Reeb,

Donald |

Professor of Political Science, State University of New York

(Albany) Donald Reeb, in a research paper published in 1998 wrote

[p.9]:

The two-rate or graded tax not only reduces the negative

effects from taxation on buildings, it promotes the development of

new buildings and jobs.

|

Ricardo,

David

ENLARGE

|

David Ricardo, whose theories of value and wages furnished the

economic groundwork for Lasalle and Karl Marx, developed also the

doctrine of rent which became the cardinal principle in the system

of Henry George. It is one of the ironies of history that the

theories of Ricardo, who was such a staunch exponent of the

interests of the moneyed classes, should have been employed to

justify radical attacks upon the economic interests of these

classes.

"In a progressive country", argued Ricardo, ...

"the landlord not only obtains a greater produce, but a

larger share.". Hence, "the interest of the

landlord is always opposed to the interest of every other class in

the community. His situation is never so prosperous as when food

is scarce and deal."

In Ricardo's Manual of Political

Economy[p. 1xxx], he wrote:

Sustained by some of the greatest names -- I will say by every

name of the rist rank in Political Economy from Turgot and Adam

Smith to Mill -- I hold that the land of a country presents

conditions which separate it economically from the great mass of

the other objects of wealth.

|

Ricardo,

David |

Rent is that portion of the produce of the earth which is paid

to the landlord for the use of the original and indestructible

powers of the soil.

[From: Principles of Political

Economy, Chap. II]

|

Ricardo,

David |

The interest of the landlord is always opposed to the

interests of every other class in the community.

[source not researched]

|

Rogers,

James Edwin Thorold

ENLARGE

|

As a matter of fact, the owner contributes nothing to local

taxation. Everything is heaped on the occupier. The land would be

worthless without roads, and the occupier has to construct, widen

and repair them. It could not be inhabited without proper

drainage, and the occupier is constrained to construct and pay for

the works which give an initial value to the ground rent, and,

after the outlay, enhance it. It could not be occupied without a

proper supply of water, and the cost of this supply is levied on

the occupier also. In return for the enormous expenditure paid by

the tenant for these permanent improvements, he has his rent

raised on his improvements, and his taxes increased by them.

[From: Six Centuries of Work and

Wages]

|

Rogers,

James Edwin Thorold |

Every permanent improvement of the soil, every railroad and

road, every bettering of the general condtion of society, every

facility given for production, every stimulus supplied to

consumption, raises rent. The landowner sleeps, but thrives. He

along, among all the recipients in the distribution of products,

owes everything to the labor of others, contributes nothing of his

own. He inherits part of the fruits of present industry, and has

appropriated the lion's share of accumulated intelligence.

[1870]

|

Rogers,

James Edwin Thorold |

No human being need trouble himself about a landlord's rents,

other to be sure than the landlord himself. The happiest state

which the human race could conceive its such a mobility of labor

and such an extension of the cultivable land and productive

industry which man gives to cultivable land as to produce that

plenty in which rent finds no place.

[From: Work and Wages, Chap.

XVI, p. 456]

|

Rogers,

James Edwin Thorold |

I can easily imagine a great proprietor of ground rents in the

metropolis calling attention to the habitations of the poor, to

the evils of overcrowding, and to the scandals which the inquiry

reveals, while his own income is greatly increased by the causes

which make house-rent dear in London, and decent lodging hardly

obtainable by thousands of laborers.

[From: Work and Wages, Chap.

XV, p. 550]

|

Roosevelt,

Franklin D.

(1882-1945)

ENLARGE

|

I believe that Henry George was one of the really great

thinkers produced by our country. I do not go all the way with

him, but I wish that his writings were better known and more

clearly understood, for certainly they contain much that would be

helpful today.

|

Roosevelt

Theodore

(1858-1919)

ENLARGE

|

Every person who invests in well-selected real estate in a

growing section of a prosperous community adopts the surest and

safest method of becoming independent, for real estate is the

basis of wealth.

[Quoted in: William H. Ten Haken, in "Real

Estate as a Marketable Commodity," The Annals of The

American Academy of Political and Social Science, Vol.

CXLVIII, No. 237, March, 1930, p.25]

The burden of taxation should be so shifted as to put the

weight upon the unearned rise in the value of land itself, rather

than improvements, the effect being to prevent the undue rise of

rents.

[From: Century Magazine,

October 1931]

|

Rousseau,

Jean Jacques

(1712-1778)

ENLARGE

|

Rousseau's observations concerning the State and the competing

interests of classes within society led him to conclude:

You are undone if you once forget that the fruits of the earth

belong to us all, and the earth itself to no one.

The following is from Rousseau's "Discussion on Inequality":

The first man, who after enclosing a piece of ground, took it

into his head to say, "This is mine" and found people

simple enough to believe him, was the true founder of Civil

Society. How many crimes, how many wars, how many misfortunes and

horrors would that man have saved the human species, who pulling

up the stakes or filling up the ditches, should have cried to his

fellow! Be sure not to listen to the imposter; you are lost if you

forget that the fruits of the earth belong equitably to us all,

and the earth itself to nobody."

[Jean Jacques Rousseau, Essay on

the Origin of Inequality Among Men (1755), Part II., p.1]

|

Ruskin,

John

ENLARGE

|

It begins to be asked on many sides how the possessors of the

land became possessed of it, and why they should still possess it,

more than you or I.

[From: Fors Clavigera, Vol. I,

Letter 2]

|

Ruskin,

John

|

Bodies of men and women, then (and much more, as I have said

before, their souls), must not be bought or sold. Neither must

land, nor water, nor air, these things being the necessary

sustenance of men's bodies and souls.

[From: Time and Tide, Sec. 150,

p. 161]

|

Ruskin,

John

|

These principles the professor [Fawcett] goes on contentedly

to investigate, never appearing to contemplate for an instant the

possibility of the first principle of the whole business -- the

maintenance, by force, of the possession of land obtained by

force, being ever called in question by any human mind. It is

nevertheless the nearest task of our day to discover how far

original theft may be justly encountered by reactionary theft, or

whether reactionary theft be indeed theft at all; and farther,

what, excluding either original or corrective theft, are the just

conditions of the possession of land.

[From: Munera Pulveris (1871),

p.20]

|

Russell,

Bertrand

(1872-1970)

ENLARGE

|

Russell reached the same conclusions as Henry George had,

writing:

The mere abolition of rent would not remove injustice, since

it would confer a capricious advantage upon the occupiers of the

best sites and the most fertile land. It is necessary that there

should be rent, but it should be paid to the state or to some body

which performs public services; or, if the total rental were more

than is required for such purposes, it might be paid into a common

fund and divided equally among the population.

|

Russell,

H. Earle |

Most municipalities in the Transvaal tax land values only.

City authorities and the people believe the land value tax is

fairer than taxing both land and improvements. There is no tax on

machinery or merchandise. This system has been in effect in

Johannesburg since 1919. It did not cause any business disturbance

when suddenly enacted and it has given general satisfaction... It

undoubtedly has helped to replace old buildings with new ones in

the more central locations.

[U.S. Consul General in the Union of South Africa]

|

Samuelson,

Paul

ENLARGE

|

Neo-Keynesian economist and Nobel Laureate, Paul Samuelson,

has over several decades in his extensively-used textbook expanded

on the subject of whether the income (i.e., cash flow) derived

from controlling locations justly belongs to the individual or

entity that happens to hold a title deed enforced by government.

Here, in a not very direct fashion, he suggests that the just

society requires that locations be leased by society rather than

sold for private gain:

Our ideal society finds it essential to put a rent on land as

a way of maximizing the total consumption available to the

society. ...Pure land rent is in the nature of a "surplus"

which can be taxed heavily without distorting production

incentives or efficiency. A land value tax can be called "the

useful tax on measured land surplus".

|

Samuelson,

Paul

and

Nordhaus,

William D.

ENLARGE

|

In the text Economics, 16th edition, p.250, the authors

write:

The striking result is that a tax on rent will lead to no

distortions or economic inefficiencies. Why not? Because a tax on

pure economic rent does not change anyone's economic behavior.

Demanders are unaffected because their price is unchanged. The

behavior of suppliers is unaffected because the supply of land is

fixed and cannot react. Hence, the economy operates after the tax

exactly as it did before the tax--with no distortions or

inefficiencies arising as a result of the land tax.

|

Savage,

Robert

|

In the 1870s ideas similar to those expressed by Henry George

were being heard in Australia. When Henry George was editing the

San Francisco Post, a copy of a tract written by Robert Savage, of

the "Land Tenure Reform League of Victoria," came to his

attention. He published an extract from it in an editorial in the

Post, 16 April 1874. The author of the tract declared:

The allocation of the rents of the soil to the nation is the

only possible means by which a just distribution of the created

wealth can be effected.

|

Schreinter,

Olive

(1855-1920)

ENLARGE

|

The doctrine that land can become the private property of one

is a doctrine morally repugnant to the Bantu. The idea which is

to-day beginning to haunt Europe, that, as the one possible salve

for our social wounds and diseases, it might be well if the land

should become again the property of the nation at large, is no

ideal to the Bantu, but a realistic actuality. He finds it

difficult, if not impossible, to reconcile his sense of justice

with any other form of tenure.

[From: Stray Thoughts on South

Africa, Fortnightly Review (July, 1896), p.6]

|

Schlesinger,

Arthur (Jr.)

ENLARGE

|

A letter written by Arthur Schlesinger, printed in the New York

Times, March 27, 1994:

"In his fascinating article on America through Russian

eyes ('Under Eastern Eyes: What America Meant to the Writers of

Russia," Feb. 27), David Plante observes that there are 'very

few' references to America in Tolstoy. Tolstoy reference Mr.

Plante might have noted struck George Kennan with singular force

when Mr. Kennan was Ambassador to Moscow.

Watching a dramatization of Tolstoy's 'Resurrection' at the

Moscow Art theater, the American Ambassador was electrified to

hear the leading man, looking straight at him, say, 'There is an

American by the name of George, and with him we are all in

agreement.' Was this a daring political gestue? Back at the

embassy, Kennan took down Tolstoy's novel and found that the line

referred to Henry George, the champion of the single tax on

unearned increase in land values and an American much admired by

Tolstoy."

|

Schopenhauer

ENLARGE

|

In the annals of natural history, after herb-eating animals

had been evolved, it was not long before beasts of prey made their

appearance, which lived on the flesh of their precursors. In like

manner, after men have honestly reclaimed the soil necessary for

the support of a people, by the sweat of their brows, others are

sure to arrive on the stage, who, instead of making the soil

productive and living on its produce, prefer to bring their own

skins to market and stake life, health and freedom on the chanceof

pouncing upon those who hold possessions which they have fairly

earned, and of appropriating their fruits.

[From: Parerga and Paralipomena

(1852 ), Vol.II, Sec. 125]

The difference between serfdom as in Russia, and landownership

as in England, and particularly between the serf, and the tenant,

occupier, mortgagor, etc., is more in form than in fact. Whether I

own the peasant, or the land from which he must obtain his

nourishment, the bird or its food, the fruit or the tree, is

practically a matter of small importance.

[From: Parerga and Paralipomena

(1852 ), Vol.II, Sec. 126]

|

Scott,

Walter

ENLARGE

|

To such a point have we been brought by an artificial system

of society, that we must either deny altogether the right of the

poor to their just proportion of the fruits of the earth, or

afford them some means of subsistence out of them by the

institution of positive law.

[From: St. Ronan's Well,

Chap. XXXII, Note G]

|

Seattle, chief of the Dwamlsh

ENLARGE

|

In the mid-nineteenth century, the tribe of indigenous people

called the Dwamlsh found themselves in the path of the

European-American conquest of North America. Their chief, Seattle,

attempted peaceful diplomacy with the President what was still a

Union of sovereign states, the national government of which had

declared geo-political control over the territory and peoples of

much of North America. The letter was directed to Franklin Pierce:

How can you buy or sell the sky -- the warmth of the land? The

idea Is strange to us... Every part of this earth is sacred to us.

|

Seneca

ENLARGE

|

From Epistles, XC (near the end):

What generation of men was ever happier? In common they

enjoyed the gifts of nature; she sufficed like a mother to the

support of all. ... To-day let avarice add field to field, let her

drive ut her neighbors by purchase or by fraud, let her swell her

estate to the size of a province, no extension of our boundaries

will bring us back to the point we started from.

|

Seward,

William H.

ENLARGE

|

But there is a higher law than the constitution, which

regulates out authority over the domain, and devotes it to the

same noble purpose. The territory is a part of the common heritage

of mankind, bestowed upon them by the Creator of the Universe.

[From a speech in the United States

Senate, 11 March, 1850]

|

Shaw,

George Bernard

(1856-1950)

ENLARGE

|

Shaw, another in a long line of controvsial, reform-minded

figures of the late nineteenth and twentieth centuries, described

his introduction to Henry George and his ideas:

I went one night quite casually into a hall in London, and I

heard a man deliver a speech which changed the whole current of my

life. That man was an American -- Henry George... Well, Henry

George put me on to the economic tack, and the tack of political

science. Very shortly afterwards I read Karl Marx, and I read all

the early political sciences of that time; but It was the

American, Henry George, who started me. Therefore, as that

happened at the beginning of my life, I have thought it fitting

that now at the end of my life... I might come and give here In

America back a little of that shove that Henry George gave to me.

|

Shaw,

George Bernard |

"Finally I must insist that the crux of the land question

is the classical theory of Economic Rent, dubbed by Lassalle the

Iron Law of Wages. Like the roundness of the Earth, it is

unfortunately not obvious. It is the pons asinorum of economic

mathematics. Our politicians cannot draw their conclusions from it

any more than Shakespeare could draw his from the okapi or the

axolotl: they simply do not know of its existence. Karl Marx, by

an absurd reference to it in 'Das Kapital', proved that he did not

understand it. John Ruskin, after a very promising beginning as an

economist by his contrast of exchange value swith human values,

was stopped dead by it. Yet Marx and Ruskin had had more brains

and keener interest in social questions than three or four million

average voters. It is the rock on which Liberal Cobdenism has been

broken and Socialism built in the struggle between plutocracy and

democracy."

From the book, Everybody's Political What's What?,

1944, p.22:

|

Shim,

Ki R.

|

Land value taxation has various advantages: the decrease in

land speculation, the acceleration of urban development, the

financial independence of local governments, redressing the fiscal

diparity between a central city and its suburbs, prevention of

urban sprawl and more effective use of land, etc. According to the

Urban Land Institute of Washington, D.C., the land value tax is

the golden key to urban renewal to the automatic regeneration of

the city -- and not at public expense.

[Professor of Economics, University of Pittsburgh, 1986]

|

Simon,

Herbert

ENLARGE

|

Assuming that a tax increase is necessary, it is clearly

preferable to impose the additional cost on land by increasing the

land tax, rather than to increase the wage tax ... It is the use

and occupancy of property that creates the need for municipal

services that appear as the largest item in the budget -- fire and

police protection, waste removal, and public works. ..[1978]

|

Simonde de Sismondi,

Jean-Charles-Leonard

ENLARGE

|

In general, as soon as there is no more vacant land, the

masters of the soil have a kind of monopoly against the rest of

the world.

[From: New Principles of Political

Economy (1820), Book III., Chap. 5, p. 202 (Second French

Edition)]

|

Sismonde de Sismondi,

Jean-Charles-Leonard |

As proprietors lastly, the whole soil of the cuntry belongs to

them, and they have sometimes arrogated to themselves the right of

dismissing the nation from her own abode.

[From: "Essay on Landed Property,"

Political Economy (1847), English Edition, p. 161]

|

Sismonde de Sismondi,

Jean-Charles-Leonard |

Let the great (land) lords of England take care! ...If once

they believe that they have no need of the people, the people may

in their turn think that they have no need of them.

[From: "Essay on Landed Property,"

Political Economy (1847), English Edition, p. 189]

|

Sismonde de Sismondi,

Jean-Charles-Leonard |

The nature of landed property, invariably limited, whatsoever

may be the demand of the producers or consumers, gives it the

power of a monopoly.

[From: "Essay on Landed Property,"

Political Economy (1847), p. 176]

|

Sismonde de Sismondi,

Jean-Charles-Leonard |

Labor applied to land produces more than it has cost. The

often debated question of this surplus is an idle question; its

existence is a fact which is not contested.

[From: "Essay on Landed Property,"

Political Economy (1847), p. 175]

|

Sloniker,

William E.

|

The tax on buildings punishes all the people who improve their

property by raising their taxes and rewards those who let their

property deteriorate or sit vacant.

Taxing land along would remove the disincentive to private

development and private renewal of our cities and towns.

[Professor of Economics, University of Wisconsin/Milwaukee,

199-]

|

Smillie,

Robert

ENLARGE

|

Smillie was elected president of the Scottish Miners' Federation

in 1894. Two years later he played an important role in the

formation of the Scottish Trade Union Congress. His role was

recognised when he was elected chairman at its first conference, a

post he was to hold until 1899. When the First World War ended in

1918, Smillie was one of the first to call for the Labour Party to

withdraw from Lloyd George's coalition government.

In 1919 Smillie called for the nationalization and workers'

control of Britain mines. David Lloyd George responded by setting

up a Royal Commission under the chairmanship of Lord Sankey. The

Sankey Royal Commission failed to agree about the solutions to

these problems, but the majority of the members did support the

idea of the mines being nationalized. Smillie was furious when

Lloyd George refused to nationalize the mines and allowed them to

go back into private ownership.

Smillie had tried several times to enter the House of Commons. He

was defeated at by-elections in 1895 (Glasgow) and 1901 (N.E.

Lanarkshire) and at General Elections held in 1906 (Paisley) and

1910 (Glasgow). Smillie was finally elected MP for Morpeth in the

1923 General Election. He declined a post in the 1924 Labour

Government headed by Ramsay MacDonald.

As a result of poor health, Smillie was forced to resign his

Morpeth seat in 1929. Robert Smillie retired to Dumfries where he

died on 16th February, 1940.

"Late in life I have realised, what I failed to see in

the early days, that the root of all our social problems lies in

the land question. So long as land is withheld from free access to

men, anxious and willing to utilise Nature's bounty, just so long

will you have a crowd of men at the factory gate waiting for jobs.

The key to the anomalies we are all endeavouring to solve is the

land problem. …If the atmosphere could have been parcelled

out and bottled up so that every child that comes into the world

would only be allowed to breathe on the payment of air-rent, you

can picture a state of affairs as deplorable, but no less unjust

and ridiculous, as that obtaining at the present time with your

private ownership and monopoly of the land."

[A statement made at

Newcastle-under-Lyme, October 1921]

|

Smith,

Adam

(1720-1790)

ENLARGE

|

In Adam Smith's Wealth of Nations we find the germs of

the idea that land rent is peculiarly an unearned and exploitative

income:

As soon as land becomes private property, the landlord demands

a share of almost all the produce which the labourer can either

raise, or collect from it. His rent makes the first deduction from

the produce of the labour which is employed upon the land. [Book

1, Ch.8, p.29]

The idea of land rent as an income which, altogether apart from

any special activity of the land owner, tends to increase

spontaneously with the progress of society, yielding to its

recipients a relatively increasing share in the distribution of

wealth, is also found in the Wealth of Nations [Book I,

Ch. 11, p.115]:

Every improvement in the circumstances of the society tends

either directly or indirectly to raise the real rent of land, to

increase the real wealth of the landlord, his power of purchasing

the labour, or the produce of the labour of other people.

The real value of the landlord's share, his real command of the

labour of other people, not only rises with the real value of the

produce, but the proportion of his share to the whole produce

rises with it.

Smith then addressed the subject of whether the rent of land

ought to be taxed [Book 5, Ch.2, pp.380-81:

Both ground-rents and the ordinary rent of land are a species

of revenue which the owner, in many cases, enjoys without any care

or attention of his own. Though a part of this revenue should be

taken from him in order to defray the expenses of the state, no

discouragement will thereby be given to any sort of industry.

...Ground-rents, and the ordinary rnt of land, are therefore,

perhaps, the species of revenue which can best bear to have a

peculiar tax imposed upon them.

Ground rents seem in this respect a more proper subject of

peculiar taxation than even the ordinary rent of land.

...Ground-rents, so far as they exceed the ordinary rent of land,

are altogether owing to the good government of the sovereign.

...Nothing can be more reasonable than that a fund which owes its

existence to the good government of the stae should be taxed

peculiarly, or should contribute something more than the greater

part of other funds towards the support of that government.

A tax upon ground-rents would not raise the rent of houses. It

would fall altogether upon the owner of the ground-rent, who acts

always as a monopolist and exacts the greatest rent which can be

got for the use of the ground.

[From: Wealth of Nations

(1776), Book V, Chap. 2, Art.1]

|

Smith,

Adam

ENLARGE

|

As soon as the land of any country has all become private

property, the landlords, like all other men, love to reap where

they never sowed, and demand a rent even for its naturla produce.

[From: Wealth of Nations,

Book I., Chap. 6]

|

Smith,

Gerrit

ENLARGE

|

Smith was born in Utica, New York, on 6 March, 1797. After

graduating at Hamilton College in 1818, he assumed the management

of his family estate. In the late 1820s he became active in the

temperance movement, and then became an abolitionist in 1835. In

1840 he helped to organize the Liberty party. An "Industrial

Congress" at Philadelphia nominated him for the Presidency in

1848, and the "Land Reformers" in 1856. In 1840 and in

1858 he was a candidate for the governorship of New York on an

anti-slavery platform.

In 1853 he was elected to the U.S. House of Representatives as an

independent, and issued an address declaring that all men have an

equal right to the soil; that wars are brutal and unnecessary;

that slavery could be sanctioned by no constitution, state or

federal; that free trade is essential to human brotherhood; that

women should have full political rights; that the Federal

government and the states should prohibit the liquor traffic

within their respective jurisdictions; and that government

officers, so far as practicable, should be elected by direct vote

of the people. At the end of the first session he resigned his

seat. After becoming an opponent of land monopoly, he gave

numerous farms of fifty acres each to indigent families, and also

attempted to colonize tracts in northern New York State with free

negroes. He favored a vigorous prosecution of the Civil War, but

at its close advocated a mild policy toward the late Confederate

states, declaring that part of the guilt of slavery lay upon the

North.

His private benefactions were boundless; of his gifts he kept no

record, but their value is said to have exceeded $8 million.

Though a man of great wealth his life was one of marked

simplicity. He died on the 28th of December 1874, while on a visit

to relatives in New York City.

I admit that there are things in which a man can have absolute

property, and which without qualification or restriction he can

buy or sell or bequeath at his pleasure. But I deny that the soil

is among these things.

[From a Speech to the U.S. Congress,

21 February, 1854. Speeches of Gerrit Smith, p.74]

|

Smith,

Gerrit

|

The world will be much happier when land monopoly shall cease,

because manual labor will then be so honorable, because so

well-nigh universal. It will be happier too, because the wges

system, with all its attendant degradation and unhappy influences,

will find but little room in the new and radically changed

condition of society.

[From: Speeches in the U.S.

Congress (1854), pp.84-5]

|

Smith,

Gerrit

|

The vacant land belongs to the landless. The simple fact that

the one is vacant and the other landless is of itself the highest

proof that they should be allowed to come together. Alas, what a

crime against nature that they should be kept apart.

[From: Speeches in the U.S.

Congress (1854), p. 247]

|

Snell,

Henry

ENLARGE

|

Henry Snell, the son of an agricultural labourer, was born at

Sutton-on-Trent, Nottinghamshire, in 1865. He was educated at the

local school until he reached the age of twelve. As an adult, he

moved to London, where he joined the Mechanics' Institution and

used the University College reference library. Books that deeply

influenced him at this time included books The Age of Reason

by Tom Paine, Progress and Poverty by Henry George and

Towards Democracy by Edward Carpenter.

In 1894 Snell joined the Fabian Society. He then joined Ramsay

MacDonald, Graham Wallas, Catherine Glasier and Bruce Glasier in

travelling around the country giving lecturers on subjects such as

'Socialism', 'Trade Unionism', 'Co-operation' and 'Economic

History'.

Snell was also a early member of the Labour Party and made

several attempts to represent the party in the House of Commons.

After failing to be elected in Huddersfield in 1910 and 1918 he

was eventually elected to represent Woolwich in London in the 1922

General Election. He continued in politics and between 1935 and

1940 was leader of the Labour Party in the House of Lords. Henry

Snell died on 21st April 1944.

I was one of the many thousands of young men whose political

and social views were greatly stimulated by Henry George's famous

book Progress and Poverty, which, if measured by the breadth and

the depth of its influence on the thoughtful workmen of the

eighties, must be considered as one of the greatest political

documents of that generation.

[From: Men Movements and Myself, 1936]

|

Snowden,

Philip

(1854-1937)

ENLARGE

|

I heard Henry George just before 'Progress and Poverty' had

been published, a book which had made a tremendous impression in

the United States and Great Britain. Henry George was having

something of a triumphal tour through Scotland. The Scottish

Radicals had been captured by the theories he had advanced in

'Progress and Poverty'.

No book every written on the social problem made so many

converts. Economic facts and theories have never been presented in

such an attractive way. Although Henry George was not a socialist,

his book led many of his readers to socialism. Keir Hardie told me

that it was 'Progress and Poverty' which gave him his first ideas

of socialism.

Henry George had a very impressive platform style. In appearance

he was of middle height, well built, had a full, brown beard, and

would have passed for a Nonconformist minister. His style of

speaking was conversational, rather than oratorical.

[from: An Autobiography, 1934]

Snowden served in the Liberal government of Lloyd George as

Chancellor of the Exchequer. Concerned over the desperate

conditions of the 1930s, Snowden campaigned for reform of the tax

struture. He wrote:

There never was a time when the need was greater than it is

today for the application of the philosophy and principles of

Henry George to the economic and political conditions which are

scourging the whole world. The root cause of the world's economic

distress is surely obvious to every man who has eyes to see and a

brain to understand. So long as land is a monopoly, and men are

denied free access to it to apply their labor to its uses,

poverty and unemployment will exist. Permanent Peace can only be

established when men and nations have realized that natural

resources should be a common heritage, and used for the good of

all mankind.

"Until they had abolished landlordism root and branch,

every other attempt at reform was building upon the sands. Every

reform not based on common ownership of the land was simply

subsidising landlordism. Every social reform increased the

economic rent of land. Therefore, unless they were going to

continue to waste their efforts by tinkering with social questions

as in the past, they must concentrate upon this fundamental

question, to secure the land for the people."

[Mr. Philip Snowden, at Memorial

Hall, London, 24th May 1919 (Land Nationaliser, June

1919)]

"We hold the position that the whole economic value of

land belongs to the community and that no individual has the right

to appropriate and enjoy what belongs to the community as a whole.

Let there be no mistake about it. When the Labour Government does

sit upon those benches it will not deserve to have a second term

of office unless in the most determined manner it tries to secure

social wealth for social purposes."

[Mr. Philip Snowden, House of

Commons, 4th July 1923 (on Third Reading of Finance Bill)]

|

Solow,

Robert

ENLARGE

|

The user of land should not be allowed to acquire rights of

indefinite duration for single payments. For efficiency, for

adequate revenue and for justice, every user of land should be

required to make an annual payment to the local government equal

to the current rental value of the land that he or she prevents

others from using.

[1987]

|

Spence,

Thomas

|

Let all the Parishioners unite, take Archdeacon Paley in one

hand and the Bible in the other, assemble in an adjoining field,

and after having debated the subject to their own satisfaction,

enter into a Convention and unanimously agree to a Declaration of

Rights, in which it is declared that all the land, including

coal-pits, mines, rivers, etc., belonging to the Parish of Bees,

now in the possession of Lord Drone, shall on Lady Day, 25th

March, 18--, become public property, the joint stock and common

farm, in which every Parishioner shall enjoy an equal

participation.

[From: Land for the Landless

(1893), p.14]

|

Spence,

Thomas

|

Thomas Spence, of Newcastle-on-Tyne, advocated ideas strikingly

similar to those of Henry George in a lecture before the

Philosophical Society of Newcastle on 8 November 1775 (for the

printing of which, wrote Spence, "the society did the Author

the honour to expel him"). Spence believed in the natural

right of all men to land. Concerning the private appropriation of

land, Spence wrote [The Rights of Infants, 1796, p.3]:

For as all the rivers run into the sea, and yet the sea is not

full, so let there ever so many sources of wealth, let trade,

foreign and domestic, open all their sluices, yet will no other

but the landed interest be ultimately the better.

Spence's remedy was "to administer the landed estate of the

nation as a joint-stock property, in parochial partnerships, by

dividing the rent" [The Whole Rights of Man, 1796,

p.11]

There are no tolls or taxes of any kind paid among them, by

native or foreigner, but the aforesaid rent. The government, poor,

roads, etc. etc. ... are all maintained by the parishes with the

rent: on which account all wares, manufactures, allowable trade,

employments, or actions, are entirely duty-free.

|

Spencer,

Herbert

(1820-1910)

ENLARGE

|

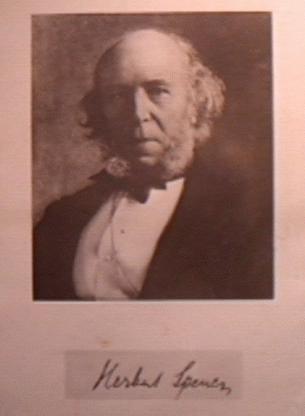

Herbert Spencer, in his Social Statics, published in

1850, the same year as Patrick Edward Dove's work, gave the

fullest exposition of the natural rights theory applied to land

prior to Henry George's writings. In chapter IX, The Right to the

Use of the Earth, he declared that "equity ... does not

permit property in land" [p.132]:

The right of each man to use of the earth, limited only by the

like rights of his fellow-men, is immediately deducible from the

law of equal freedom. We see that the maintenance of this right

necessarily forbids private property in land. On examination, all

existing titles to such property turn out to be invalid.

Spencer believed that equal apportionment of the earth among its

inhabitants and common property in land would be alike unfeasible.

But the change could be effected with no serious disturbance of

the existing order [p.141]:

The change required would be simply a change of land-lords.

Separate ownership would merge into the joint-stock ownership of

the public. Instead of being in the possession of individuals, the

country would be held by the great corporate body -- Society.

Instead of leasing his acres form an isolated proprietor, the

farmer would lease them from the nation. Instead of paying his

rent to the agent of Sir John or his Grace, he would pay it to an

agent or deputy-agent of the community. Stewards would be public

officials instead of private ones; and tenancy the only land

tenure.

|

Spencer,

Herbert

|

Equity ... does not permit property in land. For if one

portion of the earth's surface may justly become the possessio of

an individual and may be held by him for his sole use and benefit

as a thing to which he has an exclusive right, then other portions

of the earth's surface may be so held; and eventually the whole of

the earth's surface may be so held; and our planet may thus lapse

into private hands.

[From: Social Statics (1850),

Chap. IX]

|

Spencer,

Herbert |

"It may by-and-by be perceived that Equity utters

dictates to which we have not yet listened ; and men may then

learn that to deprive others of their rights to the use of the

earth, is to commit a crime inferior only in wickedness to the

crime of taking away their lives or personal liberties."

[Herbert Spencer, Social Statics

(1851), IX, 9]

|

Spencer,

Herbert

|

"It can never be pretended that the existing titles to

such property (i.e., land) are legitimate. Should anyone think so,

let him look in the chronicles. Violence, fraud, the prerogative

of force, the claims of superior cunning -- these are the sources

to which these titles may be traced."

[Herbert Spencer, Social Statics

(1851), Chap. IX]

|

Spencer,

Herbert

|

"You have turned over the soil to a few inches in depth

with a spade or a plough; you have scattered over this prepared

surface a few seeds ; and you have gathered the fruits which the

sun, rain, and air helped the soil to produce. Just tell me, if

you please, by what magic have these acts made you sole owner of

that vast mass of matter, having for its base the surface of your

estate, and for its apex the centre of the globe? . . . You say

truly, when you say that 'whilst they were unreclaimed these lands

belonged to all men.' And it is my duty to tell you that they

belong to all men still; and that your ' improvements' as you call

them, cannot vitiate the claim of all men. You may plough and

harrow, and sow and reap ; you may turn over the soil as often as

you like; but all your manipulations will fail to make that soil

yours, which was not yours to begin with. . . . This extra worth

which your labour has imparted to it is fairly yours . . . but

admitting this, is quite a different thing from recognising your

right to the land itself."

[Herbert Spencer, Social Statics,

1851, ix, 4]

|

Spinoza,

Baruch de

(1632-1677)

ENLARGE

|

Spinoza, the Dutch philosopher, in his Tractatus Politicus

proposed that the rents of the soil, supplemented perhaps by the

rents of houses, should defray the expenditures of the state [Ch

VI, On Monarchy, Sec. 12]:

Let the fields, and the whole soil, and, if it can be managed,

the houses should be public property, that is, the property of him

who holds the right of the commonwealth: and let him let them at a

yearly rent to the citizens, whether townsmen or countrymen, and

with this exception let them all be free, or exempt from every

kind of tax in time of peace. And of this rent a part is to be

applied to the defences of the state, a part to the king's

private use.

|

Stamm,

August Theodor

|

In the late 1880s, A. T. Stamm, who had previously tried to start

an organization he called "The Society for Humanism,"

sought to form a society, "The All-Weal Union." These

efforts came to naught until Michael Flürscheim launched in

Frankfort the "German Union for Land Ownership Reform."

It gained 600 members. Their educational efforts convinced

officials of the imperial government and navy of the usefulness of

the land value tax for ending land speculation and provided for 16

years a practical demonstration of that in a large colonial

territory, Kiaochow, China.

In 1871, Stamm, in Die Erlosung der darbenden Menschheit,

wrote that private property in land was the cause of nearly all

human ills. In its abolition was to be found the complete solution

of the social problem. Collective ownership might be effected in

several ways, but the best means, Stamm believed, was gradually to

absorb the rent of land by increasing the land tax. Stamm differed

from Henry George, however, in holding that, since the original

wrong of private appropriation of land was not that of the present

but of previous generations, the rights of present owners should

receive some consideration.

|

BROWSE BY AUTHOR

|