necessary to a man for the

conservation of the individual and the propagation of the species,

is his natural right which none may justly deprive him of; but all

property superfluous to such purposes is the property of the

public.

[source not identified]

|

Franklin,

Benjamin |

All the property that is necessary to a man for the

conservation of the individual and the propagation of the species,

is his natural right which none may justly deprive him of; but lal

property superflous to such purposes is the property of the

public.

[source not identified]

|

Franklin,

Benjamin |

But notwithstanding this increase (of population),

so vast is the territory of North America, that it will require

many ages to settle it fully; and, till it is fully settled, labor

will never be cheap here, where no man continues long a laborer

for others, but gets a plantation of his own; no man continues

long a journeyman to a trade, but goes among these new settlers,

and sets up for himself.

[From: Observations Concerning for

Increase of Mankind (1751), Sec. 8, Works, Vol. II, p.

225]

|

Frazier,

Douglas |

Frazier, U.S. leader of the United Auto Workers, told

the National Conference on Alternate State and Local Policies held

over the Independence Day celebration in 1979:

One day, we are going to ask ourselves, did anyone make the

oil and minerals and then put them in the ground? We will then

realize that they belong to all of us.

|

Freeman,

Edward A.

ENLARGE

|

And now the final stroke was put to a change which had been

gradually going on for some generations. The folkland, the common

land of the nation, was now changed, fully and forever, into terra

Regis, the land of the king.

[From: The Norman Conquest

(1867), Vol. IV, Chap. 17, p. 15]

|

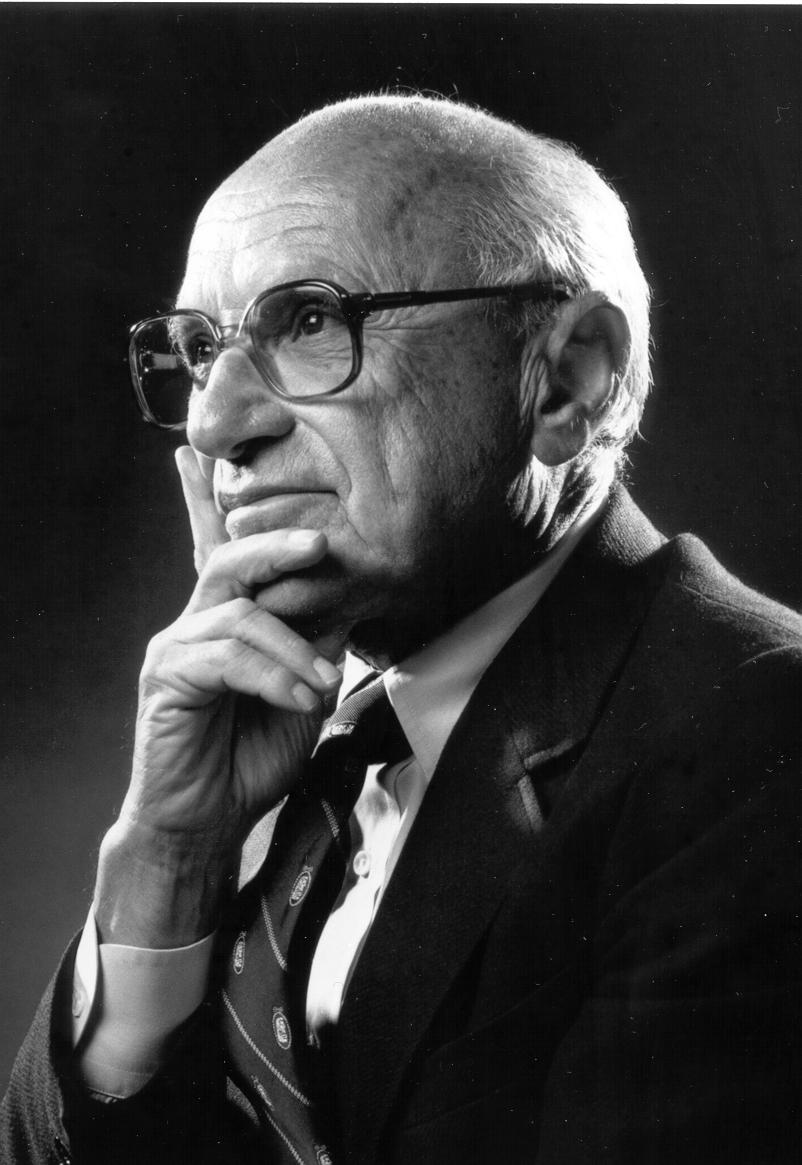

Friedman,

Milton

ENLARGE

|

Nobel Prize winning economist Milton Friedman

has written:

Land should be taxed as much as possible, and improvements as

little as possible.

In an interview in Human Events, November 18, 1979,

Milton Friedman said:

"There's a sense in which all taxes are antagonistic to

free enterprise -- and yet we need taxes. ...So the question is,

which are the least bad taxes? In my opinion the least bad tax is

the property tax on the unimproved value of land, the Henry George

argument of many, many years ago."

|

Friedman,

Milton |

The least bad tax is the property tax on the unimproved value

of the land, the Henry George argument of many years ago.

[Professor of Economics, University of

Chicago, in address to the Americanism Education League]

And, from a letter writen to William Newcomb (President, Media

Foundation for Land Economics) in 1979:

In Ricardo's words, the original and indestructible qualities

of the land d not by any means account for all of the current rent

from the land; land can be produced, its qualities can be

improved, all through investment for which there is no incentive

if the whole of the yield for improving the productivity of land

or from producing the land were to go to the government.

On the other side of the issue, there are many other resources,

of which human labor is one of the most important, which are, to

put it in technical economic jargon, in inelastic supply so that a

tax on the return from such services is unlikely to affect the

amount of such services made available for market use. The most

obvious are such items as the skill of a Muhammed Ali or of a

Frank Sinatra. These are natural resources too, and they are

limited in supply and derive their value from their scarcity.

I realize that in almost all other respects the views of the

Georgists and of my own are very much the same. I am more than

glad to join with them in common ojbectives, but I could not ally

myself with the Georgist movement in any sense which suggested

that I agreed with its fundamental underlying premises.

The following quote from Professor Friedman is also attributed to

correspondence with William Newcomb. However, this statement is

repeated here from secondary sources which do not indicate the

date of the letter or any additional comments:

I share your view that taxes would best be placed on the land,

and not on improvements.

|

Froude,

James A.

ENLARGE

|

To treat land, with the present privileges attached to the

possession of it, as an article of sale, to be passed from hand to

hand in the market like other commodities, is an arrangement not

likely to be permanent either in Ireland or elsewhere.

[From: Nineteenth Century,

September, 1880, p. 369]

|

Froude,

James A. |

Seeing that men are born into the world without their own

wills, and being in the world they must live upon the earth's

surface, or they cannot live at all, no individual or set of

individuals can hold over land that personal and irresponsible

right which is allowed them in things of less universal necessity.

[From: History of Ireland

(1872 and 1984), Book, I, Chap. 2, Sec. 6, p. 131]

|

Froude,

James A. |

Land is not, and cannot be, property in the sense

in which movable things are property. Every human being born into

this planet must live upon the land if he lives at all. He did not

ask to be born, and being born, room must be found for him. The

land in any country is really the property of the nation which

occupies it.

[From: Ireland, Nineteenth

Century (September, 1880), p. 362]

|

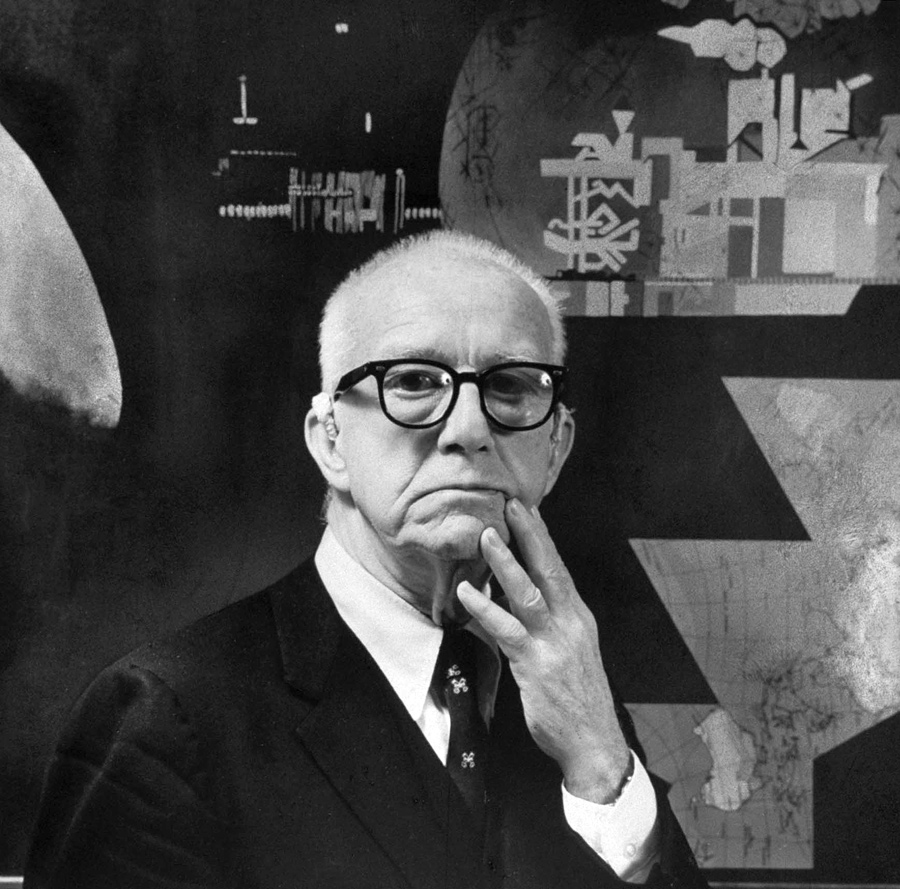

Fuller,

Buckminster

ENLARGE

|

He [Fuller] feels, as did George, that the truly effective

revolution would not lower the upper end of the socio-economic

spectrum as much as raise the bottom up.

[quote from a letter by Ann Mintz,

secretary to Buckminster Fuller, February 21, 1978]

|

Gaffney,

Mason

ENLARGE

|

George's blend of radicalism and conservatism can puzzle one,

until it is seen as a reconciliaton of the two. The system is

internally consistent, but defies conventional stereotypes.

[From: New Palgrave Dictionary of

Economic Thought, 1987]

|

Gaffney,

Mason |

The Neoclassical economists' view of their proper role is

rather like that in The Realtor's Oath, which includes a vow "To

protect the individual right of real estate ownership." The

word "individual" is construed broadly to include

corporations, estates, trusts, anonymous offshore funds, schools,

government agencies, institutions, partnerships, cooperatives,

Archbishops, families (including criminal families) and so on, but

"individual" sounds more all-American and subsumes them

all. This is a potent chant that stirs people to extremes of

self-righteousness and siege mentality when challenged.

[from: The Corruption of Economics,

1994]

|

Galbraith,

John Kenneth

ENLARGE

|

If a tax were imposed equal to the annual use value of real

property ex its improvement, so that it would now have no net

earnings and hence no capital value of its own -- progress would

be orderly and its fruits would be equitably shared.

[From the book, The Affluent

Society, p.44]

|

Gandhi,

Mahatma

ENLARGE

|

There is enough for everybody's need, but not enough for their

greed.

|

George,

David Lloyd

ENLARGE

|

The land question in the towns bears upon (over-crowding). It

is all very well to produce "Housing of Working Class"

bills. They will never be effective until you tackle the taxation

of land values.

[From: a speech not more specifically

identified]

|

George,

David Lloyd |

To prove a legal title to land one must trace it back to the

man who stole it.

|

George,

David Lloyd |

"The great criticism against rating is not merely that it

lacks uniformity and is unfair between the parties, but that it is

unfair to the class of property that you tax and rate. This is the

greatest grievance of all - that it taxes improvements. The more a

landlord improves his property the higher he is rated; the more he

neglects his property the less he is rated. …If he allows his

cottages to fall into decay and become empty, his rates are less;

but if he is a good, sound landlord, who repairs ruinous cottages

and builds new ones, up go his rates. The man who trusts to

obsolete machinery in his business can keep his rates low; but the

man who puts in new machinery and improves his buildings has to

pay a higher contribution to the rates."

[Mr. Lloyd George, in the House of

Commons, 28th April 1913]

"You cannot build houses without land; you cannot lay

down trams for the purpose of spreading the population over a

wider area without land. As long as the landlords allowed to

charge prohibitive prices for a bit of land, even land, without

contributing anything to local resources, so long will this

terrible congestion remain in our towns. That is the first great

trust to deal with, and for another reason --resources of local

taxation are almost exhausted. It is essential that you should get

some new resources for this purpose. What better resources can you

get than this wealth created by the community, and how better can

it be used than for the benefit of the community? ...It is all

very well to produce Housing of the Working Classes Bills. They

will never be effective until you tackle the taxation of

land-values."

[Mr. Lloyd George, at Newcastle,

4th March 1903]

"Who ordained that a few should have the land of Britain

as a perquisite; who made 10,000 people owners of the soil and the

rest of us trespassers in the land of our birth; who is it? Who is

responsible for the scheme of things whereby one man is engaged

through life in grinding labour, to win a bare and precarious

subsistence for himself . . . and another man who does not toil

receives every hour of the day, every hour of the night whilst he

slumbers, more than his poor neighbour receives in a whole year of

toil? Where did the table of the law come from? Whose finger

inscribed it?"

[Mr. Lloyd George, at Newcastle,

30th September 1909]

"Search out every problem, look into these questions

thoroughly, and the more thoroughly you look into them you will

find that the land is at the root of most of them. Housing, wages,

food, health, the development of a virile, independent, manly,

Imperial race - you must have a free land system as an essential

condition of these. To use a gardening phrase, our social and

economic condition is root-bound by the feudal system. It has no

room to develop, but its roots are breaking through. Well, let's

burst it!"

[Mr. Lloyd George, at Aberdeen,

29th November 1912]

"We want to do something to bring the land within the

grasp of the people. We want to put an end to the system whereby

the land of this country is retailed by the ounce, so that there

should not be an extra grain of breathing spaces. . . .The

resources of the land are frozen by the old feudal system. I am

looking forward to the spring-time, when the thaw will set in, and

when the people and the children of the people shall enter into

the inheritance that has been given them from on high."

[Mr. Lloyd George, at Liverpool,

21st December 1909]

|

George,

Henry

(1839-1897)

ENLARGE

|

More than any other figure during the late nineteenth century,

Henry George, author of the book Progress and Poverty,

dedicated his life to the cause of collecting the rental value of

land (sometimes referred to as ground rent or economic

rent) and the ending monopoly privilege associated with land

ownership. George told his readers:

What man has produced belongs to the individual producer; what

God has created belongs equally to all men ... therefore abolish

all taxation save on the value of land.

|

George,

Henry |

Here are two men of equal incomes -- that of the one derived

from the exertion of his labour, that of the other from the rent

of land. Is it just that they should equally contribute to the

expenses of the State? Evidently not. The income of the one

represents wealth he creates and adds to the general wealth of the

State; the income of the other represents merely wealth that he

takes from the general stock, returning nothing.

[From: Progress and Poverty

(1879)]

|

Getty,

John Paul |

Sadly, as many or more persons with strong scholarly or public

reputation could be found who argue against the idea that the

earth is the birthright of each of us, equally, and against the

proposal to achieve equality of opportunity by means of a reliance

on the rental value of locations for public revenue.

Many of the same persons would also disagree that moral

principles are integral to the treatment of the earth as a form of

property distinct from what we produce with our labor and what

capital goods we possess. From one of the original oil tycoons,

John Paul Getty, came some very dark humor, as Getty turned a

Biblical quotation attributed to Jesus Christ into the following:

"The meek shall Inherit the earth -- but not the mineral

rights."

|

Giffen,

Robert |

The soil of a nation is primarily the property of the whole

nation -- the common inheritance of all.

[From: Essays on Finance

(1871), First Series, Chap. X, p. 249]

|

Giffen,

Robert |

Land-owning is, beyond all other things, in the nature of a

monopoly.

[From: Essays on Finance

(1871), First Series, Chap. X, p. 239]

|

Giffen,

Robert |

It is certain, however, that a large part of the improvement

is due to the increasing value of advantageous sites, an unearned

increase of value such as Mr. Mill speaks of, and therefore a kind

of profit which the State may restrict with least harm.

[From: Essays on Finance

(1871), First Series, Chap. X, p. 244]

|

Gilder,

George

ENLARGE

|

As the late Henry George eloquently maintained in his classic "Progress

and Poverty," landowning in itself is not a productive

activity. Yet most of the tax benefits assigned to real estate in

recent years have been redeemed chiefly by inflationary capital

gains and condominium conversions.

[from a column published in the Wall

Street Journal, 29 May 1986]

|

Gladstone,

Mary |

Yesterday I began 'Progress and Poverty', supposed to be the

most upsetting, revolutionary book of the age. At present Maggie

and I both agree with it, and most brilliantly written it is -- we

had long discussions. He (W.E. Gladstone, her father) is reading

it too.

[Reprinted from: Mary Gladstone,

Diary and Letters, London, 17 August, 1883]

|

Gladstone,

Mary |

Finished 'Progress and Poverty' with feelings of deep

admiration -- felt desperately impressed, and he is ia Christian.

[Reprinted from: Mary Gladstone,

Diary and Letters, Hawarden, 30 August, 1883]

|

Gladstone,

William

ENLARGE

|

I fully admit this; I have stated it long ago in Midlothian --

I hold it without the smallest doubt; if a time came when the

British nation could think that the land ought to be nationalized,

and that it were wise to do it, they have a perfect right to do it

beyond all doubt and question.

[From: A speech delivered at Hawarde,

23 September, 1889, reported in the Times, 24 September,

1889, p. 10, column 3]

|

Gladstone,

William |

Those persons who possess large portions of the space of the

earth are not altogether in the same position as possessors of

mere personalty, for personalty does not impose the same

limitations on the action and industry and the well-being to the

community in the same ratio as does the possession of land, and

therefore I hold that compulsory appropriation, if for an adequate

public object, is a thing in itself admirable, and even sound in

principle.

[From a speech delivered at West

Calder, 27 November, 1879. Reprinted in The Times, 28

November, 1879, p. 10, column 2]

|

Goddard,

Haynes C. |

There does exist a very appropriate financial mechanism for

compensation to property owners. it is the land value increment

tax, formerly known as a betterment tax. The idea is old, simple

and widely considered fair. An increase in land value, as opposed

to changes in the property value resulting from improvements

erected on land, is basically an increase in site value. The land

owners typically has done nothing to produce the incremental

value. this increase usually results from population growth,

economic growth and the infrastructural investments made by local

governments, such as roads, water supply and sewerage. These

increments are unearned by the property owner and could be taxed

away without affecting resource allocation. That is, such taxation

would not impair the potential for the land market to assign land

to its 'highest and best' use."

[Reprinted from the New York Times,

22 May 1995, a letter by Haynes C. Goddard, Professor of Economics

at the University of Cincinnati]

|

Godwin,

William

ENLARGE

|

Humanity weeps over the distreses of the peasantry of all

civilized nations; and when she turns from the spectacle to behold

the luxury of their lords, gross, imperial and prodigal, her

sensations are certainly not less acute. this spectacle is the

school in which mankind have been educated. they have been

accustomed to the sight of injustice, oppression and iniquity,

till their feelings have been made callous, and their

understanding incapable of apprehending the nature of true virtue.

[From: Political Justice

(1793), Book VIII, Chap. 2]

|

Godwin,

William

|

It is territorial monopoly that obliges men unwillingly to see

vast tracts of land lying waste or negligently and imperfectly

cultivated, while they are subjected to the miseries of want.

[From: Political Justice

(1793), Book VIII, Chap. 3]

|

Goethe,

Johann Wolfgang

ENLARGE

|

The great ones of the world have taken this earth of ours to

themselves; they live in the midst of splender and superfluity.

The smallest nook of the land is already a possession; none may

touch it or meddle with it.

[From: Wilhelm Meister]

|

Goldman,

E.F.

(historian) |

For some years prior to 1952, I was working on a history of

American reform and over and over again my research ran into this

fact: an enormous number of men and women, strikingly different

people, men and women who were to lead 20th century America in a

dozen fields of humane activity wrote or told someone that their

whole thinking had been redirected by reading Progress and Poverty

in their formative years. In this respect no other book came

anywhere near comparable influence and I would like to add this

word of tribute to a volume which magically catalyzed the best

yearnings of our fathers and grandfathers.

|

Gompers,

Samuel

(1850-1924)

ENLARGE

|

Gompers, a leader of the U.S. labor movement, declared:

I believe in the Single Tax. I count it a great privilege to

have been a friend of Henry George and to have been one of those

who helped to make him understood in New York and elsewhere...

|

Goodman,

George

(aka Adam Smith)

ENLARGE

|

Every improvement in the circumstances of the society tends,

either directly or indirectly, to raise the real rent of land, to

increase the real wealth of the landlord, his power of purchasing

the labours or the produce of the labour of other people.

[from: Good Government

magazine, October 1999, p.6]

|

Gossen,

Hermann Heinrich |

Hermann Gossen (1810-1859) never held an academic position and

resigned from a career in the Prussian Civil Service in order to

complete work on his book. "I believe," he wrote of it, "that

my discoveries enable me to point out to man with unfailing

certainty the path that he must follow in order to accomplish

completely the purpose of his life."

The state could acquire land advantageously because it would

be able to borrow the purchase money at low rates of interest. If

collective ownership of land were introduced, society instead of

private individuals would get the advantage of any future increase

in land values.

[from: Entwicklung der Gesetze der

menschlichen Verkehrs und der darausfliessenden Regeln fur

menschliches Handeln, Brunswick, 1854.]

|

Gracchus,

Tiberius

(B.C. 162-133)

ENLARGE

|

This Roman statesman complained:

The private soldiers fight and die to advance the wealth and

luxury of the great and they are called masters of the world,

while they have not a foot of ground in their possession.

[From: Plutarch's Life of Tiberius

Gracchus. Pliny the Elder (23-79), a Roman naturalist, added

that land monopoly ruined Rome.

|

Graham,

Franklin D. |

The real unearned income is that which accrues to an

individual without his having done anything which contributes to

production. Of the several types of such income the most important

is that which issues from the site value of land. the recipient of

such an income does nothing to earn it; he merely sits tight while

the growth of the community about the land to which he holds title

brings him unmerited gain. This gain is at the expense of all true

producers whether they be laborers, enterprisers or investors in

industrial equipment. The taxation of this gain can do nothing to

deprive the community of any service since the donee is rendering

none. The land will be there for the use of society whether the

return from it be taxed or free. Society creates the value and

should secure it by taxation.

[From: Henry George News,

February 1955. Franklin D. Graham was, at the time, a Professor of

Economics at Princeton University]

|

Greeley,

Horace

ENLARGE

|

Whenever the ownership of the soil is so engrossed by a small

part of the community that the far larger part are compelled to

pay whatever the few may see fit to exact for the privilege of

occupying and cultivating the Earth, there is something very much

like slavery.

[From: "Slavery at Home," in

Hints Toward Reform (1845), pp. 354-5]

We admit and insist on the legal right of the owner of wild

lands to keep them uninhabited forever, but we do not consider it

morally right that he should do so when land becomes scarce and

subsistence for the landless scanty and precarious. . . . yes, . .

. something will be done, in spite of any stupid clamor that can

be raised about 'Infidelity' and 'Agrarianism,' to secure future

generations against the faithful evils of Monopoly of Land by the

few.

[From: New York Weekly Tribune,

Aug. 4, 1845]

|

Greeley,

Horace |

In short, the terrestrial Man, possessing the well known

properties of matter, as well as the spirit, can only in truth

enjoy the rights of "Life, Liberty and the pursuit of

Happiness," by being guaranteed some place in which to enjoy

them.

[From: Land Reform, Hints Toward

Reform, (1850), p.312]

|

Greeley,

Horace

|

He who has no clear inherent right to live somewhere has no

right to live at all.

[From: Land Reform, Hints Toward

Reform, (1850), p. 312]

|

Greeley,

Horace

|

Man ... having a right to liberty, he must have consequently

the right to go somewhere on earth and do what is essential to his

continued existence, not by the purchased permission of some other

man, but by virtue of his manhood.

[From: Land Reform, Hints Toward

Reform, (1850), p. 312]

|

Griffin,

Walter B.

ENLARGE

|

Behind every radical movement you will find Single Taxers.

Woodrow Wilson is surrounded by them.

[Walter Griffin (1876-1937) was the

designer of Canberra, Australia, and member of the Chicago Single

Tax Club]

|

Grotius,

Hugo

ENLARGE

|

Vacant and uncultivated lands which are found in the territory

of a State should be awarded to foreigners if they demand them.

And in fact they have the right to seize them; for we should not

regard as property that which is not cultivated.

[From: Rights of War and Peace,

Book II, Chap. 2, Sec. 17]

|

Hapgood,

David |

A tax on the earnings of labor seems unjust by comparison

(with a land tax) because it deprives the individual of what is

rightfully his, the fruits of his own efforts. The same is true of

a tax on the return to capital, to the extent that capital

represents the unspent return of past labor and initiative.

Equally important -- and here orthodox economics agrees with

George -- a natural resources rental charge is the rare tax that

improves rather than distorts people's incentives. Tax labor, and

people work less. Tax savings, and savings diminish. But tax land,

and the supply remains the same, while the owner is forced to put

it to more productive use.

[From: New Republic (1986)]

|

Hall,

Peter |

When the site values are taxed ... the incentive is always to

develop so as to realise the gains that are being taxed. Indeed

this is one of the most important points which have consistently

been made by the advocates of site-value rating.

[From: Land Values: The

Report of the Proceedings of a Colloquium Held in London on March

13 and 14, 1965, under the Auspices of the Acton Society Trust]

|

Harris,

W. Carlton |

Land is of fundamental importance as the basis of man's

economic and socia life. Not only does mankind live upon it, but

it is the source of all material wealth. So self-evident is this

fact that its elaboration is unnecessary.

[From: "Real Estate and

Real Estate Problems," The Annals of the American Academy

of Political and Social Science, Part I, Vol. CXLVIII, No.

237, March, 1930, p.1.]

|

Harris,

W. Carlton |

The Ricardian doctrine of rent, namely, that rent is a

differential surplus largely, or in the whole, unearned, has led

to the promulgation of certain theories of land tax which usually

go under the name of the "single tax." In detail, these

plans vary all the way from proposals to tax the future unearned

ncome of land, to proposals to absorb the past unearned income,

which would practically amount to confiscation and would lead to

systems of land nationalization.

[From: "Real Estate and

Real Estate Problems," The Annals of the American Academy

of Political and Social Science, Part I, Vol. CXLVIII, No.

237, March, 1930, pp.5-6. ]

|

Harrison,

Fred

ENLARGE

|

The forces that shaped the modern state, and therefore the

character of the power that it exercises, were disputes over land

and its rent. The struggle over public value may be tracked at

several levels. One is cross-border conflict over territory.

...The outcome was the privatisation of rent..

[From: Ricardo's Law (2006),

p. 278]

|

Heilbrun,

James |

Site value -- the value of unimproved land -- has long been

regarded [by economists] as a particularly fit object for

taxation.

[Professor of Economics, Fordham

University; from his textbook, Urban Economics & Public

Policy, 1987]

|

Heinberg,

Richard |

Tax Reform is also essential. "Geonomics" tax

theorists, who trace their lineage to 19th century American

economist Henry George, argue that society should tax land and

other basic resources -- the birthright of all -- instead of

income from labor. Geonomic tax reform, says advocates, could

decrease wealth disparities while reducing pollution and

discouraging land speculation. Similarly, taxing nonrenewable

resources and pollution - instead of giving oil companies huge

subsidies in the form of 'depletion allowances" - would put

the breaks on resource extraction while giving society the means

with which to fund the development of renewables.

[From the book, The Party's Over,

p. 246]

|

Henderson,

Arthur

ENLARGE

|

In 1903, Arthur Henderson was elected Member of Parliament (MP)

following a by-election. In 1908, when Hardie resigned as Leader

of the Labour Party, Henderson was elected to replace him. In

1914, the then-Labour leader, Ramsay MacDonald resigned in protest

over the war, and Henderson returned. In 1915, following Prime

Minister Asquith's decision to create a coalition government, he

became the first member of the Labour Party to become a member of

the Cabinet, as President of the Board of Education. When David

Lloyd George became Prime Minister in 1916t, Henderson became a

member of the small War Cabinet. He resigned in August 1917 when

his idea for an international conference on the war was voted down

by the rest of the cabinet; shortly afterwards he resigned as

Labour leader.

Henderson lost his seat in 1918 but was returned to Parliament in

1919 after winning a by-election. He became Labour's chief whip,

only to lose his seat in the 1922 general election. Again, he

returned to Parliament via a by-election but lost this seat in the

1923 general election. Yet again he was returned to Parliament

months later after winning a by-election. He was appointed Home

Secretary in the first ever Labour government (led by MacDonald).

This government was defeated in 1924.

Henderson was re-elected in 1924 and was urged by others to

challenge Ramsay MacDonald for the party leadership. Worried about

factionalism in the Labour Party, he published a pamphlet called

Labour and the Nation, in which he attempted to clarify

the Labour's goals.

In 1929, Labour formed another minority government, and MacDonald

appointed Henderson as Foreign Secretary, a position Henderson

used to try to reduce the tensions that had been building up in

Europe since the end of the War. Diplomatic relations were

re-established with the USSR and the League of Nations was given

Britain's full support.

During the Great Depression, Henderson joined with others in the

Cabinet opposing cuts in unemployment benefits. He resigned in

protest. In 1931, MacDonald attempted to form an emergency

National Government to tackle the crisis. The Labour Party

repudiated this government, and the National Executive expelled

MacDonald and all other Labour members who supported him

(Henderson cast the only vote against this). Henderson now became

leader of the party. With the economic and political situation

still uncertain, the National Government decided to call a general

election, and in the largest landslide in British political

history, it won an overwhelming majority. Yet again Henderson lost

his seat. The following year he relinquished the party leadership.

Henderson returned to Parliament after winning yet another a

by-election and spent the rest of his life trying to halt the

gathering storm of war. He chaired the Geneva Disarmament

Conference and was awarded the Nobel Peace Prize in 1934. He died

aged 72 in 1935.

"The Labour Party says that if the great landowners of

this country desire to put fences round the most productive soil

in the world … they must pay for the pleasure of doing so.

Accordingly, it is proposed to have the land valued, and to ask

the owner to pay a tax on that valuation. I think that by the

pressure of the taxation and rating of land-values the owners

would soon find that the land held out of use was not so necessary

to their pleasure as they thought. I venture to suggest that they

would quickly commence to seek buyers or tenants. The plentiful

supply of land that would come on the market would enable farmers

to obtain their holdings at a reasonable price or rent instead of

having to enter into possession on the inflated values with which

you are acquainted. I assert, without fear of contradiction, that

nothing would give a greater stimulus to the agricultural

industry than the freeing of the land. More farms would be opened

up; more opportunities of employment would offer for the

agricultural worker; the countryside would become a hive of

industry instead of a grave of disappointed hopes. The root of the

rural problem is where all roots are to be found - in the Land."

[Mr. Arthur Henderson, at Cromer,

17th March 1922]

|

Henderson,

Arthur

|

"The taxation of land-values would not impose any further

burden upon the agricultural industry. . . .The landowner would

have to pay it. He could not pass it on to the farmer, and he

could not make the agricultural worker pay it by means of a

reduction in his standard of life. I challenge anyone to say that

a tax on economic rent is paid by anyone else than the receiver of

the rent. But the Labour Party would go further than that. The

present system of assessment and rating produces an inequality of

burdens which are injurious to agriculture. Improvements are

positively discouraged. The burden of rates is often heaviest

where it can least well be borne. A farmer who improves his land

or erects an additional building for the housing of his live stock

finds immediately that his assessment is raised. The Labour Party

holds that it is suicidal for the nation to penalise by increased

taxation occupiers of land who effect improvements which add to

its value. We propose a drastic revision of the entire system of

assessment and rating in order that the taxation of land may be

used to unrate the improvements made by the occupier. "

[Mr. Arthur Henderson, at Cromer,

17th March, 1922]

|

Henderson,

Arthur

|

"Under our present system improvements are penalized. If

a shopkeeper extends his premises, or a farmer increases the value

of his farm by erecting improved buildings or draining the land,

the rates are immediately increased. That is a tax on private

enterprise with which I do not agree. Private enterprise

of a character not subversive of the public good I would

encourage. It little becomes the wealthy landlords who oppose the

shifting of the burden of the rates from houses, factories, shops,

and machinery on to the value of the land, to criticise the speech

I made at Newport. Why f I recently attached my name to a Bill for

the taking of rates off machinery. Is that an attack on private

enterprise? "

[Mr. Arthur Henderson, at

Newcastle By-election, January 1923]

|

Henderson,

Arthur

|

"The principle and policy of the United Committee have

no more sincere supporter than myself. The taxation of land-values

has been a vital need ever since the private ownership of land

formed an integral part of the social system, but the aftermath of

a great war has brought us problems which have dragged its urgent

necessity more into the light and indicated the essential truths

of the doctrine taught by Henry George."

[Mr. Arthur Henderson, Letter to

the International Conference on the Taxation of Land-values at

Oxford, August 1923]

|

Henderson,

Arthur

|

"The taxation of land-values with, of course, the

exemption of improvements, does not receive my support merely as a

plan for raising additional revenue. It is designed to achieve far

greater results. It seeks to open the way to the natural resources

from which all wealth springs. The labour is here, and with it the

wilt to work, but the land still lies locked in the grip of a

tenacious and unrelenting monopoly, while unemployment and poverty

haunt us with a terrifying persistence."

[Mr. Arthur Henderson, ib.]

|

Hill,

Edward

ENLARGE

and

Nowak,

Jeremy

ENLARGE

|

The following excerpt is from an article appearing in the Brookings

Review, "Nothing to Lose: Only Radical Strategies Can Hep

America's Most Distressed Cities":

As a first step, cities should abolish all business taxes that

inhibit the location of startup firms or discourage investment in

productivity-enhancing equipment or practices... Cities should

also replace the business property tax with a tax on the market

value of land, coupling the land tax with a broader use of

business improvement districts or tax increment finance districts

to pay for major infrastructure investments. Land taxes ... have

several advantages over property taxes in keeping a city's economy

competitive. They discourage speculative land banking. They

encourage businesses to place as much capital on property as is

economically justifiable because non-land forms of real property

are not taxes. ...

Local personal taxes commonly take three forms: sales taxes, wage

or income taxes, and property taxes, the latter being the most

common. A residential property tax has two components -- a land

tax and a sax on the value of the structure. The land component of

the residential property tax should be assessed on an equal basis

with the business land tax, again providing incentives to develop

in neighborhoods with low land values, as well as preventing

speculative land banking.

[Edward Hill is a senior research

scholar at Cleveland State University's Levin College of Urban

Affairs. Jeremy Nowak is president of the Reinvestment Fund

located in Philadelphia.]

|

Hobson,

John A.

(1858-1940)

ENLARGE

|

During his long writing career, Hobson criticizing classical

economics, holding that economic theory was bound up with the

ethical problems of social welfare and should be a guide to

reform. He is frequently referred to as a precursor of John

Maynard Keynes. Hobson advocated partial socialization, and in

Imperialism (1902) he interpreted imperialism as a product

of the economic excesses of capitalism. His other works include

The Evolution of Modern Capitalism (1894), The

Economics of Distribution (1900), The Economics of

Unemployment (1922), and Confessions of an Economic

Heretic, (1938).

The part played by rent in the problems of poverty can

scarcely be overestimated.

[From: Problems of Poverty

(1891), p.10]

|

Holmes,

Rev. John Naynes

(1879-1964) |

The National Association for the Advancement of Colored People

(NAACP) was co-founded by Rev. Holmes, who wrote:

Progress and Poverty was the most closely knit, fascinating

and convincing specimen of argumentation that I believe, ever

sprang from the mind of man.

|

Holmes,

Rev. John Naynes |

My reading of Henry George's immortal masterpiece "Progress

and Poverty" marked an epoch in my life. All my thought upon

the social question and all my work for social reform began with

the reading of this book. The passing years have only added to my

conviction that Henry George is one of the greatest of all modern

statesmen and prophets. His eloquence, his character, his life

must ever remain among the imperishable treasures of the race.

|

Howe,

Frederic C.

ENLARGE

|

While United States Commissioner of Immigration, in a

speech before the Pittsburgh Commercial Club, March 15, 1916:

Pittsburgh has set the pace for all America in her tax system

-- reducing taxes on improvements and increasing taxes on land

values -- the greatest single step any American city has taken in

city building.

|

Howe,

Frederic C.

|

The rich men I knew were not thrifty; they asked others to be

thrifty for them. They did not save; others saved for them. They

admonished others to virtues of meekness, humility, and duty, but

they observed none of their own admonitions.

They got an underhold on society, got it through monopoly and

made other people work for them. They capitalized something that

every one had to have or controlled a service that every one had

to use. They got rich easily, often quickly, and kept the wealth

they had acquired. ...Many men who got rich out of land had done

so against their will, or by accident.

[From: The Confessions of a

Reformer (1925), pp.222-223]

|

Howells,

William Dean

(1837-1920)

ENLARGE

|

Howells novel details the attempt to establish a new magazine in

New York City during America's Gilded Age. Historian Arthur

Schlesinger, Jr. described this work as "the first memorable

novel about New York City." Among the subjects explored are

the New York streetcar riot of 1889 and the execution of the

Haymarket anarchists in Chicago.

Some spaces, probably held by the owners for that rise in

value which the industry of others providentially gives to the

land of the wise and good, it left vacant comparatively far down

the road, and built up others at remoter points.

ENLARGE

[From: A Hazard of New Fortunes,

Part IV, Chap. 3]

|

Hughes,

Thomas |

The first thing which the democracy will write

upon the slate will be the nationalization of the land.

[From: An address at the Church

Congress of 1888]

|

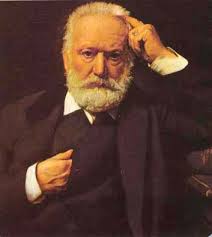

Hugo,

Victor

ENLARGE

|

Democratize property, not by abolishing, but by universalizing

it, so that every citizen without exception may be a landowner, an

easier task than it may be supposed; in short, know how to produce

wealth andhow to distribute it, and you will possess at once

material greatness and moral greatness, and you will be worthy to

be called France.

[From: Les Miserables, Saint

Denis, Book I., Chap. 4]

|

Hume,

David

ENLARGE

|

The possession alone, and first possession, is supposed to

convey property, when nobody else has any preceding claim and

pretension. Many of the reasonings of lawyers are of this

analogical nature, and depend on very slight connections of the

imagination.

[From: Enquiry Concerning the

Principles of Morals, Sec. III, Part 2, Essays, Vol.

II, p. 190]

|

Hseng,

Hsiao |

Tseng Hsiao was at the time of the following statement

in 1989 Director of the China Research Institute of Land

Economics.

The principle of equitable distribution of land rights

requires no taxation on labour and capital. Furthermore, site rent

has to be taxed for public revenue because land has monopoly

power. There is a difference between ordinary products and land.

The latter is a gift of nature, which is limited and cannot be

increased by human beings; its revenue has to be shared among all

citizens in society.

[The source of the statement is not

known. It is reprinted from Land & Liberty,

July-August 1989]

|

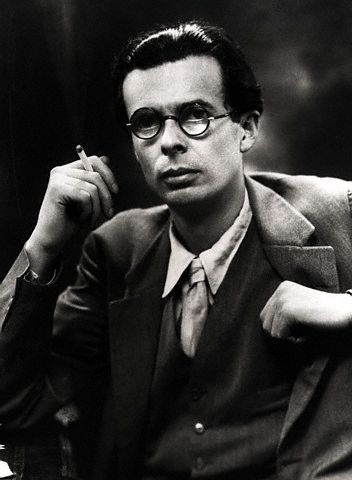

Huxley,

Aldous

(1894-1963)

ENLARGE

|

In the preface to his Brave New World (p. viii), Huxley

wrote:

If I were now to rewrite the book, I would offer a third

alternative ... the possibility of sanity ... Economics would be

decentralist and Henry Georgian.

|

Hydeman,

Albert (Jr.) |

Is there a sensible alternative to the property tax? Such an

alternative would have to do the following things: Realign the tax

burden from those least able to pay to those most able to pay,

simplify and reduce the cost of community growth and development.

I think there is such an alternative. It's known as the land

value tax. We are now taxing improvements -- buildings -- at the

same rate we tax land. I think that's a mistake.

We're discouraging people from fixing up their properties. There

should be a lower property tax on improvements -- or none at all.

[former Secretary, Pa. Department of

Community Affairs]

|

BROWSE BY AUTHOR

|